- Bankruptcy Basics

- Chapter 11 Bankruptcy

- Chapter 13 Bankruptcy

- Chapter 7 Bankruptcy

- Debt Collectors and Consumer Rights

- Divorce and Bankruptcy

- Going to Court

- Property & Exemptions

- Student Loans

- Taxes and Bankruptcy

- Wage Garnishment

Understanding the Assignment of Mortgages: What You Need To Know

3 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

A mortgage is a legally binding agreement between a home buyer and a lender that dictates a borrower's ability to pay off a loan. Every mortgage has an interest rate, a term length, and specific fees attached to it.

Written by Attorney Todd Carney . Updated November 26, 2021

If you’re like most people who want to purchase a home, you’ll start by going to a bank or other lender to get a mortgage loan. Though you can choose your lender, after the mortgage loan is processed, your mortgage may be transferred to a different mortgage servicer . A transfer is also called an assignment of the mortgage.

No matter what it’s called, this change of hands may also change who you’re supposed to make your house payments to and how the foreclosure process works if you default on your loan. That’s why if you’re a homeowner, it’s important to know how this process works. This article will provide an in-depth look at what an assignment of a mortgage entails and what impact it can have on homeownership.

Assignment of Mortgage – The Basics

When your original lender transfers your mortgage account and their interests in it to a new lender, that’s called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It’s common for mortgage lenders to sell the mortgages to other lenders. Most lenders assign the mortgages they originate to other lenders or mortgage buyers.

Home Loan Documents

When you get a loan for a home or real estate, there will usually be two mortgage documents. The first is a mortgage or, less commonly, a deed of trust . The other is a promissory note. The mortgage or deed of trust will state that the mortgaged property provides the security interest for the loan. This basically means that your home is serving as collateral for the loan. It also gives the loan servicer the right to foreclose if you don’t make your monthly payments. The promissory note provides proof of the debt and your promise to pay it.

When a lender assigns your mortgage, your interests as the mortgagor are given to another mortgagee or servicer. Mortgages and deeds of trust are usually recorded in the county recorder’s office. This office also keeps a record of any transfers. When a mortgage is transferred so is the promissory note. The note will be endorsed or signed over to the loan’s new owner. In some situations, a note will be endorsed in blank, which turns it into a bearer instrument. This means whoever holds the note is the presumed owner.

Using MERS To Track Transfers

Banks have collectively established the Mortgage Electronic Registration System , Inc. (MERS), which keeps track of who owns which loans. With MERS, lenders are no longer required to do a separate assignment every time a loan is transferred. That’s because MERS keeps track of the transfers. It’s crucial for MERS to maintain a record of assignments and endorsements because these land records can tell who actually owns the debt and has a legal right to start the foreclosure process.

Upsolve Member Experiences

Assignment of Mortgage Requirements and Effects

The assignment of mortgage needs to include the following:

The original information regarding the mortgage. Alternatively, it can include the county recorder office’s identification numbers.

The borrower’s name.

The mortgage loan’s original amount.

The date of the mortgage and when it was recorded.

Usually, there will also need to be a legal description of the real property the mortgage secures, but this is determined by state law and differs by state.

Notice Requirements

The original lender doesn’t need to provide notice to or get permission from the homeowner prior to assigning the mortgage. But the new lender (sometimes called the assignee) has to send the homeowner some form of notice of the loan assignment. The document will typically provide a disclaimer about who the new lender is, the lender’s contact information, and information about how to make your mortgage payment. You should make sure you have this information so you can avoid foreclosure.

Mortgage Terms

When an assignment occurs your loan is transferred, but the initial terms of your mortgage will stay the same. This means you’ll have the same interest rate, overall loan amount, monthly payment, and payment due date. If there are changes or adjustments to the escrow account, the new lender must do them under the terms of the original escrow agreement. The new lender can make some changes if you request them and the lender approves. For example, you may request your new lender to provide more payment methods.

Taxes and Insurance

If you have an escrow account and your mortgage is transferred, you may be worried about making sure your property taxes and homeowners insurance get paid. Though you can always verify the information, the original loan servicer is responsible for giving your local tax authority the new loan servicer’s address for tax billing purposes. The original lender is required to do this after the assignment is recorded. The servicer will also reach out to your property insurance company for this reason.

If you’ve received notice that your mortgage loan has been assigned, it’s a good idea to reach out to your loan servicer and verify this information. Verifying that all your mortgage information is correct, that you know who to contact if you have questions about your mortgage, and that you know how to make payments to the new servicer will help you avoid being scammed or making payments incorrectly.

Let's Summarize…

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender’s interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage’s terms should remain the same. Your interest rate, loan amount, monthly payment, and payment schedule shouldn’t change.

Your original lender isn’t required to notify you or get your permission prior to assigning your mortgage. But you should receive correspondence from the new lender after the assignment. It’s important to verify any change in assignment with your original loan servicer before you make your next mortgage payment, so you don’t fall victim to a scam.

Attorney Todd Carney

Attorney Todd Carney is a writer and graduate of Harvard Law School. While in law school, Todd worked in a clinic that helped pro-bono clients file for bankruptcy. Todd also studied several aspects of how the law impacts consumers. Todd has written over 40 articles for sites such... read more about Attorney Todd Carney

Continue reading and learning!

It's easy to get debt help

Choose one of the options below to get assistance with your debt:

Considering Bankruptcy?

Our free tool has helped 13,908+ families file bankruptcy on their own. We're funded by Harvard University and will never ask you for a credit card or payment.

Private Attorney

Get a free evaluation from an independent law firm.

Learning Center

Research and understand your options with our articles and guides.

Already an Upsolve user?

Bankruptcy Basics ➜

- What Is Bankruptcy?

- Every Type of Bankruptcy Explained

- How To File Bankruptcy for Free: A 10-Step Guide

- Can I File for Bankruptcy Online?

Chapter 7 Bankruptcy ➜

- What Are the Pros and Cons of Filing Chapter 7 Bankruptcy?

- What Is Chapter 7 Bankruptcy & When Should I File?

- Chapter 7 Means Test Calculator

Wage Garnishment ➜

- How To Stop Wage Garnishment Immediately

Property & Exemptions ➜

- What Are Bankruptcy Exemptions?

- Chapter 7 Bankruptcy: What Can You Keep?

- Yes! You Can Get a Mortgage After Bankruptcy

- How Long After Filing Bankruptcy Can I Buy a House?

- Can I Keep My Car If I File Chapter 7 Bankruptcy?

- Can I Buy a Car After Bankruptcy?

- Should I File for Bankruptcy for Credit Card Debt?

- How Much Debt Do I Need To File for Chapter 7 Bankruptcy?

- Can I Get Rid of my Medical Bills in Bankruptcy?

Student Loans ➜

- Can You File Bankruptcy on Student Loans?

- Can I Discharge Private Student Loans in Bankruptcy?

- Navigating Financial Aid During and After Bankruptcy: A Step-by-Step Guide

- Filing Bankruptcy to Deal With Your Student Loan Debt? Here Are 3 Things You Should Know!

Debt Collectors and Consumer Rights ➜

- 3 Steps To Take if a Debt Collector Sues You

- How To Deal With Debt Collectors (When You Can’t Pay)

Taxes and Bankruptcy ➜

- What Happens to My IRS Tax Debt if I File Bankruptcy?

- What Happens to Your Tax Refund in Bankruptcy

Chapter 13 Bankruptcy ➜

- Chapter 7 vs. Chapter 13 Bankruptcy: What’s the Difference?

- Why is Chapter 13 Probably A Bad Idea?

- How To File Chapter 13 Bankruptcy: A Step-by-Step Guide

- What Happens When a Chapter 13 Case Is Dismissed?

Going to Court ➜

- Do You Have to Go To Court to File Bankruptcy?

- Telephonic Hearings in Bankruptcy Court

Divorce and Bankruptcy ➜

- How to File Bankruptcy After a Divorce

- Chapter 13 and Divorce

Chapter 11 Bankruptcy ➜

- Chapter 7 vs. Chapter 11 Bankruptcy

- Reorganizing Your Debt? Chapter 11 or Chapter 13 Bankruptcy Can Help!

State Guides ➜

- Connecticut

- District Of Columbia

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Upsolve is a 501(c)(3) nonprofit that started in 2016. Our mission is to help low-income families resolve their debt and fix their credit using free software tools. Our team includes debt experts and engineers who care deeply about making the financial system accessible to everyone. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

- The Legally Invalid Assignment Defense to Foreclosure

People who are facing the possibility of a foreclosure on their home may want to investigate the history of their mortgage. If the assignment to the foreclosing party is not valid, this may be a viable defense to a foreclosure. In some states, you can demand that the foreclosing party produce a written assignment of the mortgage. If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

Courts in other states are more lenient in their review of assignments. Since the mortgage is closely associated with the promissory note, the foreclosing party may be allowed to enforce the promissory note even if it cannot produce a valid assignment of the mortgage. You should seek legal guidance in your state to determine whether this defense may be viable.

Homeowners who believe that they may have a defense based on an invalid assignment may wish to consult with a knowledgeable foreclosure lawyer, since this defense can become complicated. Justia offers a lawyer directory to simplify researching, comparing, and contacting attorneys who fit your legal needs.

The Relationship Between Mortgages and Promissory Notes

The mortgage and the promissory note are the two key documents attached to a loan for buying a home. Some purchases involve a deed of trust rather than a mortgage, but they are functionally equivalent in this context. While the promissory note is your guarantee to repay the loan, the mortgage gives the lender the right to foreclose if you do not repay the loan as arranged. The mortgage also identifies the property that will serve as security for the loan. Thus, the two documents work together in establishing the lender’s rights.

The Role of Mortgage Assignments in Loan Transfers

A bank or other lender often will sell a mortgage to another party, which will collect payments and pursue the homeowner if they fail to keep up with the mortgage. To transfer the loan, the original lender will endorse the promissory note to the new owner of the mortgage. This is because collection efforts hinge on owning the promissory note. If the foreclosing party cannot produce the promissory note, the homeowner will have a defense to the foreclosure.

Meanwhile, the new owner will record the assignment of the mortgage. This includes transferring the right to foreclose, as provided by the mortgage, to the new owner. The assignment will provide the amount of the mortgage and the names of the homeowner, the original lender, and the new owner of the mortgage. It also will contain a description of the property attached to the mortgage and the date when the mortgage took effect.

An invalid assignment defense may only be a temporary solution until the new owner records an assignment in their name.

The mortgage industry uses a tool known as the Mortgage Electronic Registration System (MERS) to keep track of assignments. MERS may be a nominee for the lender, or it may receive the mortgage as an assignment. If MERS is the current assignee, it cannot pursue a foreclosure because it does not have an interest in the promissory note. MERS simply serves as an agent for the current owner of the mortgage and assists in creating a record for transfers of the mortgage. This allows banks to more easily transfer loans among them without creating a new assignment each time. You may have a defense against a foreclosure action if MERS is listed as the owner of the mortgage. However, this likely will be only a temporary solution until the new owner records an assignment in their name.

Last reviewed October 2023

Foreclosure Law Center Contents

- Foreclosure Law Center

- Errors and Abuses by Mortgage Servicers & Your Legal Rights

- Foreclosure Trustees & Their Legal Obligations

- Strict Foreclosure Laws

- Expedited Foreclosure Laws & Procedures

- Tax Debt Leading to Foreclosure & Legal Concerns

- Homeowners' Association Liens Leading to Foreclosure & Other Legal Concerns

- Timeshare Foreclosures & the Legal Process

- Investment Property Foreclosures & Your Legal Options

- Manufactured Home Foreclosures & Relevant Legal Concerns

- The Right of Redemption Before and After a Foreclosure Sale Under the Law

- Reinstatement and Payoff to Prevent Foreclosure & Your Legal Rights

- Fannie Mae and Freddie Mac Foreclosure Prevention Strategies

- Divorce and Foreclosure Prevention — Legal & Practical Considerations

- Natural Disasters and Legal Options for Foreclosure Prevention

- Federal Mortgage Servicing Laws Protecting Homeowners

- Fighting a Foreclosure — Legal Options and Issues

- Homeowners' Legal Rights Before, During, and After Foreclosure

- How Liens and Second Mortgages May Legally Affect Foreclosure

- Foreclosure Scams — Legal Concerns & Consumer Protections

- Judicial vs. Non-Judicial Foreclosure Under the Law

- Fighting a Foreclosure in Court & Legal Strategies

- Delaying a Foreclosure

- The Statute of Limitations Defense Under Foreclosure Law

- Using the Legally Defective Affidavit or Declaration Defense to Foreclosure

- Setting Aside a Foreclosure Sale

- Challenging Fees in Foreclosure

- Mortgage Servicing Rules, the FDCPA, and Your Legal Rights

- Working With a Foreclosure Lawyer

- Alternatives to Foreclosure — Legal & Financial Considerations

- Foreclosure Laws and Procedures: 50-State Survey

- Foreclosure Law FAQs for Consumers

- Find a Foreclosure Defense Lawyer

Related Areas

- Home Ownership Legal Center

- Bankruptcy Law Center

- Debt Relief & Management Legal Center

- Consumer Protection Law Center

- Landlord - Tenant Law Center

- Related Areas

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Deed of Assignment: Everything You Need to Know

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. 3 min read updated on January 01, 2024

Updated October 8,2020:

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date. In order to be valid, a deed of assignment must contain certain types of information and meet a number of requirements.

What Is an Assignment?

An assignment is similar to an outright transfer, but it is slightly different. It takes place when one of two parties who have entered into a contract decides to transfer all of his or her rights and obligations to a third party and completely remove himself or herself from the contract.

Also called the assignee, the third party effectively replaces the former contracting party and consequently assumes all of his or her rights and obligations. Unless it is stated in the original contract, both parties to the initial contract are typically required to express approval of an assignment before it can occur. When you sell a piece of property, you are making an assignment of it to the buyer through the paperwork you sign at closing.

What Is a Deed of Assignment?

A deed of assignment refers to a legal document that facilitates the legal transfer of ownership of real estate property. It is an important document that must be securely stored at all times, especially in the case of real estate.

In general, this document can be described as a document that is drafted and signed to promise or guarantee the transfer of ownership of a real estate property on a specified date. In other words, it serves as the evidence of the transfer of ownership of the property, with the stipulation that there is a certain timeframe in which actual ownership will begin.

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the “assignor,” while the party who is receiving the rights is called the “assignee.”

A deed of assignment is required in many different situations, the most common of which is the transfer of ownership of a property. For example, a developer of a new house has to sign a deed of assignment with a buyer, stating that the house will belong to him or her on a certain date. Nevertheless, the buyer may want to sell the house to someone else in the future, which will also require the signing of a deed of assignment.

This document is necessary because it serves as a temporary title deed in the event that the actual title deed for the house has not been issued. For every piece of property that will be sold before the issuance of a title deed, a deed of assignment will be required.

Requirements for a Deed of Assignment

In order to be legally enforceable, an absolute sale deed must provide a clear description of the property being transferred, such as its address or other information that distinguishes it from other properties. In addition, it must clearly identify the buyer and seller and state the date when the transfer will become legally effective, the purchase price, and other relevant information.

In today's real estate transactions, contracting parties usually use an ancillary real estate sale contract in an attempt to cram all the required information into a deed. Nonetheless, the information found in the contract must be referenced by the deed.

Information to Include in a Deed of Assignment

- Names of parties to the agreement

- Addresses of the parties and how they are binding on the parties' successors, friends, and other people who represent them in any capacity

- History of the property being transferred, from the time it was first acquired to the time it is about to be sold

- Agreed price of the property

- Size and description of the property

- Promises or covenants the parties will undertake to execute the deed

- Signatures of the parties

- Section for the Governors Consent or Commissioner of Oaths to sign and verify the agreement

If you need help understanding, drafting, or signing a deed of assignment, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Define a Deed

- Contract for Deed California

- Contract for Deed in Texas

- Assignment Law

- Deed Contract Agreement

- Assignment Of Contracts

- Legal Assignment

- Deed vs Agreement

- Assignment Legal Definition

- Contract for a Deed

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Deed Of Trust: What It Is And How It Works

Updated: Mar 2, 2023, 3:15am

Buying property usually comes with an avalanche of paperwork. It can be a confusing process, especially when it comes to knowing the difference between the various documents you sign. If there’s one contract that’s important to understand, however, it’s the deed of trust.

Depending on your lender and the state you live in, you may or may not need a deed of trust when financing a home purchase. Here’s what you should know about this contract and how it differs from a mortgage .

What Is a Deed Of Trust?

When you finance the purchase of a property, you will sign either a mortgage or deed of trust—but not both. You can take out a mortgage in all 50 U.S. states, while a deed of trust is only available in some states.

A deed of trust is a legal document that secures a real estate transaction. It works similarly to a mortgage, though it’s not quite the same thing. Essentially, it states that a designated third party holds legal title to your property until you’ve paid it off according to the terms of your loan. Deeds of trust are recorded in public records just like a mortgage.

How Does a Deed of Trust Work?

A deed of trust exists so that the lender has some recourse if you don’t pay your loan as agreed. There are three parties involved in a deed of trust: the trustor, the beneficiary and the trustee.

The three parties involved in a deed of trust for a real estate transaction are a:

- Trustor. This is the person whose assets are being held in the trust, also known as the borrower (i.e., you). The title to your home is held by the trust until the loan is paid off. Even so, you remain the equitable owner as long as you keep paying the loan according to the terms outlined in the deed of trust. That means you enjoy all the benefits of being the homeowner, such as the right to live there and gain equity, even though you aren’t the legal title holder.

- Beneficiary. The beneficiary is the party whose investment interest is being protected. Usually, that’s the lender, though it also can be an individual with whom you have a contract.

- Trustee. The trustee holds the legal title of the property while you’re making payments on the loan. Trustees often are title companies, but not always. Once you’ve paid off your loan, the trustee is responsible for dissolving the trust and transferring the title to you.

If you sell the property before it’s paid off, the trustee will use proceeds of the sale to pay the lender the remaining balance (you keep the profits). If you fail to meet your payment obligations and default on the mortgage, the property would go into foreclosure , and the trustee would be responsible for selling the property.

What Is Included in a Deed of Trust

A deed of trust includes many important details about your property, loan and related terms and conditions—much of the same information you would find in your mortgage. Typically, you’ll find the following outlined in a deed of trust:

- The names of the parties involved (the trustee, trustor and beneficiary)

- The original loan amount and repayment terms

- A legal description of the property

- The inception and maturity dates of the loan

- Various clauses, such as acceleration and alienation clauses

- Any riders regarding the clauses outlined

It’s common for a deed of trust to include acceleration and alienation clauses. If you’re delinquent on your loan, it can trigger the acceleration clause—essentially a demand for immediate repayment of the loan. Depending on the terms, this can happen after missing just one payment, though lenders often give a few months of leeway to allow the borrower to catch up on payments. If you fail to do so under the terms outlined in the acceleration clause, the next step is formal foreclosure proceedings.

An alienation clause is also known as a due-on-sale clause and it prevents anyone who buys the property to take on the loan under its current terms. Instead, the alienation clause would dictate that the loan must be paid in full if you sell the property.

Depending on your state, the deed of trust may also include a power of sales clause. This allows for a much faster foreclosure process than if your lender had to involve the state courts in a judicial foreclosure. That said, you won’t be foreclosed on overnight under a power of sales clause; the exact process differs by state and lender. Still, if you’re facing a nonjudicial foreclosure, it can happen in a matter of months. If you want to formally fight the foreclosure, you’ll need to hire a lawyer.

States that allow power of sale foreclosures include: Alabama, Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, North Carolina, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Washington, West Virginia and Wyoming.

Faster, easier mortgage lending

Check your rates today with Better Mortgage.

Deed of Trust Vs. Mortgage

The terms “deed of trust” and “mortgage” are often used interchangeably, but they’re really two different things. That said, there are also some similarities. To review, here are the key ways a mortgage and deed of trust are similar as well as different.

Similarities

- Public record: Both documents are recorded with the county clerk.

- Subject to state law: The exact terms of a mortgage or a deed of trust depend on the local state law.

- Contracts, not loans: Neither document serves as the actual loan agreement; a deed of trust or mortgage is a contract that places a lien on your property and dictates how your lender can repossess the property through foreclosure.

Differences

- Parties involved: A mortgage is an agreement between a borrower and lender, while a deed of trust involves a trustor, beneficiary and trustee.

- Foreclosure type: A mortgage requires a judicial foreclosure, while a deed of trust allows for a nonjudicial foreclosure.

- Foreclosure timeline: Judicial foreclosure on a mortgage can be a lengthy process, while nonjudicial foreclosure through a deed of trust is much faster.

What’s the Advantage of a Trust Deed Over a Mortgage?

If the borrower defaults, a trust deed makes it possible for the lender to sell the property without having to go to court. With a mortgage, the lender has to file a foreclosure claim in court and secure a judge’s approval to sell the property. This can mean a lot of expenses for both the borrower and the lender.

If you are investing in a real estate project, a trust deed also has a few advantages over a mortgage. This is because the investor is considered the lender in the transaction, and their name is recorded on the trust deed as such. The investor can receive interest on their “loan” and the principal is repaid in full once the property has been built.

Warranty Deed Vs. Deed of Trust

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

When a property title is transferred with a warranty deed, ownership goes from the seller (also known as the grantor) to the buyer (also known as the grantee). The warranty deed guarantees that the previous owners, or grantor, had full ownership of the property and right to transfer it. In other words, it promises that you won’t inherit any liens or future claims against the property. It provides peace of mind that you own the property outright once the title is in your name.

Are Trust Deeds a Good Idea?

Trust deeds could be a good idea if you are an investor searching for options to earn passive income, while also being protected via the deed. However, investing in real estate is unpredictable and returns are never guaranteed. A trust deed does not reduce the probability of default or ensure that you will recoup your initial investment.

Consult with a financial advisor or investment professional before going down this route.

Get Forbes Advisor’s ratings of the best mortgage lenders, advice on where to find the lowest mortgage or refinance rates, and other tips for buying and selling real estate.

Frequently Asked Questions (FAQs)

What is an assignment of deed of trust.

An assignment of trust deed is necessary if a lender sells a loan secured by a trust deed. It assigns the trust deed to whoever buys the loan (such as another lender), granting them all the rights to the property. It is recorded along with the original, making it a matter of public record.

What happens with the deed of trust after you pay off your mortgage?

Once you pay off your loan, the trustee is responsible for releasing the trust and transferring the title to you. You now have full ownership of the home.

Can you sell a house with a deed of trust?

Yes, you can. However, if you are selling the house for less than the loan amount, you will need the lender’s approval. Once the property is sold, the trustee uses the proceeds to pay the lender what they are still owed. The borrower then gets any money that is left over.

How long does a deed of trust last?

A deed of trust, like a mortgage, typically has a maturity date, which is when the loan must be paid off in full. That date will vary transaction to transaction. Sometimes a deed of trust won’t have a maturity date. In this scenario, state law dictates the number of years a deed of trust lasts, anywhere from 10 to 60 years after it was recorded.

What is a purchase money deed of trust?

A purchase money deed of trust secures the funds used to buy the property. It also gives the buyer priority over any liens or encumbrances against them

Does a deed of trust show ownership?

No. A deed of trust is a legal document that secures a real estate transaction. It only shows that a designated third party holds legal title—i.e. ownership—to your property until you’ve paid it off, according to the terms of your loan.

- Best Mortgage Lenders

- Best Online Mortgage Lenders

- Best Construction Loan Lenders

- Best Reverse Mortgage Companies

- Best Mortgage Refinance Companies

- Best VA Loan Lenders

- Best Mortgage Lenders For First-Time Buyers

- Best USDA Lenders

- Current Mortgage Rates

- Current Refinance Rates

- Current ARM Rates

- VA Loan Rates

- VA Refinance Rates

- Mortgage Calculator

- Cost Of Living Calculator

- Cash-Out Refinance Calculator

- Mortgage Payoff Calculator

- Loan Prequalification Calculator

- Mortgage Refinance Calculator

- Zillow Home Loans

- Mr Cooper Mortgage

- Rocket Mortgage

- Sage Mortgage

- Veteran United Home Loans

- Movement Mortgage

- Better Mortgage

- Pay Off Mortgage Or Invest

- Things To Know Before Buying A House

- What Is Recasting A Mortgage?

- After You Pay Off Your Mortgage

- When Should You Refinance Your Mortgage?

- How To Choose A Mortgage Lender?

- Will Interest Rates Go Down In 2024?

- Cost Of Living By State

- Will Housing Market Crash In 2024?

- Best Cities To Buy A House In 2024

- Average Down Payment On a House In 2024

- Largest Mortgage Lenders In The US

Next Up In Mortgages

- Best Mortgage Lenders Of June 2024

- Best Mortgage Lenders For First-Time Homebuyers Of June 2024

- How Much House Can I Afford? Home Affordability Calculator

- Mortgage Calculator: Calculate Your Mortgage Payment

- Rocket Mortgage Review

- USAA Mortgage Review

Mortgage Rates Today: June 7, 2024—Rates Move Down

Mortgage Rates Today: June 6, 2024—Rates Move Down

Mortgage Rates Today: June 5, 2024—Rates Remain Fairly Steady

Mortgage Rates Today: June 4, 2024—Rates Remain Fairly Steady

Consumer Watchdog Taking Aim At Fees That Can Increase Mortgage Closing Costs

Mortgage Rates Today: June 3, 2024—Rates Remain Fairly Steady

Casey Bond is a seasoned personal finance writer and editor. In addition to Forbes, her work has appeared on HuffPost, Business Insider, Yahoo! Finance, MSN, The Motley Fool, U.S. News & World Report, TheStreet and more. Casey is also a Certified Personal Finance Counselor. Follow her on Twitter @CaseyLynnBond.

Brai is the founder of SW4 Insights, a public policy advisory firm based in Washington D.C. He has over a decade of experience as a journalist and consultant covering finance and economic policy, with a particular focus on distilling complex topics to inform readers' decision-making.

- 941-444-7142

Promissory Notes, Mortgage Assignments, and MERS’ Role in Real Estate

After the fall out of the subprime mortgage crisis that triggered the Great Recession, the effects still linger when looking at homeownership statistics in the United States. Nearly 10 million homeowners lost their homes to foreclosure between 2006 and 2014. Damaged credit and traumatized psyches paired with stricter lending standards and soaring median home prices mean that some former homeowners will never own another home.

Today, the United States is seeing the highest rates of unemployment since the Great Depression at nearly 15% due to the COVID-19 pandemic, and of those who still own a home, nearly 4.1 million borrowers are struggling to make their monthly payments. Many are turning to forbearance for momentary relief from their mortgages.

For many homeowners, the question of what happens to their mortgage after closing day might not ever come up. Until the threat of foreclosure or the need for forbearance arises, most borrowers simply send in their monthly payments with no questions asked.

Now is a good time to consider the process after closing, and how it affects their property rights. Here are some of the questions to ask.

What happens after a real estate closing?

- At closing, the borrower signs the mortgage, the deed, and the promissory note

- The mortgage and the deed are recorded in the public record

- The promissory note is held by the lender while the loan is outstanding

- Payments are sent to the mortgage servicing company

- The mortgage may be securitized and sold to investors

- The mortgage may be transferred to another bank

- The mortgage servicing rights may change to another company

- When the mortgage is paid in full, a mortgage lien release or satisfaction with a number referencing the original mortgage loan is recorded in the public record to show the debt is no longer outstanding

- The promissory note is marked as paid in full and returned to the borrower

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

What are Loan Transfer Documents?

Assignments and endorsements prove who owns the debt and subsequently who has the authority to bring foreclosure action.

Mortgage Assignments

A Mortgage Assignment is a document showing a mortgage loan has been transferred from the originator to a third party.

Note Endorsements

In addition to the assignment, the originator of the loan or the most recent holder of the loan must endorse (or sign over) the promissory note whenever the loan changes hands. Sometimes, the note is endorsed “in blank,” which means that any party that possesses the note has the legal authority to enforce it.

While these documents are supposed to be recorded in the public land records systems, sometimes there’s a “break” in the chain. A missing mortgage satisfaction or assignment can cause a huge headache for homeowners when they go to sell. Without knowing who the official mortgage lienholder of the property is, the home can’t be sold. The title agent in charge of the closing is tasked with fixing the issue so that clear ownership rights can be established and the final mortgage payoff can be sent to the right lender if needed.

What is Mortgage Securitization?

In the last 30 years or so, the buying and selling of mortgage loans between lenders, banks, and investors has grown more complicated. When a mortgage is turned into a security, it’s pooled with similar types of loans and sold on the secondary mortgage market. The purchasers or investors in these securities receive interest in principal payments.

Securitization is good for lenders because it allows them to sell mortgage loans from their books and use that money to make more loans.

Where securitization goes wrong, as we saw during the housing crisis, is when bad or “toxic” assets are pooled together and sold on the secondary market to unsuspecting investors. Subprime mortgage-backed securities had received high ratings from credit agencies and offered a higher interest rate, but they also were the first to hemorrhage losses when borrowers began defaulting on homes with underwater mortgages.

Securitization isn’t an inherently good or bad process, it’s simply a mechanism by which banks liquidize assets, increase their credit and ratings, and clear their balance sheets.

For homeowners, securitization means that the mortgage isn’t owned by a single lender and is instead part of a pool of mortgages owned by investors. A mortgage service company is responsible for collecting the mortgage payments and sending it to the proper investors. Securitization also means that tracking the note and who has the authority to enforce it can get messy.

What is the Mortgage Electronic Registration System, Inc. or MERS?

The MERS system is a private, third-party database system used to track servicing rights and ownership of mortgages in the United States. This system of registering the promissory note and mortgage was created to make transferring these documents easier on the secondary mortgage market.

How does MERS work?

For some real estate transactions, the mortgage originator will designate MERS as the mortgagee at closing. These loans are called MERS as Original Mortgagee (MOM) loans. When buying a home, a borrower should see clear language on the mortgage or deed of trust document granting and conveying legal title of the mortgage to MERS as mortgagee. This gives the company the right to act on behalf of the current and subsequent owners of the loan.

In other transactions, the loan may be assigned to MERS in the public record at a later date after closing.

After MERS is designated as a nominee to act on behalf of the lender, it tracks the transfers of the loans between parties and acts as a nominee for each holder. This eliminates the need to file separate assignments in the public record each time the loan is transferred. If a lender sells the loan, MERS will update this information in their system.

Even though MERS is designated as the mortgagee, it doesn’t own the debt or hold the promissory note. MERS doesn’t service mortgages or collect payments on mortgages.

Benefits of MERS

Some of the benefits of the MERS system include:

- No document drafting fees

- Eliminates the need for multiple assignments each time the loan changes hands

- Reduces recording costs

- Saves time and administrative costs for lenders and servicers

- Provides the identification of servicers and investors for free for homeowners and lenders

- Used by Lenders to find undisclosed liens

- Used by municipalities to find companies responsible for maintaining vacant and abandoned properties

- Mortgage Identification Numbers (MIN) are assigned to each loan for easy tracking

- Selling of loans and servicing transfers are more efficient in the secondary market

- Obtaining lien releases when a lender goes out of business is simplified

- Cost savings by the mortgage industry is theoretically passed on to homeowners

Does MERS really save consumers money?

The MERS system is not meant to act as a replacement for public land records. However, some states, including Kentucky, New York, Texas, Alabama, and Delaware have sued the company that controls MERS for lost revenue from missing record filing fees. In the case of Kentucky , the state alleged that MERS did not record mortgage assignments with Kentucky County Clerks as they were transferred between banks. At $12 a recording, all those transfers without corresponding mortgage assignments add up to big bucks.

Despite numerous lawsuits challenging MERS over its mortgage assignment authority, the company that controls MERS usually receives favorable judgments . In 2016, courts in Texas ruled that MERS’ mortgage assignments were valid and dismissed two cases. County recorders in Pennsylvania also brought cases claiming that MERS and MERS System members failed to record mortgage assignments when transferring promissory notes, a violation of Pennsylvania recording laws. MERS emerged as the winner of these lawsuits as well.

Kentucky and other states argue that skipping out on these fees hurt the consumers and taxpayers in their states.

What is MERS role in foreclosures?

Depending on the state, a foreclosure process might be either judicial (reviewed by a judge in court) or nonjudicial. In the past, MERS, acting on behalf of lenders, has been named as the plaintiff in foreclosure proceedings. Sometimes MERS was even listed as the beneficiary in nonjudicial notices.

Whether or not MERS has the authority to file foreclosure as either the plaintiff or beneficiary is hotly contested. Some states have ruled that MERS doesn’t have standing to foreclose since it doesn’t have any financial interest in either the property of the promissory note.

MERS Splits the note and the mortgage

A court case from 1872, Carpenter v. Longan , established that where the promissory note goes, a deed of trust or mortgage must follow and, according to the United State’s Uniform Commercial Code (UCC) , the promissory note must also have a clear chain of title.

Foreclosure proceedings during the Great Recession proved to be complicated by the MERS system. Within the MERS system, a note and mortgage may be transferred multiple times, so to avoid an endorsement each time, the note is “endorsed in blank.” In one foreclosure after the other, borrowers were able to demonstrate that the subsequent assignments of the promissory note had gone unendorsed.

Although the MERS systems has helped the mortgage industry, title agents, and even borrowers better manage and understand who has the servicing rights and holds the authority to foreclose, several borrowers facing foreclosure have argued that the system impermissibly “splits” the note and the mortgage between the note holder and MERS as the beneficiary of the deed of trust or mortgage.

This process of bifurcation, it’s claimed, causes the relationship between the mortgage and note to become defective and subsequently unenforceable.

Homeowners facing foreclosure, especially in the aftermath of the housing bubble burst of 2008, were successful in delaying or avoiding foreclosure by arguing that the authority to foreclose was not satisfactorily established due to breaks in the chain of assignments and endorsements.

However, Article 3 of the UCC establishes anyone who possesses the note has the legal authority to enforce it. So foreclosing parties have countered that possession of the note should be enough.

As a result, some states, like Michigan, have ruled in favor of these borrower’s arguments by requiring reunification through valid assignment before foreclosures may proceed. Others have ruled that reunification is not necessary since MERS would be authorized to foreclose for the note holder on their behalf. In 2015, The Nevada Supreme Court actually clarified previous rulings by stating that the involvement of MERS actually cures the defect. This is because the note holder could potentially or theoretically direct or compel MERS to assign the deed of trust, resulting in reunifying the instruments.

Homebuyers should always ask questions

With the advent of eClosing solutions, eNotes, eVaults, and the MERS eRegistry , the real estate, title, and mortgage industry continues to build systems that improve the homebuying experience.

Despite all the advancements, homebuying can be a confusing and overwhelming process. It’s important to ask questions of the right real estate professionals. Hiring your own attorney to represent your interests in the real estate transaction is always a good idea.

While the pros and cons of MERS is debated, homeowners today will want to keep up with recommendations from the CFPB should they fall behind on their mortgage payments and reach out to their mortgage servicer as soon as possible.

Keep Reading

Is release tracking part of your post-closing process?

What the Experts are Saying About This Year’s State of the Industry for 2024

Reflecting on 2023’s Biggest Moments

What The Experts Are Saying About This Year’s State of Title – Technology and AI

2023 State of the Title Industry Survey Webinar Recap

What Kind of Land Survey Do I Need?

10 Common Misconceptions About Land Surveys

6 Practices for Title Professionals to Safeguard Against Email Phishing Attacks

Amanda Farrell is a digital media strategist at PropLogix. She enjoys being a part of a team that gives peace of mind for consumers while making one of the biggest purchases of their lives. She lives in Sarasota with her bunny, Buster, and enjoys painting, playing guitar and mandolin, and yoga.

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

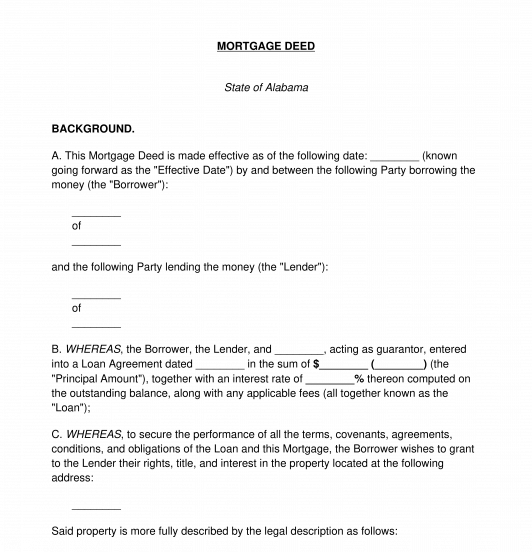

Mortgage Deed

Rating: 5 - 1 vote

A Mortgage Deed , also known as a Mortgage Agreement, is a document where a borrower of money grants the lender of that money conditional ownership in a property as a security interest against the loan until the loan is paid in full . If the borrower fails to repay the money as agreed, the lender then becomes the owner of the property used as security and will have the power to sell it to recoup the costs of the unpaid loan. This document is separate from a Secured Promissory Note or Loan Agreement , which creates the actual loan and more fully sets out the terms and conditions of the loan itself.

Mortgage Deeds are most commonly used to secure a loan taken out by the borrower to purchase a piece of property or home . The purchase of a property or home is often a big investment that involves a substantial amount of money. Lenders will want added security before loaning large sums of money to ensure that they will recoup their investment. A Mortgage Deed allows them to take possession and sell the property if the Borrower stops making loan payments. It also gives buyers the ability to borrow large sums of money and provides an incentive to make payments on the loan or risk losing their property. A Mortgage Deed is used specifically to put up a piece of real property, like land or a home, as security . To use personal items, such as jewelry or a car, to secure a loan, use a Security Agreement instead.

A Mortgage Deed is very similar to a Deed of Trust , but the two documents operate differently to serve similar purposes. A Mortgage Deed and a Deed of Trust both create a lien on a property to secure repayment of a loan. However, a Mortgage Deed is only between two parties – the Borrower and the Lender – whereas a Deed of Trust is between three parties – the Borrower, the Lender, and the Trustee . In a Deed of Trust, the Trustee holds the title to the property in trust for the Lender. A Deed of Trust also allows the Trustee to initiate a foreclosure sale on the property without a court order if the Borrower is in default on the loan – also called the "power of sale". In contrast, the Lender under a Mortgage Deed would have to initiate foreclosure proceedings through the courts unless the borrower agrees to grant them the power of sale in the Mortgage Deed.

How to use this document

This document contains all of the information necessary to use a piece of real property as security or collateral for a loan. The Mortgage Deed includes all of the important information, such as:

- Name and contact information for both Parties

- Description of the type of property being mortgaged, using its legal description, found on previous deeds or tax forms, and the location of the property

- Outline of the basic terms of the promissory note or loan agreement that is being secured by the property , such as how often payments will be made, the amount of the payments, and any applicable interest rates and/or penalties

Once the Mortgage Deed is completed, the borrower must sign and date it in front of a notary and have the document notarized . A notary page is included at the end of the document. After the Mortgage Deed is signed and notarized, it needs to be recorded in the county where the property is located . Often a small fee must be paid at the time of filing. The county will keep the original copy of the Deed, but the Parties should keep a copy of the Deed in a safe and secure location for their records and in case of future dispute.

Applicable law

Mortgage Deeds are governed by state law . Different states have different requirements for when and how the Deed should be filed. Contact the local county Register of Deeds to get information about which governmental agency should be given the Deed to file and record before being returned to the parties.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- Mortgage Deed vs. Deed of Trust

- Foreclosure and Eviction FAQ

Other names for the document:

Deed of Mortgage, House Mortgage Agreement, Mortgage Agreement, Property Mortgage Contract, Mortgage Contract

Country: United States

Housing and Real Estate - Other downloadable templates of legal documents

- Security Deposit Return Letter

- Lease Assignment Agreement

- Rent Payment Plan Letter

- Residential Lease Agreement

- Sublease Agreement

- Tenant Maintenance Request Letter

- Rent Receipt

- Late Rent Notice

- Notice of Intent to Vacate

- Roommate Agreement

- Quitclaim Deed

- Parking Space Lease Agreement

- Short-Term Lease Agreement

- Tenant Security Deposit Return Request

- Termination of Tenancy Letter

- Change of Rent Notice

- Complaint Letter to Landlord

- Lease Amendment Agreement

- Notice of Lease Violation

- Consent to Sublease

- Other downloadable templates of legal documents

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Suspended Counterparty Program

FHFA established the Suspended Counterparty Program to help address the risk to Fannie Mae, Freddie Mac, and the Federal Home Loan Banks (“the regulated entities”) presented by individuals and entities with a history of fraud or other financial misconduct. Under this program, FHFA may issue orders suspending an individual or entity from doing business with the regulated entities.

FHFA maintains a list at this page of each person that is currently suspended under the Suspended Counterparty Program.

| Suspension Order | |||||

|---|---|---|---|---|---|

| YiHou Han | San Francisco | California | 03/26/2024 | Indefinite | |

| Alex A. Dadourian | Granada Hills | California | 02/08/2024 | Indefinite | |

| Tamara Dadyan | Encino | California | 01/10/2024 | Indefinite | |

| Richard Ayvazyan | Encino | California | 01/10/2024 | Indefinite | |

| Michael C. Jackson | Star | Idaho | 01/10/2024 | Indefinite |

This page was last updated on 03/26/2024

Get the Reddit app

A subreddit for those who enjoy learning about flags, their place in society past and present, and their design characteristics

Flag of Elektrostal, Moscow Oblast, Russia

- Bahasa Indonesia

- Eastern Europe

- Moscow Oblast

Elektrostal

Elektrostal Localisation : Country Russia , Oblast Moscow Oblast . Available Information : Geographical coordinates , Population, Altitude, Area, Weather and Hotel . Nearby cities and villages : Noginsk , Pavlovsky Posad and Staraya Kupavna .

Information

Find all the information of Elektrostal or click on the section of your choice in the left menu.

- Update data

| Country | |

|---|---|

| Oblast |

Elektrostal Demography

Information on the people and the population of Elektrostal.

| Elektrostal Population | 157,409 inhabitants |

|---|---|

| Elektrostal Population Density | 3,179.3 /km² (8,234.4 /sq mi) |

Elektrostal Geography

Geographic Information regarding City of Elektrostal .

| Elektrostal Geographical coordinates | Latitude: , Longitude: 55° 48′ 0″ North, 38° 27′ 0″ East |

|---|---|

| Elektrostal Area | 4,951 hectares 49.51 km² (19.12 sq mi) |

| Elektrostal Altitude | 164 m (538 ft) |

| Elektrostal Climate | Humid continental climate (Köppen climate classification: Dfb) |

Elektrostal Distance

Distance (in kilometers) between Elektrostal and the biggest cities of Russia.

Elektrostal Map

Locate simply the city of Elektrostal through the card, map and satellite image of the city.

Elektrostal Nearby cities and villages

Elektrostal Weather

Weather forecast for the next coming days and current time of Elektrostal.

Elektrostal Sunrise and sunset

Find below the times of sunrise and sunset calculated 7 days to Elektrostal.

| Day | Sunrise and sunset | Twilight | Nautical twilight | Astronomical twilight |

|---|---|---|---|---|

| 8 June | 02:43 - 11:25 - 20:07 | 01:43 - 21:07 | 01:00 - 01:00 | 01:00 - 01:00 |

| 9 June | 02:42 - 11:25 - 20:08 | 01:42 - 21:08 | 01:00 - 01:00 | 01:00 - 01:00 |

| 10 June | 02:42 - 11:25 - 20:09 | 01:41 - 21:09 | 01:00 - 01:00 | 01:00 - 01:00 |

| 11 June | 02:41 - 11:25 - 20:10 | 01:41 - 21:10 | 01:00 - 01:00 | 01:00 - 01:00 |

| 12 June | 02:41 - 11:26 - 20:11 | 01:40 - 21:11 | 01:00 - 01:00 | 01:00 - 01:00 |

| 13 June | 02:40 - 11:26 - 20:11 | 01:40 - 21:12 | 01:00 - 01:00 | 01:00 - 01:00 |

| 14 June | 02:40 - 11:26 - 20:12 | 01:39 - 21:13 | 01:00 - 01:00 | 01:00 - 01:00 |

Elektrostal Hotel

Our team has selected for you a list of hotel in Elektrostal classified by value for money. Book your hotel room at the best price.

| Located next to Noginskoye Highway in Electrostal, Apelsin Hotel offers comfortable rooms with free Wi-Fi. Free parking is available. The elegant rooms are air conditioned and feature a flat-screen satellite TV and fridge... | from | |

| Located in the green area Yamskiye Woods, 5 km from Elektrostal city centre, this hotel features a sauna and a restaurant. It offers rooms with a kitchen... | from | |

| Ekotel Bogorodsk Hotel is located in a picturesque park near Chernogolovsky Pond. It features an indoor swimming pool and a wellness centre. Free Wi-Fi and private parking are provided... | from | |

| Surrounded by 420,000 m² of parkland and overlooking Kovershi Lake, this hotel outside Moscow offers spa and fitness facilities, and a private beach area with volleyball court and loungers... | from | |

| Surrounded by green parklands, this hotel in the Moscow region features 2 restaurants, a bowling alley with bar, and several spa and fitness facilities. Moscow Ring Road is 17 km away... | from | |

Elektrostal Nearby

Below is a list of activities and point of interest in Elektrostal and its surroundings.

Elektrostal Page

| Direct link | |

|---|---|

| DB-City.com | Elektrostal /5 (2021-10-07 13:22:50) |

- Information /Russian-Federation--Moscow-Oblast--Elektrostal#info

- Demography /Russian-Federation--Moscow-Oblast--Elektrostal#demo

- Geography /Russian-Federation--Moscow-Oblast--Elektrostal#geo

- Distance /Russian-Federation--Moscow-Oblast--Elektrostal#dist1

- Map /Russian-Federation--Moscow-Oblast--Elektrostal#map

- Nearby cities and villages /Russian-Federation--Moscow-Oblast--Elektrostal#dist2

- Weather /Russian-Federation--Moscow-Oblast--Elektrostal#weather

- Sunrise and sunset /Russian-Federation--Moscow-Oblast--Elektrostal#sun

- Hotel /Russian-Federation--Moscow-Oblast--Elektrostal#hotel

- Nearby /Russian-Federation--Moscow-Oblast--Elektrostal#around

- Page /Russian-Federation--Moscow-Oblast--Elektrostal#page

- Terms of Use

- Copyright © 2024 DB-City - All rights reserved

- Change Ad Consent Do not sell my data

IMAGES

VIDEO

COMMENTS

A mortgage assignment is the transfer of a mortgage from its initial lender to another party. Learn how this affects you! ... The first is a mortgage or, less commonly, a deed of trust. The other is a promissory note. The mortgage or deed of trust will state that the mortgaged property provides the security interest for the loan.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest. However, by assigning the loan the mortgage company will free up capital.

If the assignment to the foreclosing party is not valid, this may be a viable defense to a foreclosure. In some states, you can demand that the foreclosing party produce a written assignment of the mortgage. If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure ...

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the "assignor," while the party who is receiving the rights is called the "assignee.". A deed of assignment is required in many different ...

An assignment of trust deed is necessary if a lender sells a loan secured by a trust deed. It assigns the trust deed to whoever buys the loan (such as another lender), granting them all the rights ...

An assignment of a mortgage refers to an assignment of the note and assignment of the mortgage agreement. Both the note and the mortgage can be assigned. To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.

At closing, the borrower signs the mortgage, the deed, and the promissory note. The mortgage and the deed are recorded in the public record. The promissory note is held by the lender while the loan is outstanding. Payments are sent to the mortgage servicing company. The mortgage may be securitized and sold to investors.

It endorses the promissory note (signs it over) to the new loan owner. The promissory note owner is the only party with the legal right (called "standing") to collect payment on the debt. Assignment. The seller also prepares an assignment of mortgage to the new entity and, usually, records the assignment in the county records.

This is an overview of what an assignment of mortgage is and why it is important and the steps you must take to get the assignment recorded properly at the c...

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan − aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time. The assignment of mortgage occurs because without a security ...

Again, while a mortgage involves two parties, a deed of trust involves three: the trustor (the borrower) the lender (sometimes called a "beneficiary"), and. the trustee. The trustee is an independent third party, like a title company, trustee company, or bank. The trustee holds "bare" or "legal" title to the property.

A Mortgage Deed, also known as a Mortgage Agreement, is a document where a borrower of money grants the lender of that money conditional ownership in a property as a security interest against the loan until the loan is paid in full. If the borrower fails to repay the money as agreed, the lender then becomes the owner of the property used as security and will have the power to sell it to recoup ...

A quitclaim deed facilitates a property transaction between a grantor and grantee. The grantor is who initially owns the property and sells it, and the grantee receives the deed of the property. A deed is a legal document that makes the transaction official and valid. Technically you don't even need an attorney to file a quitclaim deed, but ...

What does Assignment of Mortgage mean: The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

All of the security instruments, notes, riders & addenda, and special purpose documents that should be used in connection with regularly amortizing one- to four-family conventional first mortgages that are sold to Fannie Mae are available for viewing, printing, or downloading in Microsoft ® Word format. Each document is accompanied by an ...

This assignment is a document that indicates the mortgage has been transferred to a new owner. ... If you sign a deed of trust instead of a mortgage, MERS could be named as the beneficiary of your loan. In the lending industry, these loans are known as "MERS as Original Mortgagee" or MOM loans. Your lender might name MERS as the beneficiary ...

the. day of. 20. Full name and address of each Borrower Borrower 1 Borrower 2. Haven Mortgages Limited having its registered office at 10 Molesworth Street, Dublin 2, D02 R126 ('Haven'). This deed is supplemental to the legal Mortgage or Charge and other documents (if any) (hereinafter collectively called the "Principal Deed")

FHFA established the Suspended Counterparty Program to help address the risk to Fannie Mae, Freddie Mac, and the Federal Home Loan Banks ("the regulated entities") presented by individuals and entities with a history of fraud or other financial misconduct. Under this program, FHFA may issue orders suspending an individual or entity from ...

Deed of Assignment - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. This document is a mortgage agreement between Spouses Lismis Giray Almeria and Wilma Tolibas Mongote (the mortgagors) and Gloria Geraldo Hugo (the mortgagee). The mortgagors borrow PHP 50,000 from the mortgagee and secure the loan with a mortgage on a 32 square meter ...

596K subscribers in the vexillology community. A subreddit for those who enjoy learning about flags, their place in society past and present, and…

Elektrostal Geography. Geographic Information regarding City of Elektrostal. Elektrostal Geographical coordinates. Latitude: 55.8, Longitude: 38.45. 55° 48′ 0″ North, 38° 27′ 0″ East. Elektrostal Area. 4,951 hectares. 49.51 km² (19.12 sq mi) Elektrostal Altitude.

In 1938, it was granted town status. [citation needed]Administrative and municipal status. Within the framework of administrative divisions, it is incorporated as Elektrostal City Under Oblast Jurisdiction—an administrative unit with the status equal to that of the districts. As a municipal division, Elektrostal City Under Oblast Jurisdiction is incorporated as Elektrostal Urban Okrug.

This Act may be cited as the Conveyancing and Law of Property Act 1898. Nothing in this Act contained shall be taken in any way to alter or modify the provisions of the Married Women's Property Act of 1893, but this Act shall take efect only so far as it is not inconsistent with the said Married Women's Property Act of 1893. First Schedule.

* calculated weighted mean of apartment cost per 1 square foot/meter in Elektrostal secondary housing market. Among prices in range from 30 to 200 thousand Rub/m² for Elektrostal.Among apartments with area in range: from 20 to 350 m², from 215 to 3767 ft².