Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

Customer Experience

Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

What are the top market research challenges in 2022?

We all know that conducting market research in today’s landscape is nothing short of challenging — from the need to deliver deeper and more meaningful insights faster to developing strategic, always-on research functions.

In many ways, the pandemic amplified existing challenges while creating new ones: the role of the market researcher has evolved from just the deliverer of insight to the supporter of strategy, while organizations are gradually moving towards end-to-end research platforms to support every area of the business.

These are, of course, early days, and many organizations are still finding their footing — but those that are aware of and combating these challenges are those leading the charge.

In this blog, we analyze some of the top market research challenges from our 2022 Market Research Trends report, and provide tips and tricks on how to overcome them.

Challenge 1: Addressing market uncertainty

For market researchers, acting during times of uncertainty is nothing new. After all, much of their expertise lies in analyzing large amounts of disparate data to uncover conclusions and highlight opportunities. And it’s through this data, specifically experience data, that researchers can chart a course forward.

However, in times like these (with the pandemic and shift to digital), there’s a tendency to pause or cancel projects and initiatives — perhaps to recoup lost investments, protect employees or ensure the business can continue to run.

That said, there’s a compelling argument for organizations to weather the storm — to continue pushing through and put more faith into their research activities to understand how business and customer mindsets have shifted. By investing more time and resources into market research, organizations can get ahead of the competition and start to deliver experiences fit for the new world of work.

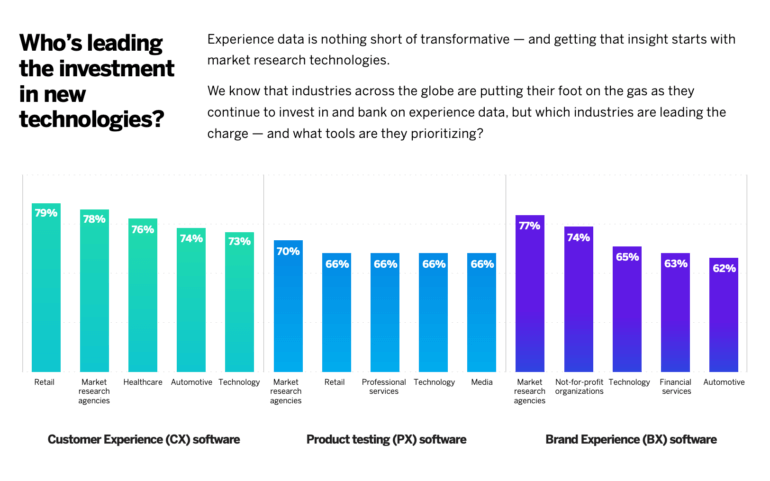

And most organizations have responded positively. Through our research, we discovered that while market uncertainty is one of the top challenges for market researchers — the vast majority of respondents (67%) are investing more in specialized market research technology to get a grasp of the post-COVID-19 world. As important, 77% see these technologies as critical to their organization’s success.

There’s more — these organizations are also investing heavily in product, brand and customer experience technology to close gaps across their activities. It’s through these tools that they can improve brand recognition and sentiment, customer engagement and satisfaction, and ultimately deliver more valuable products.

The reality is that uncertain times are highly dynamic. Needs, priorities, concerns and perceptions change frequently. But the only way to be successful in an ever-changing landscape is to adapt and understand the new state of play.

Challenge 2: Improving data quality and insights

For almost a third of our report’s respondents (31%), the most helpful innovation for addressing their business’ challenges in 2022 would be an automated data quality solution. Indeed, gathering and processing data, especially with a series of disconnected, disparate tools and a growing list of digital channels — often leads to inconclusive or low-quality insights.

But as well as lacking the right tools, some organizations lack the expertise and resources required to properly utilize the assets at their disposal. According to our report, 20% of respondents cite a lack of skills and training as one of the reasons their market research is being held back. Another variable affecting data quality.

Similarly, data from Forrester Consulting’s report (The State of Evidence-Based Experience Design) — commissioned by Qualtrics — highlights that limited use (by almost half of the respondents) of analytics tools and siloed processes poses major challenges to data-driven experience design and adoption.

Typically, data quality issues arise from these problems:

Therefore, to get the most value from market research in these instances, organizations must do the following things:

1. Develop and implement a repeatable, scalable and robust data gathering and collection process.

As business outcomes are built around new market research, ensuring you have a solid strategy and approach to using the data is absolutely critical. This means embedding consistency at every phase of your research project, carefully evaluating the methods you (or your market research agencies) use and asking yourself: “is there a better way of doing this?”

And in most cases, there is. You may have disconnected processes and knowledge gaps, or your approach to market research is outdated. The idea here is that you build a best-in-class research culture that’s supported by the technology you choose to use. If your strategy and approach are riddled with problems, your data will suffer the same.

At every opportunity, try to identify ways of doing things better and more efficiently to support your overall market research goals, whether that’s automating specific elements or outsourcing the data collection so you can focus on analysis. What’s key is that the process is repeatable, scalable and robust.

2. Acquire a solution that empowers everyone, across the organization, to carry out and analyze research

We’ve spoken previously about the benefits of platformification for the market research industry, but it bears repeating here. Considering the challenges facing market research projects, including the need to glean higher quality insights faster — platformification offers a solution.

By consolidating data, and combining qualitative and quantitative capabilities and datasets in a single platform, platformification enables organizations to connect the dots at every stage to surface more holistic insights efficiently. This is also incredibly important as less than half of organizations (45%) use qualitative and quantitative data to uncover new experiences.

Analytically, platformification means organizations can use modern technology to capture data from multiple sources and deliver richer insights, faster. For the expert market researcher, it enables them to use advanced statistical analysis tools to elevate findings and get significantly more from the same amount of data.

Finally, with the right choice of platform, it becomes possible for anyone in the organization to carry out data collection and research projects — all without training. It’s the natural evolution of market research, an approach that gives everyone the capabilities they need.

3. Clearly define research methods, analysis and use the right tools

Relying on a platform that offers all types of research, quantitative, qualitative and more, vastly increases your data collection and analysis capabilities while giving you the flexibility you need to carry out specific projects.

Furthermore, using the right tools and technology means that you can make sense of certain types of data, such as structured and unstructured data. For example, the ability to capture and analyze open-text responses across multiple channels to determine customer sentiment and engagement.

4. Establish collaboration across the enterprise

A core part of developing and deploying successful market research projects is collaboration across the entire enterprise. Having a singular platform helps — in that everyone is effectively working from the same location — but it’s also important to get buy-in and clearly articulate the purpose of the research in advance.

It’s also worth setting up regular meetings or sessions with teams before, during and after any market research project to understand progress, highlight opportunities or issues, and then identify ways of improving upon the process.

This kind of collaboration fosters not just good relationships with departments (enabling market researchers to become trusted advisors and strategists, rather than just analysts), it also builds a culture where market research is put at the heart of all campaigns.

Challenge 3: Getting leaders to invest

Conducting market research today is perhaps one of the most important things an organization can do. With the right data sources, market researchers get better insights, leaders can push business decisions and product developers can come up with solutions to business problems.

The challenge is getting leaders to continually invest. According to our report, 21% highlight communicating ROI and business impact as one of their top market research challenges. The same percentage highlights competing internal priorities as another.

At some organizations, market research is a means to an end — done to support new product initiatives or marketing campaigns. But the real value is in ongoing market research supported by an embedded research function.

The first step to getting leaders to invest is to clearly demonstrate, regularly, the impact of market research on business outcomes. For example, by using role-based dashboards, you can provide stakeholders and executives with high-level summaries of how market research projects have contributed to business outcomes.

As for ongoing product development, let’s say you carry out some product research, using conjoint analysis, to identify which product features customers value most. You can then compile this information for product teams and executives to see before making the necessary changes. You could also carry out market research to identify the ideal product pricing point before going to market — or do that same research to work out how to alter your product prices in the current market.

What about ongoing improvements? Well, you can apply market research to products in situ and run focus groups and surveys to uncover new customer preferences. You could even use listening tools on digital platforms to capture customer feedback and reviews and use that information to create new products or add features to existing ones. Then, communicate the results of these changes to teams, executives and stakeholders with ease.

Of course, all of the above requires the right platform — one that can listen, understand and act on market research data to empower you and your teams to create better experiences.

Discover the market research trends of 2022

At the heart of business success is market research, but overcoming the problems and capitalizing on the trends requires a well-thought strategy.

In our second annual study into the state of market research globally, we delve deeper than ever before to uncover the market research challenges and opportunities for organizations in 2022.

From the changing role of the market researcher to what you should be prioritizing, discover everything you need to know.

Just download your free copy using the button below.

Learn more about the 2022 market research trends and challenges

Qualtrics // Experience Management

Qualtrics, the leader and creator of the experience management category, is a cloud-native software platform that empowers organizations to deliver exceptional experiences and build deep relationships with their customers and employees.

With insights from Qualtrics, organizations can identify and resolve the greatest friction points in their business, retain and engage top talent, and bring the right products and services to market. Nearly 20,000 organizations around the world use Qualtrics’ advanced AI to listen, understand, and take action. Qualtrics uses its vast universe of experience data to form the largest database of human sentiment in the world. Qualtrics is co-headquartered in Provo, Utah and Seattle.

Related Articles

March 21, 2024

Turning reactive CX into proactive CX

February 14, 2024

Experience Management

3 key ways AI can help drive human-centered government

February 5, 2024

Qualtrics again named a Leader in 2024 Gartner® Magic Quadrant™ for Voice of the Customer report

January 30, 2024

Qualtrics now a CMS-approved vendor to conduct the Health Outcomes Survey

December 12, 2023

To be a change maker in CX, focus on business outcomes

November 15, 2023

Consumer trends to watch out for in 2024

November 7, 2023

Brand Experience

The 4 market research trends redefining insights in 2024

October 24, 2023

The 5 employee experience trends redefining work in 2024

Stay up to date with the latest xm thought leadership, tips and news., request demo.

Ready to learn more about Qualtrics?

- Case Studies

Top Challenges Faced by Market Researchers and How to Solve Them

It’s been a challenging few years, to say the least. As we look ahead to the coming years, we wanted to uncover the biggest challenges currently facing market researchers. So we did what we do best: designed and conducted a study of 145 insights pros to learn more about the difficulties they’re facing – and then provide ways to address them. Here’s what we learned.

Watch the on-demand webinar here to see the full research report from our study.

Common difficulties

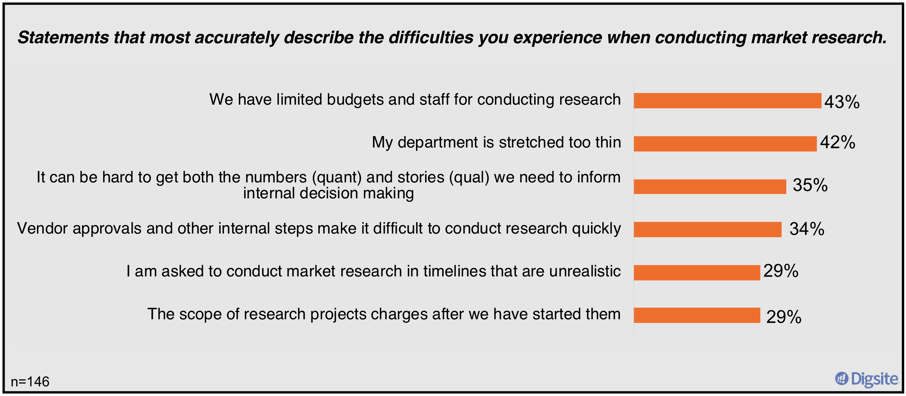

We all know that conducting research in today's landscape has been challenging. in many ways, the pandemic amplified the challenges we were already facing. top issues included:.

- Limited budget and staff

- Team is stretched too thin

- Hard to get both the numbers and stories needed to inform internal decision making

- Slow internal approval process for vendors

- Unrealistic timelines

- Changes in scope after starting a project

Participants said the most problematic and common issues they faced included the need to:

- Conduct research faster to meet internal deadlines

- Offer simpler and less expensive ways to conduct iterative research

- Conduct quality research with limited resources

- Conduct more research with the same amount of resources

In other words, the top challenges revolved around the need to move faster while dealing with limited resources. These are the biggest challenges because insights pros are just that – pros – who want to do quality work. We all get that – we take pride in our work, and we know it takes more than an algorithm to come up with meaningful insights and recommendations for a team.

Key research study takeaways

We asked insights pros how they are dealing with these challenges today. their workarounds to time, budget and resource constraints are....

- Working more hours

- Using experience and qualitative insights to get to more actionable stories behind the data

- Seeking out new tools and partners to drive automation and efficiencies

How to address these challenges

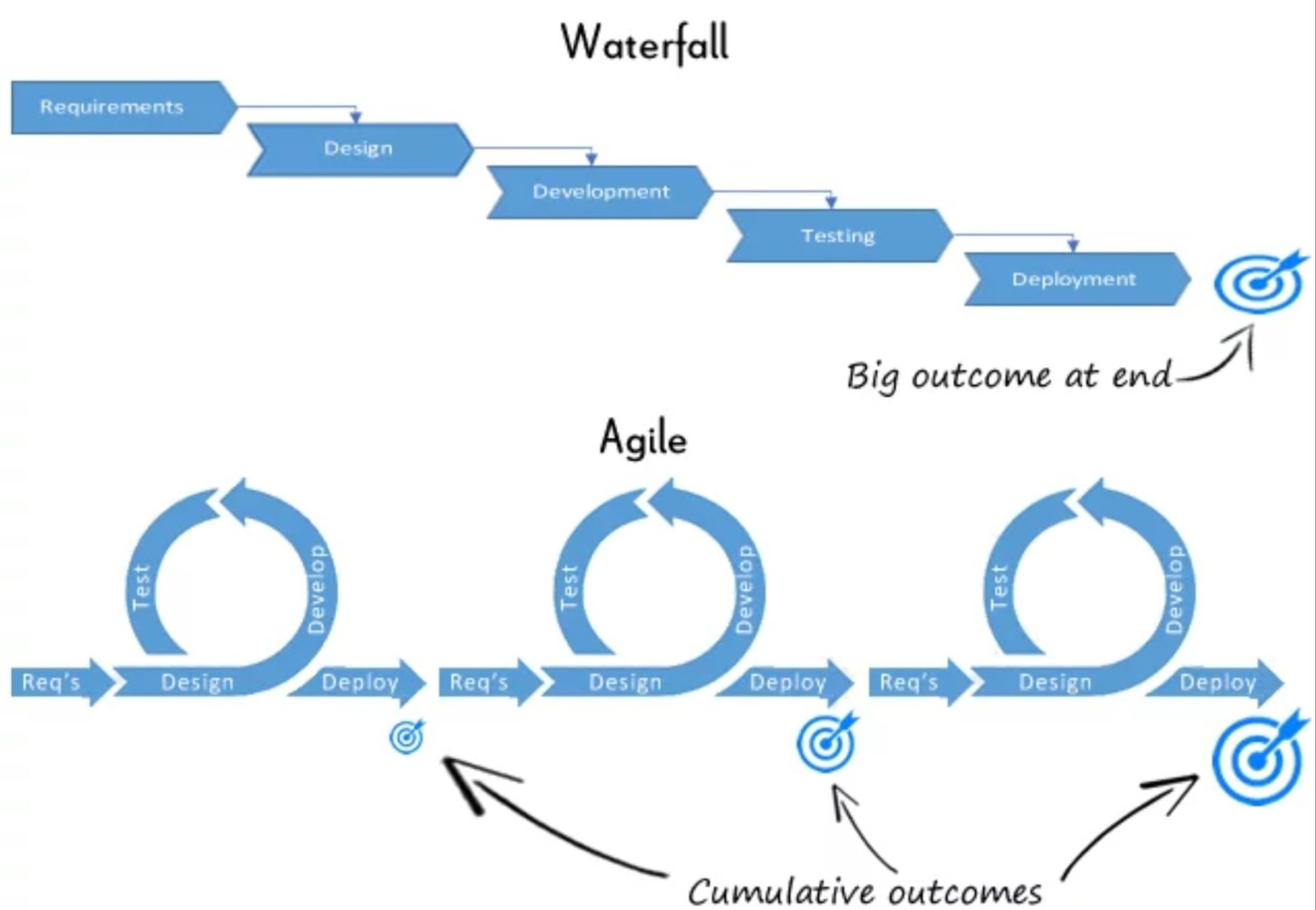

In talking to leaders across the industry, we have seen firsthand that it is possible to get more from limited resources and budgets. it isn’t simply about working harder or faster, but about using technology to build flexibility into our methods so we can move faster while getting more targeted, relevant insights. i have two suggestions for any company that wants to take their insights to the next level., build research agility to deliver speed and efficiency. being able to do both qual iteration and quant validation is key. creating a build, test and learn cycle will speed up processes and deliver faster insights..

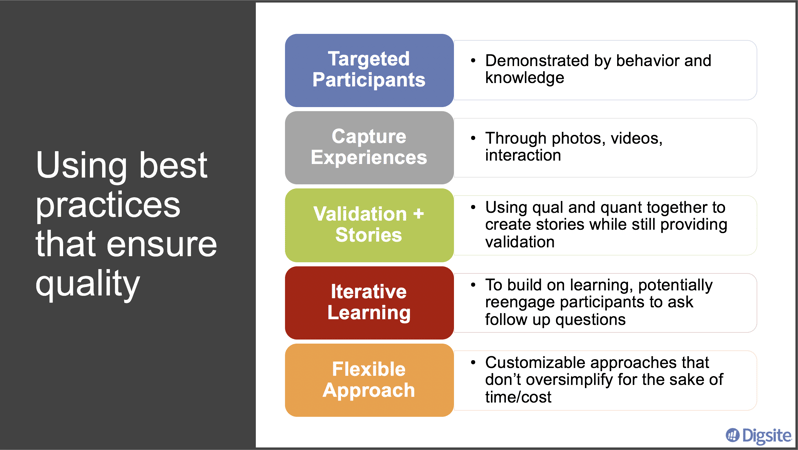

Use best practices to ensure quality. Here’s what we suggest:

- Find more targeted participants for your research: people who have demonstrated the specific behavior you want to talk to them about, or who have the knowledge you’re seeking in terms of user experience. Doing this will help ensure quality results and enable focused learning that ties to behavior.

- Use qual and quant together for better context in decision-making by the team. Making these two work together more seamlessly will allow you to create stories while still providing validation.

- Build on learning by re-engaging participants to ask follow-up questions. Newer qual + quant methods allow you to iterate on learning by inviting targeted participants to participate in qual follow-ups to drill deeper into the “whys” and improve as you build.

- Take a flexible approach, using automated research studies with customizable templates that don’t oversimplify for the sake of time/cost. The more you can tailor your questions, the higher likelihood that your team will get the results they need.

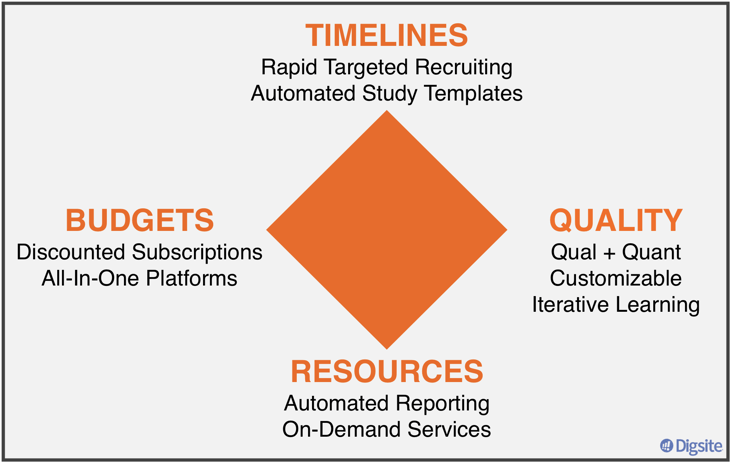

Four key ways insights technology can help you deliver

Timelines: Seek out insights technology providers that can offer highly targeted qual + quant recruiting within hours or days. They have automated study templates and reporting dashboards, so you can get instant reporting to drive faster decisions.

Quality: Look for tech solutions that can capture context and experiences rather than just attitudes. You also want the ability to recontact quantitative participants or have multiple touchpoints in your qualitative studies, so you can drill deeper into the whys and iterate on your learning.

Resources: Seek out technology with reporting dashboards that include built-in sentiment and theme analysis in addition to charts and graphs. Also look for built-in comparisons, benchmarking and stat testing. When looking at your tech options, also consider on-demand services or assisted DIY capabilities. It’s a great alternative to full DIY, if you’re limited on time and need some help getting it all done. It’s also a doable, cost-effective alternative to working with full-service vendors.

Budgets: Working with a tech platform on a subscription basis can be a smart decision. Not only do you save more than traditional discounts with full-service vendors (sometimes 20% or more), but it can save your team time in dealing with bids and approvals on every project. And tech solutions that offer on-demand services can give you the benefits of full-service partners, without the cost.

Next steps to become more agile

So what should you do next if you want to be more agile? First, get leadership buy-in by demonstrating the potential benefits to your timelines and budgets. Next, start building agile skills in your team by experimenting with smaller research sprints. Find a technology partner that can help you – you need to feel comfortable with them and be able to collaborate. As you move forward, take time at the end of each agile study for a short retrospective. Look at your results: Did you get what you needed? Did you work too many hours? What went well? What was inefficient? How can you streamline going forward?

To learn more about agile methods and best practices , check out our new 3-part eBook series: Ready, Aim, Fire: A Guide to Agile Insights for Consumer Product Teams.

Subscribe to our newsletter to stay up-to-date on all things Digsite!

Sign up for our monthly newsletter to get our new blogs, webinar invites and other handy resources sent directly to your inbox so you can stay current on agile insights and innovation trends.

Topics: Market Research , Strategic Best Practices , Quantitative Research , Online Communities , Agile

Monika Rogers

Monika Rogers is the CEO and Co-founder of Digsite. She has more than 20 years of marketing, innovation and market research experience, including positions at General Mills, Pillsbury and the A.C. Nielsen Center for Marketing Research at the University of Wisconsin-Madison.

About Us Product Pricing Blog eBooks Case Studies Contact Careers Press Login

Exclusive eBooks

- How to Get the Most Out of Your Concept Testing

- Innovate Faster with Jobs-to-be-Done Research

- Ready, Aim, Fire: A Guide to Agile Insights for Consumer Product Teams

- How to Conduct Market Research During the COVID-19 Era

- ©Digsite 2020

- Privacy Policy

- Terms & Conditions

The biggest obstacles for market researchers – and how to overcome them

Many market researchers face similar obstacles when conducting research. Not having enough time, the right data or skillset can lead to inaccurate or unexplored results.

Overcoming the largest marketing research challenges

Editor's note: Emily Smith is the marketing content specialist at Brandwatch.

Market research can be time-consuming, expensive and hard to implement correctly. Brandwatch has researched the toughest obstacles for insights teams and in this article we’ll offer effective solutions to help your business get ahead of the competition.

The biggest obstacles for market researchers

For our latest report on market research, we asked businesses what was impacting their ability to get to know their customers. We surveyed 63 respondents from Brandwatch’s network. Here’s what they said – and how you can overcome the challenges that arose.

Not having enough time

Over half of respondents said that time was a key obstacle getting in the way of market research efforts at their organization. With most teams in the field pressed for time, important research questions that could help drive business results are being left unexplored.

An effective way to save time is to work with specialist agencies who can conduct research for you. They can offer a second opinion on areas to target while giving you regular feedback on outcomes. Alternatively, a social listening tool can do all this and more. A great tool will transform the way you conduct market research internally by providing both real-time signals for changes in your market and historic analysis to help you dive deep into trends with just a few clicks.

Lack of budget

Budgeting issues can be the biggest roadblock for market researchers. Being short on the funds needed to conduct effective research might mean your findings are inaccurate, out of date or irrelevant.

Using a consumer intelligence tool can help save money for your business as they don’t rely on recruiting or incentivizing research participants. Instead, you can simply access unprompted feedback from millions of online sources about your brand, products or market. As you improve understanding of your market and audience, you’re able to use these insights to inform better business decisions.

Not having the right data

Working with data can be complicated and time-consuming – especially if you’re not sure what to look for. Our survey participants agreed that data can help inform strategic decisions and empower businesses to become smarter and more effective in all areas. Being truly consumer-centric means continuously gathering, processing and analyzing various data sources to stay on top of shifting consumer behaviors.

Working with the right data tools takes away the complications of data management, allowing you to work with a wide breadth of data sources in one platform and make important business decisions with confidence.

Not having the right technology

Having the right solutions in place is fundamental to gathering and analyzing the data that can help your organization thrive. According to our survey, 82.54% of respondents thought that having the right social data analysis tool in place will best support consumer insights generation and sharing in 2022.

The right analysis tool can help you search millions of online mentions, segment this data in a way that’s relevant to you, analyze insights and act on them to improve your business results.

Not having the skillset

The final challenge we’ll highlight from our research is not having the right data skills, which can significantly impact the success of an organization. Adapting to a rapidly changing market is much easier when the right skills are explored within an organization and encouraged across teams.

Investing where there are gaps in skills or knowledge in the workforce can help you stay abreast of all the changes that will impact your organization.

Key takeaways

Understanding how to conduct time-effective, budget-friendly research is important for every business, whether you’re an up-and-coming SMB or a well-established enterprise.

The right consumer intelligence tool can transform your approach to market research in rapidly changing times, enabling your organization to act with agility and confidence.

You can read about these insights in more detail in our report on The Researcher of 2022.

www.brandwatch.com

Glimpse: The next-generation research platform Related Categories: Research Industry, Data Analysis, Marketing Research-General Research Industry, Data Analysis, Marketing Research-General, Artificial Intelligence / AI, CX/UX-Customer/User Experience, Market Segmentation Studies

Enhancing consumer privacy in 2024: Data management and AI guidelines Related Categories: Research Industry, Data Analysis, Marketing Research-General Research Industry, Data Analysis, Marketing Research-General, Artificial Intelligence / AI, Consumer Research, Consumers, Data Processing, Data Quality, Innovation

The Q Report: Outsourcing seen as a valued, versatile option for corporate marketing research teams Related Categories: Research Industry, Data Analysis, Marketing Research-General Research Industry, Data Analysis, Marketing Research-General, Questionnaire Analysis, Recruiting-Qualitative, Recruiting-Quantitative, Respondent Database/Recruiting System

Historian to market research: Q&A with the winner of the 2023 Researcher or the Year (end-client) Award Related Categories: Research Industry, Data Analysis, Marketing Research-General

- Books & Reports

- Product-led Growth

- Pricing & Positioning

5 Market Research Challenges (And How to Solve Them)

Tien-Anh Nguyen

December 31, 2013

Conducting buyer insights research can be overwhelming. From planning to the actual studies, there are a lot of responsibilities and hurdles to manage. Here are a few of the most common market research challenges that companies face, as well as some of the simplest solutions to get everyone up and running.

Few initiatives will provide your company with as many in-depth insights into your customers as effective buyer insights research. By asking your customers and prospective buyers the right questions you’ll further your understanding of:

- The distinct buying roles that exist in your buyer’s organization

- The different stages in the customer buying process

- The features that matter most to buyers’ business goals

- How your buyer views your product and your competitors’

While it provides a wealth of information, market research also comes with its share of challenges: generating support from stakeholders, difficulty contacting prospects, and unforgiving time constraints. Before you give up, we’d like to stress that the benefits of buyer insights certainly outweigh the challenges. Here are five of the most common market research challenges and the simply solutions to each.

The 5 Market Research Challenges (And Their Solutions)

Photo by : Michael Lokner

Chief Business Officer at UserTesting

Tien Anh joined UserTesting in 2015 after extensive financial and strategic experiences at OpenView, where he was an investor and advisor to a global portfolio of fast-growing enterprise SaaS companies. Until 2021, he led the Finance, IT, and Business Intelligence team as CFO of UserTesting. He currently leads initiatives for long term growth investments as Chief Business Officer at UserTesting.

What’s in store for B2B marketing in 2024. Marketing expert Jon Miller shares his eight game changing predictions here.

ABM, or account-based marketing, is a powerful strategy to push relevant leads further down the funnel towards purchase. But for many companies, it’s often led by sales’ own criteria, rather than driven by powerful marketing data. Here’s how to do ABM the right way.

Ready to use paid advertising to grow your B2B startup’s customer base? Here’s an in depth guide to get you started.

Subscribe & Scale

Sign up for our newsletter.

- By submitting your information, you agree to receive periodic emails from OpenView. Please review our privacy policy here .

- Email This field is for validation purposes and should be left unchanged.

Share on Mastodon

- Help Center

- Download Center

- Distribution

- English English Español

The 4 top challenges and opportunities in market research industry

The 4th Industrial Revolution is technology-driven and will impact the business market unprecedentedly, adding US$14.2 billion to the global economy in the next 15 years (Accenture), and affecting industries. Within this context, if the market research sector wants to survive such a deep transformation, it must overcome significant barriers. But… what are the challenges for market research and how can this industry be accelerated?

The fourth industrial revolution is here

According to Klaus Schwab and many other experts, we are entering the so-called “4th industrial revolution”:

“Of the many diverse and fascinating challenges we face today, the most intense and important is how to understand and shape the new technology revolution, which entails nothing less than a transformation of humankind. We are at the beginning of a revolution that is fundamentally changing the way we live, work, and relate to one another. In its scale, scope and complexity, what I consider to be the fourth industrial revolution is unlike anything humankind has experienced before.”

First paragraph of the book “ The Fourth Industrial Revolution ”.

Klaus Schwab, Founder of the World Economic Forum.

In preparation for this revolution, many companies have already started their digital transformation to be more competitive, which by definition supposes a deep change in organizations. The digital transformation is much more than just the acquisition of technology: it demands that we are up to speed on new technological advances and implement those that fulfill strategic objectives. In this sense, Microsoft remarks that the transformation must encompass four basic pillars: optimization of operations, empowerment of workers, achievement of higher engagement with clients, and transformation of products.

Digital transformation will have a great impact on all sectors, and market research is no exception. On one hand, market research must think about how to apply the technology within the sector. And on the other hand, it must address important challenges associated with digital transformation such as loss of exclusivity at the time of obtaining insights on the clients. Next, the biggest challenges and opportunities are explained in detail.

Challenge 1: On the optimization of operations

One of the clearest effects of digital transformation on the market research sector has been the optimization of data collection processes . Currently more than 56% of today´s market research has been digitized (digitization process).

In quantitative research , data compilation carried out with digital technology surpasses 70%, which has helped collect large amounts of data, reduce prices and times, and improve data quality. In qualitative research , there is a slightly growing interest in online communities, but this currently only represents 37% of data collection.

Regarding other research tools, there are no concrete data but, for example, typical neuromarketing techniques such as implicit response tests have been digitized and can already be taken online (learn more about neuromarketing techniques ).

Nevertheless, technology can contribute even more to the sector, for example, through the automation of many operations required to carry out research. Although automation is already used for the development of graphics and infographics, in survey analysis, data analysis and analysis of social media, there is still a wide margin for automation and optimization of processes.

In this line, some experts estimate that 90% of the typical tasks carried out in market studies could be automated in 10 years [ Dirk Huisman ] and that the probability of teleoperators, data transcriptors and encoders disappearing is 99%, while the probabilities of interviewers and market research analysts disappearing are 94% and 61% respectively [ Benedikt, C. y Osborne, M. A. ].

CHALLENGE 1

How to make better use of technology to offer more reliable and cheaper market research that will not disappear along the way?

Challenge 2: On the empowerment of the worker

Regarding the possibility of empowering the employees, the market research industry, as other sectors, has adopted cloud and mobile devices/technologies that have helped researchers collaborate anywhere, anytime. However, market research is technologically behind in comparison with other industries and should be aware of some innovations that start to be a reality . For example:

The use of collaborative platforms to outsource specific and limited tasks to market research professionals located anywhere in the world.

The use of virtual reality (VR) to train human resource interviewers to be more empathic.

The use of artificial intelligence (AI) tools to help the researcher (learn more about artificial intelligence and feelings ). It is especially interesting that ESOMAR has implemented an intelligent search tool ANA , to obtain 70-year data on scientific papers, videos and white papers, but ANA seems to remain underexplored and underutilized.

The use of new technologies, such as neurotechnology to improve cognitive performance of employees.

Being on the cutting edge and empowering employees is fundamental in the case of millennials , who do not accept to work in companies that are sub-optimal in this sense. Maybe this is why the data scientist is the most attractive and in-demand occupation of the 21st century, being much more attractive than the market researcher position, despite the fact that both professionals are responsible for obtaining actionable insights.

CHALLENGE 2

How to make use of technology to offer an attractive professional career and attract/retain talent in the industry?

Challenge 3: On how to connect with the client

During many years it has been said that “the customer is always right”. However the truth was that very few companies focused their strategy on the client. The digital transformation of the society has empowered the client and this has changed the strategy of companies, which now focus on creating customer experiences : rather than being only good practice, now it is mandatory to be “customer-centric”.

The companies are not only concerned on whether their product is going to be sufficiently liked and purchased, but they also know that connecting with the client is increasingly important and that if they do not project attractive values and personality, sales will be affected. This is an excellent opportunity for the market research firms, as now, more than ever, it is important to know the consumer. However, technological companies have also detected this necessity (and also business opportunity), and numerous Big Data solutions have started to emerge, along with DIY (do it yourself) solutions that enable data collection from clients, putting at risk the privileged position once occupied by the market research industry. Nowadays, traditional market research is no longer the only way to obtain consumer insights .

The development of Big data is unstoppable: real-time data that is currently already collected (such as the digital behavior of consumers) will be soon complemented by data from the Internet of Things IoT (information on how consumers relate to any object) and from the revolution of wearables with neurotechnology (information on the emotional and cognitive reactions of consumers). Regarding the latter, it will be very important to implement ethics to support the use of neurotechnology in our society.

CHALLENGE 3

How to coexist the new “parallel world” to market research created by Big Data and DIY?

Challenge 4: On how to transform products/services

The digital transformation of companies leads to indispensable innovation in the development of products and new business models . Highly technological startups have been converted into references to all types of companies. More specifically, the extremely popular Lean Startup methodology created by Eric Ries in 2011 is crucial to with traditional market research methods, as a tool to design new innovative products or business models.

According to Ries, companies must establish a market hypothesis , design a basic version of the product to validate the hypothesis (the so-called minimum viable product, MVP), place it in the hands of clients and target market, and then observe and learn whether the hypothesis was actually correct. Once there is sufficient and validated knowledge, this process is repeated with a new hypothesis. With this iterative process, business decision-making is agile and risks are reduced when launching innovative products because failures are detected early and can be corrected in time.

CHALLENGE 4

How to address the perception that market research is not compatible with agile methodologies and innovation?

Some additional opportunities, ideas and thoughts

Thanks to the artificial intelligence tool ANA, we have analyzed the information compiled by ESOMAR since January 2011 on the future of market research and we now share some ideas and new opportunities:

- Industry must develop a more powerful brand identity.

- High standards must be defended and valued, along with the rigorousness of industry and the capability of asking the right questions.

- Innovation is mandatory and agility and intelligence must be added to processes in a proactive manner (it might be too late to do this later on…)

- It is important to understand which research methodology is better for each specific problem: “What” versus “Why”.

- It is necessary to find partners and generate collaborations that help us grow, adapt and learn. And as a result, offer more holistic investigation approaches.

- Business and strategic recommendations must be made, based on the results of the research. The “must know” has to be separated from the “nice to know”. Focus on the message and not on data.

Therefore, the implementation of these ideas is absolutely mandatory for the market research sector to face the technological revolution that emerges, but it is still unknown whether this will be sufficient. The changes that will come in the following years are unpredictable.

These and many more ideas were debated in the digital research event La @ de AEDEMO , in which María López, Bitbrain’s CEO participated.

You might be interested in:

All you need to know about neuromarketing

Nissan’s Brain-to-Vehicle technology communicates our brains with vehicles

Will machines ever feel emotions?

Advances in motor neuroprosthetics improve mobility in tetraplegics

Nutritional neuroscience reveals the gastronomic tastes of the Spaniards

How to improve work performance in people over 40?

Overview of cognitive rehabilitation and stimulation therapies in dementia

15 FAQs before selecting a neuromarketing master degree program or training course

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

4 Top Trends, Challenges, and Opportunities in the Market Research Industry

Here is a look at some of the emerging and prevalent trends in the market research industry and the measures being taken by our team at The Farnsworth Group to stay on top of changes, continually implement best practices, and ensure the reliability of research findings:

Technological advances—such as the proliferation of various generative Artificial Intelligence (AI) and use of language learning models like Chat GPT, plus the increasing sophistication of market research bots—are affecting the market research industry and necessitating an adjustment to best practices and policies when conducting surveys.

As a custom market research firm , our continual aim here at The Farnsworth Group is to keep pace with industry changes, adjust our best practices, and integrate the highest quality controls to stay up to date and produce reliable findings to guide our customers’ important business decisions.

Top Takeaways from the Quirk’s Event

To get new and professional insights about recent developments in the market research industry, several team members from The Farnsworth Group attended The Quirk’s Event in July. This annual in-person conference is designed to support marketing research and insight professionals and provide tools and information to help us drive our practices forward in the 21 st century.

1. The Spread of AI Presents Opportunities and Challenges

The explosion of generative AI such as Chat GPT is sure to have an indelible impact on the way market research is conducted . Industry professionals are experiencing a mixture of emotions and concerns surrounding the benefits and potential ramifications of AI.

A significant portion are worried about the possibilities that AI presents, while a smaller segment is curious and filled with optimism. Professionals at the conference also expressed concern that AI will threaten their job, while others believe it will make their job easier.

In response to the pervasiveness and ever-evolving nature of generative AI, we’re integrating technology platforms and survey design practices that will identify AI and terminate surveys or reject surveys that involve suspected fraud. We are actively improving the standards we use when creating robust survey questions and when searching for “human elements” in data responses to weed out fake respondents.

For example, we are

- looking for grammatical errors in long-form answers, AND grammatical perfection as Chat GPT won’t make spelling mistakes unless prompted;

- analyzing the length of responses to open-ended questions, as people use an average of just nine words, while Chat GPT averages more than 200;

- asking for self-identification or self-detection;

- and looking for more personal answers that reference life experiences.

Also, since AI is programmed to be politically correct, and won’t use swear words, we are considering and testing techniques to exploit this tell of AI to identify real human vs fake respondents.

“Even though AI is the biggest technology disruptor since the iPhone, the human element is still important. AI is a tool, not an oracle. While people’s roles may change, their expertise is still needed to ask it the right questions, verify, and interpret the information.” - Kimber Kreilein, Project Director at The Farnsworth Group

2. Sample Quality is an Industry-wide Challenge

The struggle continues for research firms and in-house insights teams alike, working to ensure quality sample in surveys , as there has been an increase in bad actors—bots or those using AI to quickly supply answers that aren’t thoughtful or genuine—over the past three years. Plus, survey respondents are becoming increasingly sophisticated, which makes it challenging to spot them among a group of legitimate respondents.

Here are 5 real examples showing the process we use to prevent fake responses from affecting research output, insights, and recommendations.

Unfortunately, there is not one simple solution for dealing with this, but we can use a multi-pronged approach. One way we can help address this issue is by designing research surveys that are shorter in length and more simply structured. This will enable suppliers to eject bad actors from all databases quickly and efficiently by frequently sharing information on rejected respondents.

Additionally, we can use server-to-server integration (S2S) to eradicate ghost completions and help mitigate fraud on the customer end. Also, we have to be aware of the survey incentive rate; if it’s not valuable enough, real people won’t invest their time, and it will be difficult to achieve an adequate sample size of genuine respondents.

3. Making Research Tell a Dynamic Story is Critical

Another struggle is that market research can be perceptively dry and unengaging, making it difficult for people to understand and interact with the data. To deal with this challenge, it’s important that research presentations tell a dynamic story and integrate appealing elements to illustrate key themes.

At The Farnsworth Group, our goal is to make sure insights are clear and comprehensible for the variety of stakeholders in your organization and across departments. We also add videos, recordings, word-for-word transcripts, and other visual elements to capture the voice of the customer behind the findings and conclusions.

4. Using Secondary Data as a Valuable Supplement

We do believe that AI can be used to help deliver additional value to clients. One way AI can potentially assist market research professionals is by mining existing data to look for any information and insights that can augment findings in a new or original survey. We are actively investigating the reliability of this approach, usually manual processes for quality assurance during this testing.

While it can’t replace the benefits of primary research, it can supplement that work. For example, any secondary data and internal client data that’s available can be used to cross-check additional findings from primary research.

Selecting the Right Vendor for Market Research

Companies in various industries utilize market research to make important and often costly decisions about product development, increasing revenue, pursuing new markets and acquisitions, and furthering brand recognition. You don’t want to make those decisions lightly or based on faulty research.

The best way to help reduce the risk of making questionable corporate decisions is to partner with a market research company that is constantly evolving and using up-to-date tools to improve the authenticity, reliability, and value of data and insights.

That’s what you can expect with our team at The Farnsworth Group, as we respond to changes in the market research industry, employing accurate data collection practices and taking measures to prevent bad actors from distorting findings.

5 Ways to Navigate Challenges in Market Research

- January 30, 2024 February 9, 2024

Alifia Berizky

Market research serves as a foundation that underpins all informed decisions. It serves as a map to guide them in dynamic markets dictated by consumer interest rates, industry benchmarks and the competitive marketplace. The evolution of market research is a multidimensional and substantive process that does not bend to the restrictions of an ‘all-to-one’ solution. It is a process of adaptive, ongoing dynamics replicating the ever changing nature of the market, which it tries to understand.

Companies that make a commitment to in-depth and long term market research show advanced thinking, realizing that it takes not only an understanding of current market dynamics today when they do business but also that it has become necessary nowadays to take into consideration how it will progress in the future. In this paper, we are going to discuss market research as a key aspect of understanding the importance of understanding the various aspects that revolve around market research, the varieties associated with it, and how it enables businesses to make informed decisions.

Significance of Market Research

The term market research is not mere hype for the business community; it acts as an embodiment of one pillar that is responsible for determining the success or failure of enterprises across various industries. Analysing the market at a deeper level lead to discovering some insights that help organizations identify big opportunities, figure out possible risks, and modify products or services offered to customers. This becomes a pre-emptive approach based on market understanding that will help in developing sturdy marketing strategies that essentially allow us to preserve our competitive advantage amidst a dynamically changing business world.

Market research is a broad term that encompasses an array of activities that may entail anything from studying the behavioural dynamics and preferences of consumers to analysing competitor moves and industry trends. The analysis of this multitude of information provides businesses with a holistic perspective on the playing field so that better decisions are shaped in pursuit of what customers want most. Such insight-guided decision-making processes not only reduce the element of unpredictability but also help organizations in strategic planning to be adaptable to changing market trends.

In addition, market research is a continuous process whereby an individual or organization is alert to changes in consumer moods, emerging technologies and economic situations. The regular updates allow the businesses to be flexible as well as evolve, hence maintaining their hold on reacting quickly to changes in trends or strategies. Such continuous measurement of progress is like a guide for firms, making any errors in the previous directions and steering them towards untreaded paths.

Essentially, market research is the navigation compass of a business journey through the frightening maze of the marketplace. The device is more than a mere means of comprehending the current situation, as it serves as a forward-looking instrument that projects developments and lays the foundations for future undertakings. There is a need for market research to be incorporated into the core operations mandates and not viewed as just another strategic option by business organizations that are jostling for continued relevance.

Key Components of Market Research

Market research can be described as a holistic process with several segments that are important in collecting, analyzing and determining the types of information that inform decisions about business strategy.

1. Market Segmentation

Segmentation means cutting out the target market into homogenous sub-markets distinct in terms of segmentation variables. This enables businesses to segment their market through efficient methods and offerings that meet the unique needs and preferences of all target segments.

For example, demographic segmentation takes note of variables such as race, gender and income, whereas psychographic markers look into lifestyle brands, beliefs and attitudes. An effective targeting strategy makes sure of the optimal use of resources and thus helps to ensure that a truly appropriate marketing message is communicated to the targeted audience. Being a dynamic process, it quickly responds to changing consumption patterns that necessarily must keep businesses relevant in today’s structurally diverse and transient market.

2. Data Collection Methods

The mode of data collection is a key factor in getting relevant and true information. The quantitative approach uses surveys, questionnaires, and even analytics tools that help extract numerical data. In contrast, qualitative approaches make use of focus groups, interviews, and observational studies to offer in-depth information with regards to consumers’ attitudes and perceptions.

The approaches used consensual synergy, which contributes to the establishment of a holistic comprehension of the market. Moreover, new data collection methods have emerged alongside technological improvements, with the most recent being social media analytics and web scraping, which contribute significant other dimensions to the research procedure.

3. Competitor Analysis

Competitor analysis is a continuous strategy based on conducting meaningful research to figure out who its direct and indirect competitors are. It entails a critical analysis of their strategies, strengths, weaknesses, and the market position in which they are involved. This analysis enables businesses to identify gaps in the market, possible mergers or acquisitions that companies can bank on, as well as areas where they may create a competitive advantage through building distinctive capabilities.

Also Read: Market Maker Options: Definition and How They Make Money

The competitor website audit allows business people to make an informed analysis of competitors’ moves, see trends in their movement direction, and prepare their own strategy based on this understanding. At the same time, it is all about others mimicking best practices strategy: developing innovations and unique selling points that distinguish a business from its competitors.

4. SWOT Analysis

SWOT analysis is an application for the process where an organization formally uses its internal strengths and weaknesses to consider external opportunities and threats. Businesses are able to thus pinpoint those fundamental internal factors that make them unique, as well as areas for improvement and development.

The environmental level consists of market trends, economic circumstances and regulatory regimes, among others. This integrated analysis enables an informed strategic position as it pinpoints strengths to build on and interventions necessary at the same time. SWOT analysis is not, and cannot be, a one off event; it must be dynamic and always adapt to changes in the business environment.

Market Research Methodologies

The market research methods vary widely and involve a broad spectrum of processes and tools that are utilized to gather, review, and interpret data about the market, its consumers, as well as competitors. The above methodologies are paramount for businesses because their main goal is to make informed decisions, spot opportunities and remain competitive.

– Surveys and Questionnaires

The most common quantitative methods of research include surveys and questionnaires, which use a specific sample of people to collect and organize structured data. This type of investigation is specifically designed by businesses to make sure that they collect information on consumer preferences, attitudes and behaviors.

In addition, these tools are flexible as they enable large-scale aggregation of data from several aspects using online platforms such as phone interviews and even questionnaires sent through the mail service. However, despite the resounding efficacy of numerical information surfaced by surveys, careful design and analysis are needed to ensure that the results are also valid. Since there are plenty of questions that businesses can come up with in accordance with the targeted objectives of their own research surveys, these could be pretty versatile tools for understanding general market trends and attitudes among consumers.

– Focus Groups

Instinct groups are a qualitative research approach that consists of recruiting diverse participants to discuss particular topics using moderators. This type of methodology makes it possible for businesses to delve further into the minds of consumers, enabling a deeper understanding of consumer perceptions, attitudes and motivations.

By engaging in non-directed discussions, focus groups bring out hidden opinions and help develop an innovative idea to work on product development or end involve marketing. But on the other hand, qualitative data can be moderated only by a professional facilitator due to its subjective nature, and strict research will have to determine whether skillful art or science has been used in order to facilitate proper mediation between researchers and smooth communication. The limitations of using focus groups, such as group dynamics affecting the responses, and others, apart from those discussed by McGraw (2014), include emotions, motivations or other issues that have to also be identified with biometric solutions through eye tracking.

– In-Depth Interviews

Focus group interviews take place in groups instead of individual ones and are conducted among several participants simultaneously, creating a conducive setting that enables the exploration of complicated issues. Qualitative analyses permit detailed investigation into personal points of view, experiences and decision-making procedures.

Also Read: Market Making: Strategies and Techniques

Businesses often use in-depth interviews as a means to collect deep and specific details within a particular context that could have gone unnoticed in overall or wide scale surveys. One of the most typical types of interviews conducted in consumer research is one that leads to discovering some unconscious factors affecting consumer behavior. Though expensive and time-consuming, the richness of information derived from an in-depth interview makes it a technology that can be used by businesses to understand the needs of segments, particularly if they are untapped markets.

– Observational Research

The observer method, or observational research, involves direct observation and documentation of consumer behavior in their natural environments through means that do not affect the subject’s actions. This approach has been considered one of the most effective ways to realize individuals’ behavior towards products, services, or environments in actual environments.

Businesses can get hands on information that can reveal certain patterns, preferences and possible pain points that might not be noticeable with data obtained through self-report. This is further enhanced by ethnographic research, which is a type of observational research that will observe how consumers are living within their culture in order to establish cultural differences and influences from the environment. However, observational research provides an insider’s point of view, but it demands foresight into minimizing bias and adhering to moral principles.

A great deal of the process is about being challenged as part of making sure that market research provides valid and viable results. Market research is a valuable means of collecting information, but some major hurdles may affect each step of the process’s accuracy and efficiency.

1. Sampling Bias

If sampling bias starts to additionally distort the results of the market research, it can significantly decrease their accuracy since some factors may not correspond with those that largely characterize a broader population. However, the issue of lack of practical randomness is especially pronounced when researchers struggle with the actuality of obtaining a truly random and diverse sample from which to extend their results.

The consequences of sampling bias can sometimes be huge, limiting the external validity of the study’s results To tackle the challenge, designers need a well-designed sampling strategy; all determinants of sampling must be made perfect. For instance, techniques involving random sampling, stratified sampling of the participant space, or oversampling underrepresented groups could help to ensure that any insights gathered are reflective of the real diversity existing within the target population. Sampling bias refers to the fact that samples might not be representative of the population under study, and if taken care of, this can improve reliability and validity during research, helping businesses make decisions.

2. Data Quality and Integrity

The primary thing that should be noted in the context of market research is the importance of data quality and integrity, which serve to preserve its reliability. Wrong or almost accurate data can completely mislead the entire process of the analysis, and unfortunate decisions in business most end up making.

In spite of the existence of credible research, reliable data collection methods must be used to ensure that information in this regard is correct and comprehensive. This involves using trustworthy tools, verifying the data sources, and performing quality control checks during the research. The validity of the data is essential, as it influences not only the credibility of this study but generally how future analyses or strategic decisions using that same data may be perceived by other individuals. This is rather helpful, as the rigorous data quality allows us to justify the results, and a lot of companies tend to make good decisions based on information.

3. Respondent Bias

One more reason for the issue is respondent bias; participants might give wrong or socially desired answers and thus change the true performance of the researched dataset. Social desirability, respondent fatigue and the desire to figure out what the researcher wants could lead to this bias. One of the ways to overcome this challenge is by meticulously devising surveys and questionnaires with specific attention to language that mirrors the target audience’s understanding.

The use of objective wording, the lack of leading questions, and the assurance that respondent anonymity protect participants from stereotypical moral norms or anything specific to their way of life. Alternatively, it is possible to implement the combination of both quantitative and qualitative methodologies as a sort of mutual cross verification strategy that can reduce the influence of respondents’ bias on overall research outcomes. By addressing this particular difficulty, organizations can improve the integrity of their insights and develop a better understanding of the considerations used by consumers.

4. Privacy considerations

As well as ethics, these are among the things that impact market researchers and will continue to play a role in an era where technology continues to advance. Thus, mishandling of personal information results in breaches of trust, and the validity of research is compromised. The researchers must maintain vigilance as regards the regulations put in place to protect the data and support strong security measures before handling and transparency in practice about proper communication practices regarding the handling of data between researcher participants.

The method of tackling and managing data through the use of technology should be guided by ethical concerns, letting a researcher try their best as much as possible to maintain privacy and later continue with other aspects. The way businesses manage the intricacy of balancing between both technological progress and privacy issues is, hence, enabled by their enjoyment while observing how results assure trust.

5. Dynamic Market Conditions

Massive change in markets becomes a major issue for contemporary studies that use traditional research methods, as the insights gathered via this approach can never be immediate. This issue can be tackled not only in traditional ways but also through dynamic approaches such as real-time data analytics, social media listening and trend analysis.

Such methodologies deliver more relevant data, enabling firms to implement effective change plans that respond timely to changing customers’ behavior, trends in their markets, and so forth. The fact that businesses embrace the fluid nature of markets implies that the research initiatives intended to drive decision making processes remain effective and productive; hence, institutions are able to make appropriate, timely strategic decisions.

Just like the compass used in an unpredictable land, market research helps to explore any ground. Organizations using this strategic instrument secure competitive advantages due to their managed ability to risk-taking with informed or guided choices. The concepts that are extracted from a disciplined approach to investigation turn into the compass needle, which points out opportunities that would have remained embedded in their shadows otherwise. By adopting this preventive strategy, businesses not only survive threats but also anticipate and exploit emerging issues, creating a pauldron market that supports their dynamic configurations.

In addition, market research stands as a hinge for all companies that strive to survive ahead of competitors. With the constant fluctuations in consumer preferences, new technologies, and large-scale shifts in the global economy, people must periodically check what is going on with the market. Market research becomes a strategic substructure for organizations, thus aiding in the development of flexibility and responsiveness. Awareness of characteristics in consumer behavior and changes in market conditions helps them develop offerings, improve ideas on offerings, and outsmart competitors.

Disclaimer: The information provided by Quant Matter in this article is intended for general informational purposes and does not reflect the company’s opinion. It is not intended as investment advice or a recommendation. Readers are strongly advised to conduct their own thorough research and consult with a qualified financial advisor before making any financial decisions.

I craft stories that make complex ideas clear. I simplify the blend of data science, machine learning, and crypto trading, showcasing how advanced tech and quantitative models analyze data for informed trading choices. Join me in exploring the realm of quantitative trading, where my narratives make intricate concepts easy to grasp.

- Alifia Berizky https://quantmatter.com/author/alifia-berizky/ What is Cap Rate? Definition and The Factors Influencing

- Alifia Berizky https://quantmatter.com/author/alifia-berizky/ What is Black Market?

- Alifia Berizky https://quantmatter.com/author/alifia-berizky/ What is Margin Trading? Risk Associated and Potential Rewards

- Alifia Berizky https://quantmatter.com/author/alifia-berizky/ Technical Analysis: Key Components and Patterns

Who We Serve

External Contributors

Prop Trading

Market Making

Treasury Management

©2022 QuantMatter. All Rights Reserved

Challenges in Conducting International Market Research

- Reference work entry

- First Online: 03 December 2021

- Cite this reference work entry

- Andreas Engelen 4 ,

- Monika Engelen 5 &

- C. Samuel Craig 6

7197 Accesses

1 Altmetric

This chapter explains the need to conduct international market research, identifies the main challenges researchers face when conducting marketing research in more than one country and provides approaches for addressing these challenges. The chapter examines the research process from the conceptual design of the research model to the choice of countries for data collection, the data collection process itself, and the data analysis and interpretation. Challenges identified include differentiating between etic and emic concepts, assembling an adequate research unit, ensuring data collection equivalence, and reducing ethnocentrism of the research team. We draw on the extant literature to determine methods that address these challenges, such as an adapted etic or linked emic approach, to define the concept of the culti-unit, and to identify prominent approaches to cultural dimensions and collaborative and iterative translation and statistical methods for testing equivalence. This chapter provides researchers with the methods and tools necessary to derive meaningful and sound conclusions from research designed to guide international marketing activities.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

For the sake of simplicity, we will subsequently refer to nations as the unit of research, acknowledging that other culti-units may be more appropriate as outlined in section “Conceptual Framework (Phase 1).”

Adler, N. (2002). International dimensions of organizational behavior . Cincinnati: South-Western College Publishing.

Google Scholar

Appadurai, A. (1990). Disjuncture and difference in the global cultural economy. Public Culture, 2 , 1–24.

Article Google Scholar

Auh, S., Menguc, B., Spyropoulou, S., Wang, F. (2015). Service employee burnout and engagement: The moderating role of power distance orientation. Journal of the Academy of Marketing Science , 1–20. https://doi.org/10.1007/s11747-015-0463-4 .

Bagozzi, R., Yi, Y., & Phillips, L. (1991). Assessing construct validity in organizational research. Administrative Science Quarterly, 36 (3), 421–458.

Becker, T. E. (2005). Potential problems in the statistical control of variables in organizational research: A qualitative analysis with recommendations. Organizational Research Methods, 8 (3), 274–289.

Bensaou, M., Coyne, M., & Venkatraman, N. (1999). Testing metric equivalence in cross-national strategy research: An empirical test across the. Strategic Management Journal, 20 (7), 671–689.

Berry, J. (1980). Introduction to methodology. In H. Triandis & J. Berry (Eds.), Handbook of cross-cultural psychology (pp. 1–28). Boston: Allyn & Bacon.

Berry, J. (1989). Imposed etics-emics-derived etics: The operationalization of a compelling idea. International Journal of Psychology, 24 (6), 721–734.

Beugelsdijk, S., Maseland, R., & van Hoorn, A. (2015). Are scores on Hofstede’s dimensions of national culture stable over time? A cohort analysis. Global Strategy Journal, 5 (3), 223–240.

Braun, W., & Warner, M. (2002). The “Culture-Free” versus “Culture-Specific” management debate. In M. Warner & P. Joynt (Eds.), Managing across cultures: Issues and perspectives (pp. 13–25). London: Thomson Learning.

Brewer, P., & Venaik, S. (2014). The ecological fallacy in national culture research. Organization Studies, 35 (7), 1063–1086.

Brislin, R. (1980). Translation and content analysis of oral and written materials. In H. Triandis & J. Berry (Eds.), Handbook of cross-cultural psychology (pp. 389–444). Boston: Allyn and Bacon.

Burgess, S., & Steenkamp, J.-B. (2006). Marketing renaissance: How research in emerging markets advances marketing science and practice. International Journal of Research in Marketing, 23 (4), 337–356.

Cadogan, J. (2010). Comparative, cross-cultural, and cross-national research: A comment on good and bad practice. International Marketing Review, 27 (6), 601–605.

Chen, F. F. (2008). What happens if we compare chopsticks with forks? The impact of making inappropriate comparisons in cross-cultural research. Journal of Personality and Social Psychology, 95 (5), 1005–1018.

Cheung, G. W., & Chow, I. H.-S. (1999). Subcultures in Greater China: A comparison of managerial values in the People’s Republic of China. Asia Pacific Journal of Management, 16 (3), 369–387.

Child, J., & Warner, M. (2003). Culture and management in China. In M. Warner (Ed.), Culture and management in Asia (pp. 24–47). London: Routledge.

Clarke III, I. (2001). Extreme response style in cross-cultural research. International Marketing Review, 18 (3), 301–324.

Craig, C. S., & Douglas, S. P. (2005). International marketing research (3rd ed.). Chichester: Wiley.

Craig, C. S., & Douglas, S. P. (2006). Beyond national culture: Implications of cultural dynamics for consumer research. International Marketing Review, 23 (3), 322–342.

Demangeot, C., Broderick, A., & Craig, C. S. (2015). Multicultural marketplaces. International Marketing Review, 32 (2), 118–140.

Deshpandé, R., & Farley, J. (2004). Organizational culture, market orientation, innovativeness, and firm performance: An international research odyssey. International Journal of Research in Marketing, 21 (1), 3–22.

Dheer, R. J. S., Lenartowicz, T., & Peterson, M. F. (2015). Mapping India’s regional subcultures: Implications for international management. Journal of International Business Studies, 46 (4), 443–467.

Douglas, S. P., & Craig, C. S. (1997). The changing dynamic of consumer behavior: Implications for cross-cultural research. International Journal of Research in Marketing, 14 (4), 379–395.

Douglas, S., & Craig, C. (2006). On improving the conceptual foundations of international marketing research. Journal of International Marketing, 14 (1), 1–22.

Douglas, S. P., & Craig, C. S. (2007). Collaborative and iterative translation: An alternative approach to back translation. Journal of International Marketing, 15 (1), 30–43.

Douglas, S. P., & Craig, C. S. (2011). The role of context in assessing international marketing opportunities. International Marketing Review, 28 , 150–162.

Engelen, A., & Brettel, M. (2011). Assessing cross-cultural marketing theory and research. Journal of Business Research, 64 (5), 516–523.

Featherstone, M. (1990). Global culture: Nationalism, globalism and modernism . London: Sage.

Geyskens, I., Steenkamp, J., & Kumar, N. (2006). Make, buy, or ally: A transaction cost theory meta-analysis. Academy of Management Journal, 49 (3), 519–543.

Ghauri, P., & Cateora, P. (2010). International marketing (3rd ed.). New York: McGraw-Hill.

von Glinow, M. A., Shapiro, D. L., & Brett, J. M. (2004). Can we talk, and should we? Managing emotional conflict in multicultural teams. Academy of Management Review, 29 (4), 578–592.

Hartog, D. (2004). Assertiveness. In R. House, P. Hanges, M. Javidan, P. Dorfman, & V. Gupta (Eds.), Culture, leadership, and organizations: The GLOBE study of 62 societies (pp. 395–436). Thousand Oaks: Sage.

He, Y., Merz, M. A., & Alden, D. L. (2008). Diffusion of measurement invariance assessment in cross-national empirical marketing research: perspectives from the literature and a survey of researchers. Journal of International Marketing, 16 (2), 64–83.

Hofstede, G. (2001). Culture’s consequences: Comparing values, behaviors, institutions, and organizations across nations . Thousand Oaks: Sage.

Hofstede, G., & Bond, M. (1988). The confucius connection: From cultural roots to economic growth. Organizational Dynamics, 16 (4), 5–21.

Hofstede, G., Hofstede, J., & Minkov, M. (2010). Cultures and organizations – software of the mind: Intercultural cooperation and its importance for survival . New York: Mcgraw-Hill.

Hohenberg, S., & Homburg, C. (2016). Motivating sales reps for innovation selling in different cultures. Journal of Marketing, 80 (2), 101–120.

Homburg, C., Cannon, J. P., Krohmer, H., & Kiedaisch, I. (2009). Governance of international business relationships: A cross-cultural study on alternative governance modes. Journal of International Marketing, 17 (3), 1–20.

House, R., Javidan, M., & Dorfman, P. (2001). Project GLOBE: An introduction. Applied Psychology. An International Review, 50 (4), 489–505.

Hult, T., Ketchen, D., Griffith, D., Finnegan, C., Gonzalez-Padron, T., Harmancioglu, N., et al. (2008). Data equivalence in cross-cultural international business research: Assessment and guidelines. Journal of International Business Studies, 39 (6), 1027–1044.

Javidan, M., House, R., Dorfman, P., Hanges, P., & Luque, M. d. (2006). Conceptualizing and measuring culture and their consequences: A comparative review of GLOBE’s and Hofstede’s approaches. Journal of International Business Studies, 37 , 897–914.

de Jong, M. G., Steenkamp, J.-B. E. M., Fox, J.-P., & Baumgartner, H. (2008). Using item response theory to measure extreme response style in marketing research: A global investigation. Journal of Marketing Research (JMR), 45 (1), 104–115.

Katsikeas, C. S., Samiee, S., & Theodosiou, M. (2006). Strategy fit and performance consequences of international marketing standardization. Strategic Management Journal, 27 (9), 867–890.

Kirkman, B. L., Chen, G., Farh, J.-L., Chen, Z. X., & Lowe, K. B. (2009). Individual power distance orientation and follower reactions to transformational leaders: A cross-level, cross-cultural examination. Academy of Management Journal, 52 (4), 744–764.

Kluckhohn, C. (1951). The study of culture. In D. Lerner & H. Lasswell (Eds.), The policy standard (pp. 393–404). Stanford: Stanford University Press.

Knight, G. A., & Cavusgil, S. T. (2004). Innovation, organizational capabilities, and the born-global firm. Journal of International Business Studies, 35 , 124–141.

Lenartowicz, T., & Johnson, J. P. (2002). Comparing managerial values in twelve Latin American countries: An exploratory study. Management International Review (MIR), 42 (3), 279–307.

Lenartowicz, T., Johnson, J. P., & White, C. T. (2003). The neglect of intracountry cultural variation in international management research. Journal of Business Research, 56 (12), 999–1008.