8+ SAMPLE Co-operative Business Plan in PDF

Co-operative business plan, 8+ sample co-operative business plan, a co-operative business, benefits of a co-operative, types of co-operatives, how to start a co-operative business plan, how do co-operatives generate revenue, who benefits from a co-operative’s profits, what is the maximum number of owners that a co-operative can have.

Co-operative Business Plan Template

Basic Co-operative Business Plan

Co-operative Business Plan Outline

Power Co-operative Business Plan

Food Co-operative Business Plan

Investment Co-operative Limited Business Plan

Co-operative Valley Business Plan

Co-operative Business Plan in PDF

Printable Co-operative Business Plan

What is a co-operative business, share this post on your network, file formats, word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates, you may also like these articles, 5+ sample investment company business plan in pdf.

What do you do when you have tons of spare cash lying around your home or burning a hole in your wallet or expensive jeans pocket? For some people, the…

41+ SAMPLE Unit Plan Templates in PDF | MS Word

As a teacher, you might know about every school policy, the steps to keep classrooms safe for intellectual development, how to set up an organized classroom, and the proposed…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

Home > Business > Business Startup

How to Get a Business Cooperative Started

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

A business cooperative is an enticing alternative to the standard capitalism model, offering a democratic management style, lower risk of debt, and other social and economic benefits. Cooperatives also give small-business owners more control over their organization and come with certain tax advantages.

In this article, we’ll define a cooperative business, offer examples of worker cooperatives, and discuss how to get a business cooperative started.

- What is a business cooperative?

Business cooperative examples

- Steps to starting a business cooperative

The takeaway

Business cooperative faq.

By signing up I agree to the Terms of Use and Privacy Policy .

What is a cooperative business?

A business cooperative (co-op), is an organization or enterprise owned by its members. While a traditional business serves the interests of investors, founders, or board members, a co-op services the interest of its customers or workers. Most co-ops are established to fulfill an economic need, such as providing products, services, or bargaining power that is otherwise unavailable to a certain group of people.

Business cooperatives come in many forms, such as housing co-ops, food co-ops, credit unions, and agricultural co-ops. However, many large corporations are also cooperatives, including Ace Hardware, REI, and Land O’Lakes dairy.

Here are some other well-known cooperatives in the US.

- Navy Federal Credit Union: The largest credit union in the US, serving military servicemen and government employees

- Alliant Credit Union: A credit union based in Chicago, Illinois, originally founded by employees of United Airlines

- Dairy Farmers of America: A marketing cooperative owned and operated by dairy farmers across the US

- Associated Wholesale Grocers: The nation’s largest food co-op, which supplies independent grocery stores across the country

- People’s Food Co-op: A Portland, Oregon-based food co-op with a focus on sustainability

- Berkeley Student Cooperative: A housing co-op for students of UC Berkeley

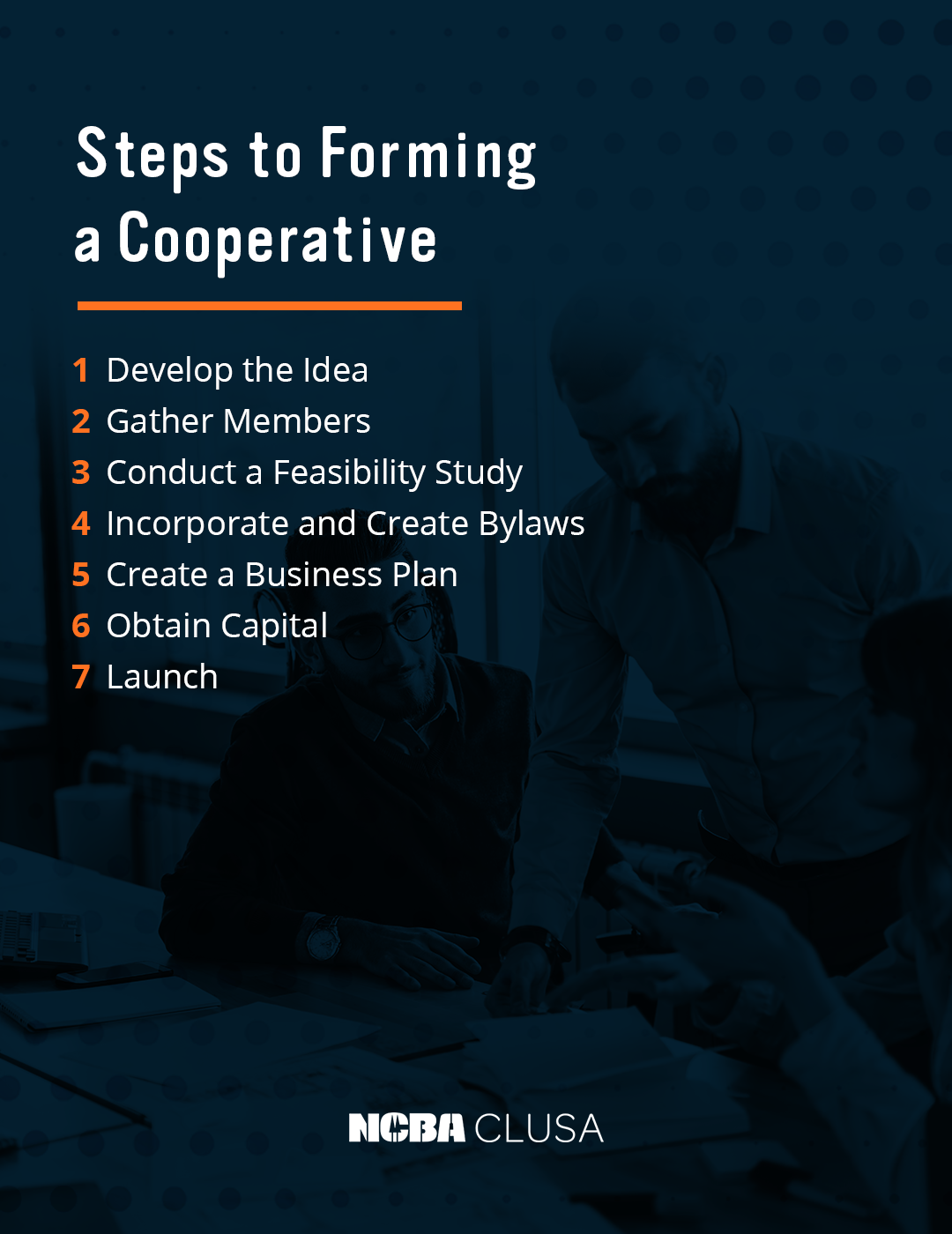

How to start a business cooperative

Since co-op founders usually organize cooperatives based on a specific need or problem, the first step in starting one is to identify that need. Once this is done, the group should take the following actions to officially establish the co-op:

1. Establish a steering committee.

A steering committee is a group of people that represents the members of the organization. This committee should create a timeline for coordinating the logistics of the co-op. They should also establish the co-op’s values and mission, as well as gauge the overall level of interest in the co-op.

2. Conduct a feasibility study.

Once the steering committee is established, the group should conduct a study to consider all possible challenges and obstacles the co-op might face. This study should look closely at opportunities for financing, operating costs, and other factors that influence the market.

3. Create articles of incorporation.

Every cooperative must have articles of incorporation and bylaws that govern the organization. These bylaws should be made by a legal counsel and can be changed and enhanced over time.

4. Draft a business plan.

Like a traditional business, a co-op should have a detailed business plan that guides the company as it grows. The plan should include a market analysis, a marketing plan, product research, and a description of the co-ops goals and objectives.

5. Get financing.

Most co-ops need cash flow for day-to-day operations. This cash often comes from member investments, but some co-ops use a business loan to finance their organization in the early stages.

6. Begin operations

At this point, the co-op can hire a manager and employees, secure a facility, and open its doors. It’s important for members to remain committed to and aligned with the goals of the organization to ensure long-term success.

A worker cooperative offers a number of benefits to small-business owners, including a democratic management style, less debt risk, and member dividends. To set up a business cooperative, a setting committee must conduct a feasibility study, establish articles of incorporation, create a business plan, and secure financing.

Would you like to learn more about starting a business cooperative? Check out Business.org for How to Start a Small Business: Must-Have Checklist to Spark Success .

Related reading

- 11 Best Collaboration Software for Small Business 2023

- Best Crowdfunding for Startups 2023: How to Fund Your Small Business

- Best Startup Business Line of Credit 2023

Some cooperatives are not designed to make a profit and instead operate at cost. If a cooperative does make a profit, the members who purchase goods or services generate that money. Those profits are typically returned to the members as a refund or put back into the organization.

Safety stock is a term used to describe the excess inventory business owners choose to keep in hand in the event of an increase in demand or supplier delay.

Here are the steps to starting a worker cooperative:

- Establish a steering committee.

- Conduct a feasibility study.

- Create articles of incorporation.

- Draft a business plan.

- Get financing.

- Begin operations.

A cooperative (co-op) is a type of business organization that exists to benefit its members rather than outside investors. The co-op is owned and run by the members, and any profits are divided among those members. Most cooperatives are organized to reduce costs, fulfill an unmet need, improve the quality of a product or service, or improve bargaining power.

What are some cooperative business examples?

There are many types of cooperative business organizations, including mutual insurance groups, credit unions, electrical power co-ops, housing co-ops, and retail co-ops, such as Ace Hardware or REI.

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

- Business Templates

- Sample Plans

FREE 10+ Co-operative Business Plan Samples [ Ecological, Food, Arts ]

Cooperatives need a working business plan in order to maintain their operation and to bring in more profitable client progress . A cooperative business plan is a systematic approach to a favorable profit and loss turnout that sets the goals and objectives of the institution as well as the practical steps to realize them. Below are free Co-operative Business Plan Samples that you can download to get you started with your own cooperative business plan. Keep reading.

Co Operative Business

10+ co-operative business plan samples, 1. co-operative business plan sample, 2. co-operative food business plan, 3. ecological and co-operative business plan, 4. co-operative business plan format, 5. community co-operative business plan, 6. rural electric co-operative business plan, 7. editable co-operative business plan, 8. co-operative arts business plan, 9. standard co-operative business plan, 10. professional co-operative business plan, 11. new co-operative business plan, parts of a co-operative business plan, 1. executive summary, 2. methods of operation, 3. external environment analysis , 4. marketing plan, 5. production, what is a patron of a cooperative, what does a dividend mean, what is a preferred stock.

Size: 377 KB

Size: 381 KB

Size: 762 KB

Size: 10 MB

Size: 423 KB

Size: 562 KB

Size: 226 KB

Size: 264 KB

Without a reliable and concrete plan, the cooperative will not progress and will not meet its goals as a simple small business investment that serves average-income workers of a particular community. The business plan should serve as a guide to the undertakings of the cooperative and will redirect the business administration according to what’s stated in the plan. Hence, the cooperative should be written in a clear and informative manner. Below are the salient parts of a cooperative business plan.

The executive summary includes everything that a reader or a prospective client should know about the business. It comprises an overview of the coop’s humble beginnings and goals. This part also contains, most importantly, the mission, vision, purpose, and values that the cooperative wants to uphold.

The operational plan that keeps the manpower of the coop moving follows certain standards and methods of evaluation to be followed properly. This section provides the identification of materials and human resources to carry out the tasks of specific designations.

This section of the plan analyzes the existence of the coop’s natural environment external to its organization. External factors such as the weather of the locality at which it operates and the kind of residences living nearby are key factors of its failure and success because it is from this environment that potential customers and clients are made. Other external factors that affect the operation of the coop are the legal, political, and social environment.

This part discusses how to reach out to prospective customers and how to promote the product and services of the cooperative. Whether the coop’s nature of business is anchored more on retail business or wholesale , promotional works can be implemented to increase profit.

The production plan and structure of the cooperative depends on what kind of profit-making institution it is. If it is anchored on manufacturing and fabrication, several factors should be considered such as the location and limitation of land area to conduct operations. A considerable amount of budget for capital will be allocated to the equipment required to mobilize operations of this kind of cooperative.

An individual or organization who buys the products and avails the services of the cooperative for a sum of money. They are either members or nonmembers of the cooperative and members usually have privileges to discounts.

These are monetary returns of the cooperative’s investors and the amount of return depends on the invested items or products or preferred stocks. In the US, dividends from many state-owned cooperatives are limited to an annual rate of 8%.

Capital stocks that have a specific dividend rate. It is preferred over other stock dividends and refunds to members of the cooperative. It is a type of equity capital that is different from other dividends paid by the board members and other stakeholders. These stocks are also the kind that other members can buy from stockholders at a defined amount of money by the regulations and by-laws of the cooperative.

Related Posts

Free 4+ yearly lesson plan samples in pdf, free 50+ strategic planning samples in google docs | pages | pdf | ms word, free 10+ construction project plan samples in ms word | google docs | apple pages | pdf, free 10+ construction marketing business plan samples in ms word | google docs | pdf, free 17+ construction business continuity plan samples in ms word | google docs | pdf, free 11+ construction business development plan samples in ms word | google docs | pdf, free 20+ budget planning samples in pdf, free 20+ workout plan samples in ms word | google docs | pages | pdf, free 20+ lesson planning samples in pdf, free 14+ employee work plan templates in pdf | ms word, free 8+ sample weekly meal plan templates in pdf, free 17+ sample classroom management plan templates in pdf | ms word, free 13+ homework planner samples and templates in pdf | ms word, free 14+ leadership development plan samples in ms word | pages | google docs | pdf, free 15+ sample math lesson plan templates in pdf | ms word, free 13+ memorandum of agreement templates, free 12+ sample classroom management plans, free 10+ school discipline plan samples & templates, free 9+ it operational plans.

Responsive menu mobile icon

BETA This part of our website is new – your feedback will help us to improve it.

4.2 Create your business plan

- Share with Facebook

- Share with Twitter

- Share with LinkedIn

Are you ready to write your co-op's business plan? We provide advice on the best approach, links to a template plan, and a brief overview of each section you might need to include.

It's worth understanding that all business plans are different – like all businesses are different.

You can use a template as a guide, but don't feel wedded to it. Make it work for your needs.

Writing your business plan

Feasibility studies determine whether to go ahead with the business or with another idea. Business plans are designed after the decision to go ahead has already been made and provide a roadmap for this work.

Make sure you have completed a feasibility study before you start on your business plan.

How do I start?

- Getting past a blank piece of paper is the most difficult and important part of the whole process. It does not matter how poor your first draft is, just start writing! You can refine it later

- Get advice and keep asking questions. You do not have to take on every piece of advice. But if someone you know asks a question, it's worth thinking about how to answer it. They may think of something you haven't considered

- Every time you find something worth putting in the business plan, add it in

How much detail?

- Business plans should be meaningful documents and only include relevant information. Seventy page business plans may look impressive but nobody will actually read it, so it becomes no use at all

- For each part of the business plan, create a resource folder which contains all the information that backs up your plan. This might be market research, quotes, work flow diagrams, etc. You can refer to these when you need them, but they don't need to be in the main document

Financial projections

Financial projections are a key part of your business plan. They help your reader understand how you have calculated the investment your business needs, how you're sourcing this finance and your projected income and expenditure

What do I need to include?

Projections for three years are usually sufficient for a start up business plan. You will need:

- Financial projections – you can use these templates

- Assumptions – what evidence do you have that your projections are accurate?

- Scenarios and contingency plans – what will you do if things are worse (or better) then you expected?

What investment do you need?

As part of the business planning process you should have carried out a feasibility study . The investment requirement analysis that you did as part of your feasibility study will inform what investment is needed.

If you haven't done this yet, you will need go back and do this before you can complete your financial projections. Go back to feasibility study .

Ready to write your business plan?

Download a template and jump straight in – try this one from gov.uk .

Financial projection templates

Download and complete this financial projections template, which acts as the second 'half' of your business plan.

- Co-op values and principles

- Types of co-ops

- What does membership mean

- Quick facts about co-ops

- Useful links and resources

- More co-operative resources

- Co-ops across the world

- Business Support – start your co-op

- Sign up for email updates

- Ownership Hub

- About the Ownership Hub

- UnFound Accelerator

- Why platform co-ops?

- The pioneers

- How to start a platform co‑op

- Support for platform co-ops

- UnFound resources

- UnFound blogs

- About UnFound

- UnFound newsletter

- Business Support – convert to a co-op

- Different types of community ownership

- What is an employee buyout?

- Conversions and HR

- Free business banking with The Co‑operative Bank

- Discover co-ops

- Fair use policy

- Co-op secretary: Training package

- Directors toolkit

- Election canvassing

- Role of the board

- Operations and processes

- Performance and roles

- Members and participation

- Governance help and advice

- Co-operative corporate governance code

- Contact package

- Tailored advice

- HR training

- Diversity equity and inclusion

- Recruitment and resourcing

- Performance management

- Family friendly rights

- Dealing with sickness absence

- Grievances and ending employment

- Why do we need members?

- Member recruitment

- Member participation

- Keeping good membership records

- Community Shares Membership Register

- Meet the membership team

- Marketing strategy

- Inclusive communications

- Social media

- Meet the marketing team

- Narrative reporting

- Finance toolkit

- Co-op Friendly Accountants

- Dissolution or Cancellation for solvent co-operative society

- Business support – help for your co‑op

- Business for Good West Yorkshire

- Other funding and support

- Practitioners directory

- Meet the development team

- About community shares

- Booster Fund application guidance

- Booster Fund – pre-grant support

- Booster Fund – expression of Interest (eligibility)

- Apply to the £150m Community Ownership Fund

- Standard Mark for Investors

- Standard Mark for Societies

- Standard Mark share offers

- Community shares newsletters

- Altogether different

- Get involved in Co‑op Fortnight

- Sign up to get involved

- What is Co‑op Fortnight

- Book your place at the Co-op Hackathon

- Stories from the Co‑op Hackathon 2023

- The Co‑op Economy

- Give a Little Something

- Podcast episodes

- A Call for Co-operative Growth

- The Law Commission Review

- Help influence Scottish Government

- Mutuals and Co-operatives Prospectus

- System reboot: Let co-operatives in

- Pledge your support

- Search policy activity

- About Empowering Places

- Covid-19 fighting for co‑ops

- Meet the policy team

- Apply for membership

- Membership packages

- Exclusive member discounts

- Request a CEO surgery session

- Who is on our board?

- Board elections

- Our reports

- Co-operative Development Forum

- Co-operative Governance Expert Reference Panel

- Co-operative and Community Capital Committee

- Co‑operative Performance Committee

- International Co-operative Working Group

- Meet the team

- Meeting room hire

- Whistleblowing, safeguarding and complaints

- Case studies

- Events calendar

- Watch again – Co-op Congress 2022

- About the Co-op of the Year Awards

- Vote in the Co-op of the Year Awards

- Nominate your Co-op of the Year

- Training events

- Networking events

- Co-op Retail Conference

- Practitioners Forum Programme

- National Youth Summit 2022

- Find a co-op

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Subscribe Now!

Co-op 101: how to start a co-op.

Share this content with your representative

Are you wondering how to start a cooperative or if a co-op is right for your business? There are a lot of steps to starting a cooperative and factors to consider throughout the process. We’re here to help you get started. In this guide to starting a cooperative, we’ll provide an overview of how to organize a co-op and what you can expect. If you determine the co-op model is the right fit, you’ll be ready to commit to a rewarding and empowering business venture.

What Is a Cooperative?

A co-op, or cooperative , is a user-controlled, user-owned enterprise. It is a type of corporation . People voluntarily form a cooperative together to meet common needs and benefit from the products or services of the cooperative they create. For example, a grocery co-op is owned by the people who shop there.

Cooperatives are open to anyone who is willing to accept the terms of membership. They are fully controlled by their members, and members equally contribute to the capital. The profits of the co-op are distributed among the members or re-invested in the company.

Members have an equal say in the business of the cooperative. Unlike other types of corporations, where shareholders have more say if they own a higher percentage of the company, all co-op members follow the principle of “one member, one vote” which carries equal weight. Equality is one of the core values and founding principles of a co-op. A co-op will usually have a board of directors to run the co-op, set up policies and make sure the co-op stays on track. The members of the board are members of the cooperative and are usually elected by vote. The board of directors makes decisions based on the votes of regular members.

A cooperative can be created in any industry and can be any size. Cooperatives are commonly found in agriculture, grocery, healthcare, housing, financial services and utilities. One in three Americans is a member of a cooperative.

Should Your Business Be a Co-Op?

If you’re interested in starting a new business or changing the structure of your current business, there’s a lot to consider if you’re thinking about setting up a co-op. As with any business, you want to make sure the cooperative model suits your vision best before investing your time and money. Here are some reasons a cooperative might be right for you:

- Stability: According to the W.E. Upjohn Institute for Employment Research, employee-owned businesses are less likely to reduce employment during a recession . This helps companies like cooperatives make it through economic challenges. Employee-owners help increase profits as well. A Rutgers University study found that businesses that switch to employee ownership see profits increase as much as 14 percent .

- Democratic control: If you want your business to be run by its members rather than controlled by investors, a co-op might be right for you. With a co-op, no one has a greater say than the other person.

- Lower startup costs: A cooperative may be an appealing option for those who require lower startup costs. With a cooperative business, every member contributes to the capital and provides support.

- Benefits to the community: Co-ops are an excellent option for businesses that want to serve their community. For example, co-ops may obtain products or services that would usually be unavailable in the community or would otherwise be unaffordable. Co-ops also contribute to the economy of the local community. Overall, the focus of a cooperative is to benefit its members, instead of delivering profit to investors.

- Worker engagement: Employees are more likely to be engaged with a company they own and benefit from. They are also more likely to be committed to the quality of service and products they provide because they will want to see their company succeed.

- Tax advantages: Like other businesses, cooperatives face tax rules, but they can also reduce their tax burden in ways other corporations can’t. For example, a co-op can issue patronage dividends which can be deducted from the cooperative’s taxable income.

Despite the advantages, the cooperative model may not be the right fit for all businesses. Here are reasons why you may wish to reconsider starting a cooperative:

- Financing: Generally, cooperatives don’t attract large investors who want greater control of the company with more shares. It can also be tough for cooperatives to get loans from banks. However, that doesn’t mean financial assistance is unavailable for cooperatives. There are various funding opportunities to help co-ops get started, such as the Rural Cooperative Development Grant (RCDG) program which supplies funding for development through cooperative development organizations around the country. A cooperative may also attract funding if a funder wants to promote the development of the community.

- Longer decision-making process: Cooperatives require time to make decisions because all members are part of the decision-making process. If you anticipate the need to make decisions fast, a cooperative may not be the best option for your business.

- Reliance on members’ involvement: Co-ops depend on their members’ interest levels and involvement. If members lose interest in the co-op and stop investing energy in the business, it can be hard to continue to provide benefits for members.

- Profits are disbursed among members: A cooperative spreads its wealth among its members. Therefore, the founding members of a cooperative business do not benefit more than others only because they started the cooperative. This may make a co-op an unattractive option for some business owners.

Steps to Forming a Cooperative

Like any business, starting a cooperative requires dedication and business know-how. If you are new to the business world, there are professionals out there to assist you throughout the process. Also, a cooperative is about its members, so you won’t be alone if you find people who want to join your mission and be part of your success.

Follow this step-by-step co-op startup guide to get an idea of what it takes to organize a co-op, and where to start.

1. Develop the Idea

A cooperative is a business that needs to make a profit to continue operating. You first need to know what you are going to sell or what services you plan to provide. Consider who will buy your product and if they will be willing to purchase your product or services at the prices you offer.

One way to develop a co-op idea is to identify something your community needs and how your business can fill that need. Are there certain products or services unavailable? Are some products of poor quality or overpriced? Research your community to determine if your idea will work. Plan to spend 3 to 6 months exploring your business idea.

2. Gather Members

You need to gather individuals who are genuinely interested in your business idea and who may want to become members of your cooperative. Hold a meeting with potential members and develop your mission and core values. Clearly define your business idea and describe how it’ll benefit the lives of the co-op members. Also during the meeting, choose the name of the co-op and its head office location.

3. Conduct a Feasibility Study

A feasibility study will help you determine if your idea is doable and will work well in your community. After you consider the results of the study, you can decide whether or not to continue with your co-op idea. If you decide to move forward, you can use the information from the study as the basis of your business plan. Here are components to include in your feasibility study:

- Preliminary analysis: First, consider if your product will serve the needs of your community. Also, ask if you can successfully compete with other businesses offering the same products or services. Lastly, identify any obstacles that may stand in your way of success. For example, can you acquire the capital needed for your business, or is it unaffordable? The preliminary analysis will illuminate the potential of your idea.

- Market survey: Conduct a market survey or hire an outside company to conduct the survey. Conducting a market survey is a crucial part of your feasibility study. You’ll review factors such as demographics and purchasing power in your community, and you’ll use the information to analyze competitors and potential customers.

You and other members might consider hiring a consultant to assist you with the feasibility analysis. It may be well worth the money to ensure you complete a thorough and accurate study because it can save you a lot of money and effort in the long run.

4. Incorporate and Create Bylaws

If you conclude that your idea is financially feasible, you can take the next steps with confidence. You’ll next want to elect a board of directors, incorporate your business and adopt bylaws.

You must incorporate your business if you want to be recognized as a corporation legally. A cooperative is a type of corporation. A corporation is simply the term used to describe a legal entity owned by a group of shareholders . There are many advantages to incorporating, such as:

- Protecting your assets against liabilities

- Allowing you to transfer ownership easily

- Receiving tax advantages

Not all cooperatives are incorporated. However, if you decide to incorporate, you’ll need to take the following steps:

- File articles of incorporation with your state: Articles of incorporation are documents your file with your state to legally record the formation of your cooperative. Articles of incorporation include information such as your co-op’s name and address, as well as the names and addresses of the board of directors. The exact document requirements vary by state.

- Write bylaws: Bylaws are the rules of your co-op. The board of directors establishes bylaws during the process of setting up a new company. Creating bylaws will be the step you take after your co-op is legally formed. You do not generally need to file bylaws with your state unless you are applying for non-profit status. Your bylaws should include information such as the name and address of the business, board member duties, and meeting and record-keeping procedures. Be sure to consult your state’s statutes to help you create bylaws. You might ask a lawyer to ensure your bylaws comply with the laws in your state.

5. Create a Business Plan

After you incorporate and create bylaws, it’s time to develop a detailed business plan. You can think of your business plan as a map that will show members and the board of directors which direction to take to reach common goals. Use the information you gathered from your feasibility study to help you write your business plan.

Overall, your business plan should include everything you and members need to know to run and grow the co-op. There is no right or wrong way to create a business plan as long as it meets your needs. Traditional business plans include the following:

- An executive summary which includes your mission statement and basic company information

- A description of the problems your co-op solves and the people it serves

- A market analysis describing trends in your industry, the outlook, what competitors are doing and how you’ll do it better

- Information about organization and management, such as who runs the co-op and how it’s structured

- A description of the products you sell or services you provide and how it benefits members

- How much funding you need and what you will use it for

6. Obtain Capital

The board of directors will be responsible for acquiring the capital needed to launch the co-op. You might raise money from members, local residents and lenders. You may also be eligible for government startup grants. Make sure you include how much financing you need and how you plan to obtain it in your business plan.

Once you have an adequate amount of capital, you’ll be ready to launch. Hire staff and teach them their duties and responsibilities as cooperative members. Open business doors and provide products and services to meet the needs of your members, and don’t forget to market your co-op. Lastly, remember to celebrate your journey and accomplishments.

Keys to Successful Cooperative Development

Various key elements will determine the success of your cooperative and its development. According to a cooperative development guide put together by the Cooperative Development Institute , the following elements are signs your co-op is off to a good start:

- Founding members are committed and motivated: Your co-op’s members will determine the success of the business. Without your members, the co-op can’t exist. The development of your co-op is more likely to be successful if the members are committed, motivated by your vision, involved in the process from the beginning and will benefit the most from the co-op.

- The project has strong leaders: Every project needs strong leadership to guide members and keep motivation high. If your project has leaders who are strongly interested in the success of the cooperative and are willing to contribute their skills, vision, and experience, you’ll be heading in the right direction.

- The vision is clear: You have to have a clear vision, so members know what’s expected of them, how to resolve issues, and most importantly, how to achieve goals.

- The business is well-planned: Planning is essential to the success of any business. Make sure you properly planned all the details of your cooperative and how it will operate. This should include market research.

- It’s financially feasible: You will need adequate capital to succeed. Founding members should be financially committed to the co-op. If you have the financial resources you need from the start, you’ll be able to grow.

Other tips for co-op success include:

- Stay focused

- Keep members up to date and involved

- Set realistic goals

- Use market research, rather than opinions, to guide decisions

- Identify and reduce risks

- Maintain open communication

- Invest in staff training and education

- Raise adequate funding

Join NCBA CLUSA Today

We hope we helped you learn the basics of starting a co-op. Starting any business is a complicated process that demands careful planning and consideration. It also requires the help of other individuals who are as dedicated to your mission as you are. At NCBA CLUSA, we are passionate about promoting the cooperative business model and Building an Inclusive Economy.

If you have more questions, we’re here to help. Browse our site to learn more about cooperatives and how we advocate for co-ops around the world or reach out to us so we can assist you. If you’re ready to join our mission to advance, promote and defend cooperative businesses, become a member today .

The Role of Energy Cooperatives in Advancing Clean Energy

Advantages of the Cooperative Business Model

Share this post.

We hope you enjoyed this article. If you did, we would love it if you would share it to your social networks!

Related Posts

Cooperative Business Planning

This resource includes several templates for cooperative business plans from actual housing cooperatives in North America. Other references provided are a blueprint for the development process, of which the business plan is a part, and a cooperative business plan presentation given at the 2009 NASCO Institute.

- Basics of Business Sustainability

- For Business Leaders

- For Researchers & Educators

- For Students

- For Public Sector

- For Sustainability Centres

- View full resource library

- Climate Change

- Circular Economy

- Sustainable Finance

- Sustainable Innovation

- Social Justice

- Sustainable Business Education

- Mission and activities

- Share an Idea

- SCC Workshop – June 2023

Show more results

How to Adopt a Cooperative Business Model

- | September 9, 2020

Cooperative businesses can contribute to a more just, resilient economy. Here’s how companies are adopting cooperative business models.

Capitalism built around investor-owned companies is struggling to meet society’s needs. Nathan Schneider (University of Colorado Boulder) argues that cooperatives could do better.

Starting or running a business? A cooperative model might help you do it better.

While our economy keeps getting more efficient and generating more value, most people are getting a smaller and smaller portion of it. The investor-owned companies that dominate our economy are geared to maximizing shareholder value, more than pleasing customers, creating jobs, or benefitting society.

Cooperatives are a different way of doing business. They have been around since the 19th century, but many people aren’t familiar with them. They’re likely all around you, blending in with for-profit enterprises but serving a very different purpose.

In this article, I’ll describe what makes a cooperative and how you can build the principles into your enterprise. I’ll describe advantages and disadvantages and how cooperatives are being retooled for the modern era. These ideas are adapted from my 2018 book, Everything for Everyone: The Radical Tradition that Is Shaping the Next Economy .

What makes an enterprise cooperative

Cooperatives are based on the idea that those who use an enterprise — the members — should also own and govern it. Cooperative members decide to produce, how to do it, and what to do with the profits. The goal is to make businesses truly accountable to those they claim to serve.

A co-op’s members might be individuals, or businesses, or other co-ops. Cooperatives of any substantial size hire staff to manage the day-to-day, but for big decisions or board elections, the rule is one member, one vote.

As co-owners, members receive dividends from the enterprise’s profits, proportional to how much they have spent. Members can also choose to reinvest dividends to develop the cooperative.

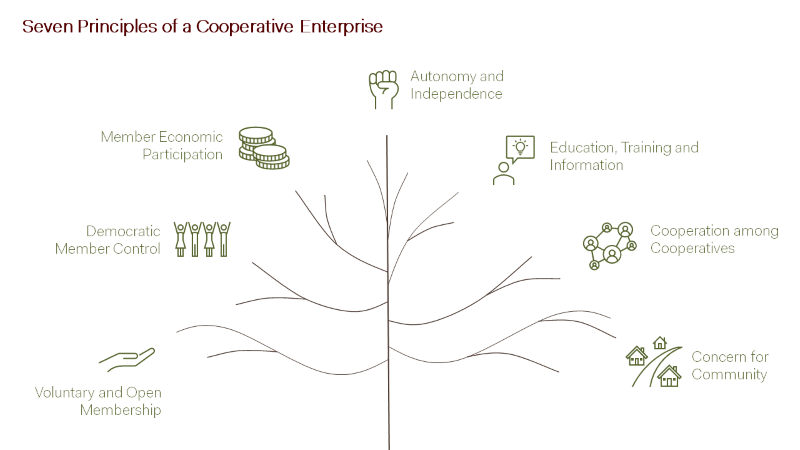

The International Cooperative Alliance, an international non-profit, identifies seven principles of cooperatives. In addition to member control, these principles also stress voluntary and open membership – no discrimination – and concern for community. Cooperatives must aid not only their members but the broader society.

7 Principles of a Cooperative Enterprise, from the International Cooperative Alliance (design by Abby Litchfield)

Cooperatives aren’t all or nothing.

Businesses can also take partial inspiration from the co-op model. For example, Employee Stock Ownership Plans (ESOPs) give employees an ownership stake in the company. Trusts are another strategy; they can hold some or all of a company’s stock on behalf of certain beneficiaries, such as its workers, or in service of a social purpose.

Many emerging business models draw on the co-op idea; while they aren’t formal co-ops per se, they can still gain some of the benefits. In my recent work on the idea of an “ Exit to Community ” for startups, we’ve been exploring a wide range of models for shared ownership.

Cooperatives in practice

Globally, commonwealths are a major market force. The largest cooperatives generate about $2.2 trillion in turnover and employ about 10 percent of the world’s employed population. For example:

In Canada, the vast credit-union federation Desjardins is a cooperative bank.

New Zealand has the world’s largest cooperative economy as a percentage of GDP, thanks mostly to hulking dairy co-ops .

Smart—originally, Société Mutuelle pour Artistes —organizes 80,000 workers in 9 European countries to provide employment support services.

When Argentina’s economy collapsed in 2001, workers took over factories that owners tried to close and started running them for themselves.

The case for a cooperative business model

Cooperatives have advantages over investor-owned or purely for-profit companies. For example:

Cooperatives are innovative, often identifying a missing market . They’re a ground-up approach; traditionally, they have evolved when people have to figure out how to do what no one will do for them.

Cooperatives can have lower costs. Volunteerism and sweat equity reduce start-up costs , and co-ownership can mean lower transaction and contracting costs. When people trust each other as co-owners, they can cut fair deals more easily.

Cooperatives have greater trust and loyalty from customers. Customers see cooperatives as providing higher quality products and more worker and community benefits.

Cooperatives are more resilient. They have a lower chance of failure , especially after the startup phase, and greater resilience in downturns (likely due to shared sacrifice and greater risk aversion).

Today, as digital firms dominate the economy, the democracy of cooperatives has even more appeal. It can provide safeguards around data privacy and labour conditions , both under threat.

Limitations of cooperatives

Cooperatives have disadvantages as well. Raising capital is a challenge in an economy designed for investor ownership. Lenders and investors expect businesses to be owned by a small group of founders, not a community of members; we need policies that can change that.

Cooperatives can become stuck in their ways. Investor-owned businesses attract investor-owners by promising to exceed expectations; co-ops tend to attract members by meeting known, day-to-day needs. We need to ensure that the co-ops have built-in incentives not just to meet member needs but to help prepare members for uncertain futures.

A new generation revives cooperatives

Over the years, many large, established cooperatives – like credit unions and mutual insurance giants — have lost the kind of member involvement that they had at their founding. They have low member turnout in board elections, for example. They’ve also often become conservative and hesitant to adopt new ideas. Some organizations, like We Own It , are organizing co-op members to re-activate their democracy.

Newer cooperatives often have different goals than their predecessors. They want go beyond serving their members to do good in the broader world. They can adopt complex, multi-stakeholder ownership structures to address complex challenges; many new co-ops, for instance, have separate member classes for workers, users, founders, or outside investors. Co-ops increasingly view themselves as social entrepreneurs and secure B Corp certifications, based on metrics of social impact.

Modern cooperatives

Two cases show the more modern cooperative approach.

Brianna Wettlaufer, an executive at image provider iStock, was frustrated that the imperatives coming from the company’s investor-owners required her to keep payments to independent artists. She left iStock and founded Stocksy United . It’s an artist-owned cooperative, where 50%-75% of all licenses go directly into contributors’ pockets. Stocksy presents its value proposition: “The sense of community and ownership felt by our members drives a greater level of passion into their work, resulting in inspired imagery of the highest quality.”

Namaste Solar is a worker co-op solar utility company based in Colorado. By combining and connecting different co-op models, the founders of Namaste have achieved both a successful local business and national-scale impact on their market. Namaste organizers created Amicus Solar, a purchasing co-op that allows other small solar utilities across North America to buy equipment together, dramatically lowering costs. Namaste has also spun off the Clean Energy Federal Credit Union to assist with financing.

Be part of cooperative change

Cooperatives provide an imaginative, exciting, possible future. In my Media Enterprise Design Lab at the University of Colorado, we explore some of the ways that cooperatives are evolving. Check out our work – and share your ideas for an economy that better addresses society’s needs.

Share this post:

Powered by WP LinkPress

Add a comment.

You must be logged in to post a comment.

This site uses User Verification plugin to reduce spam. See how your comment data is processed .

Join the Conversation

- Categories: Articles , Sustainable Innovation

View all posts

Related Articles

Teaching Climate Policy in Business Schools – NBS Climate Teaching Series

Three business school educators share their interactive approaches for embedding a sustainability mindset in students.

Wineries Earn More Per Bottle When They Adapt to Climate Change

More frequent wildfires are damaging grapes in California. Wineries are sourcing grapes from more vineyards to reduce risk – and it’s paying off.

Sustainability Resources

Engage with us.

- Opportunities

- Terms of Service

- [email protected]

Partner with NBS to grow our impact

How to Form a Farmer's Cooperative Business Plan

- Small Business

- Business Planning & Strategy

- Business Plans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Set up a Co-op Store

How to write a farm business plan, how to become a cigar distributor.

- The Structure of a Cooperative Organization

- Grants for Beginning Female Farmers

Increased bargaining power and the opportunity to reach more markets makes a cooperative a lucrative idea for small farms. When it comes to preparing the business plan, co-op plans differ from those of other organizations in that the focus is about providing for the needs of the members rather than making a profit as a whole. The plan should include several key components that show your group has studied the market and is in agreement on the types of services the cooperative will provide.

Executive Summary

The executive summary appears at the beginning of your plan where it briefly explains the background and experience of each farmer involved in the co-op. Describe the legal nature of your cooperative and explain how decisions are made, such as requiring a vote by all of the members for major decisions. List the goals of the group in forming the organization, including reaching out to retail markets or accessing corporations that buy large quantities of farm goods.

Explain the services your cooperative plans to offer, such as providing training to help farmers better understand potential markets. Some co-ops provide immediate payment for delivery of products so the members can put the money right back into their farms. Or you may provide transportation to get products to market or high-quality storage spaces that members would not have access to otherwise. Since your co-op likely consists of farms that grow or raise similar types of products, explain how you need the selling power of the group as a whole to find better-paying markets that want larger quantities than individual farmers could produce.

Describe the branding your cooperative plans to use to develop a name and reputation in the marketplace. Explain the types of companies you plan to approach. For instance, a co-op made up of hay farmers may want to approach overseas markets that need large volumes of hay for their livestock. Explain how the co-op plans to differ from individual farms, such as by accessing wholesalers and restaurants that would be difficult to reach by single farmers. Provide details on the marketing, promotions and advertising activities needed to make your buyers aware of the products you provide as a cooperative.

Typically, the founding members lead a cooperative with legal, technical and financial consultants brought in when necessary. Explain who will monitor the business and marketing plan the cooperative creates to make sure all of the farmers are on target and participating in the manner originally planned.

The financial section explains how much cash each member will contribute to fund the cooperative. Outline the types of stock or certificates to be given to each farmer who becomes a member. Explain how the money invested will pay for facilities and marketing efforts as part of the co-op’s mission to provide services to the members that help them increase their profits.

- Oregon State University Small Farms: Siskiyou Sustainable Cooperative, A Model for Cooperative Farming and Marketing

- University of Kentucky: Grower Cooperatives

Nancy Wagner is a marketing strategist and speaker who started writing in 1998. She writes business plans for startups and established companies and teaches marketing and promotional tactics at local workshops. Wagner's business and marketing articles have appeared in "Home Business Journal," "Nation’s Business," "Emerging Business" and "The Mortgage Press," among others. She holds a B.S. from Eastern Illinois University.

Related Articles

Organizational structure of a co-op, wine marketing research grants, how to write a business plan for an animal shelter, grants for women-run businesses in agriculture, how to sell your product to concessions in arenas, cattle farm start-up grants, what is the difference between articles of organization & articles of association, how to obtain grant money to start a farm, what is the difference between wholesale & distribution, most popular.

- 1 Organizational Structure of a Co-Op

- 2 Wine Marketing Research Grants

- 3 How to Write a Business Plan for an Animal Shelter

- 4 Grants for Women-Run Businesses in Agriculture

MSU Extension Product Center

Starting a cooperative and developing a business plan: phase 2.

Questions about this information? Contact us . June 04, 2015

Updated from an original article written by Mark Thomas, Michigan State University Extension.

Having enough interest in starting a cooperative is just the first step, developing a viable business plan, when implemented, that meets the identified needs is the second.

In my first article on starting a cooperative I noted that the purpose of starting a cooperative was recognition of the need to solve problems or meet needs of the marketplace with goods or services. A steering committee should be formed to determine if there is data to support the feasibility of the cooperative. This committee should present its findings to potential members and let them make the decision to move forward with the development of a cooperative. The development of a business plan is then critical, as it will map out the necessary steps for a successful enterprise.

The feasibility study will lay the foundation for the business plan. It contains market information about the potential members’ usage and how a cooperative would differentiate itself from existing competition (if any). Additionally, financial viability and management expertise will be spelled out, as well as facilities needed and potential locations. Having this study prepared in an expert manner will insure the business plan is on solid footing s moving forward.

The business plan is a road map to launching a cooperative and will allow the Board of Directors to know where they want to be and how to get there. Having a professional who is familiar with cooperatives to assist with the preparation of the business plan is a good idea and can avoid and voids problems in the future. It should include the preparation of three years’ projections (pro-forma) of cash flow, operating statements and beginning and year-end balance sheets. These will be used to paint the picture of the capital needs and potential sources of funds to meet the asset needed. Additionally financial planning should include funding the operating until profitable.

The steering committee should study the legal aspects of cooperatives and have an understanding of the duties necessary. At this point employment of legal counsel to develop the articles of incorporation, specific to the State should be undertaken. They can also assist with bylaw development and they should be in sync with the purpose and scope of how the cooperative will operate.

The steering committee should now be ready to hold a fourth member exploratory meeting. It is essential to have a large turnout of the identified potential members. Direct contact, newspaper articles, web postings and any other method of “spreading the word” about the meeting should not be overlooked. The meeting is conducted to present the business plan to potential members. The business plan will tell the story of the potential cooperative. Why the steering committee supports the development and how it will benefit the community of interest at large should be spelled out. Financial details regarding membership investment requirements should leave no doubt in the minds of the potential members that their assets will be at risk.

With full disclosure of the information regarding the risks and possible returns of the cooperative, the potential members conduct a vote to continue or not. If the vote is in the affirmative, the cooperative can hold its first meeting at which two items of business need to be conducted:

- Approve the bylaws

- Elect a Board of Directors

Michigan State University Extension educators working with the MSU Product Center’s Michigan Cooperative Development Center can provide assistance with helping guide groups of potential cooperatives through this process.

This article was published by Michigan State University Extension . For more information, visit https://extension.msu.edu . To have a digest of information delivered straight to your email inbox, visit https://extension.msu.edu/newsletters . To contact an expert in your area, visit https://extension.msu.edu/experts , or call 888-MSUE4MI (888-678-3464).

Did you find this article useful?

Pantry food safety - it's your job 22april2024 (zoom webinar), fiscally ready communities: capital asset management and planning.

new - method size: 3 - Random key: 1, method: tagSpecific - key: 1

You Might Also Be Interested In

Using the MSU Product Center to Take Your Cottage Food to the Next Level

Published on February 23, 2023

Starting a Commercial Food Business

Mobile Food Vehicle Fire Safety

HACCP Overview for Employees in Meat and Poultry Establishments

Cómo Iniciar un Negocio Móvil de Comida

How to start a food truck business.

- business development

- entrepreneurship

- michigan cooperative development program

- msu extension

- business development,

- entrepreneurship,

- michigan cooperative development program,

- msu extension,

- product center

- Become a Client

- Accelerated Growth Services

- Strategic Support

- Venture Development

Making it In Michigan

- Marketplace Trade Show

- Questions & Contact

Center for Economic Analysis

- Economic Forecast

- State of Michigan

- Lansing - East Lansing

Food Processing and Innovation Center (FPIC)

- Location & Contact Info

- Featured Articles

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

How a Cooperative Business Works in the 21st Century

Learn about types of co-ops, advantages, problems, and taxation

- What is a Cooperative Business?

Types of Cooperative Businesses

Pros and cons of co-ops, how to start a cooperative business, cooperative businesses and taxes, for more information in your state.

Mike Harrington/Getty Images

When you think of the word “co-operative,” you might think of a local food co-op, but there are many more types of cooperative businesses operating in the U.S. today. As some business owners and consumers look beyond traditional, capitalist ways of doing business, co-ops may provide one alternative.

What is a Cooperative Business?

A cooperative (co-op) is a business or organization owned by and operated for the benefit of its members. Profits or earnings are distributed among its members.The co-op can be a for-profit business or a non-profit organization.The co-op runs similarly to a corporation, because members purchase shares and elect a board of directors and officers. It differs from a corporation because typically each member gets one vote. Members of a co-op can be individuals, families, businesses, farmers/ranchers, or manufacturers.

The International Co-operative Alliance and National Cooperative Business Association define a cooperative as a group of people with a specific need who work together to create a company to meet that need.

The cooperative movement dates back to the mid-19th century, but the concept goes back even further, to craft guilds, farmer organizations, and mutual insurance companies. The 21st-century cooperative movement has taken off with the growing emphasis on equality and concern about people and planet, in addition to profits (these three are sometimes called “the triple bottom line”).

These are some of the many types of co-ops, formal and informal, in operation today:

- Mutual insurance companies (most with the word “mutual” in their names) are owned by policyholders, rather than stockholders.

- Credit unions are not-for-profit organizations that serve their members.

- Rural electric power co-ops are private, not-for-profit organizations incorporated in 48 states to provide at-cost electric service to customers.

- Consumer-goods co-ops , like REI Co-op (yes, that’s part of its name). The company, an outdoor outfitter, says that “more than 70 percent of our annual profits are invested back into the outdoor community.”

- Producer co-ops , like Sunkist, owned by and operated for their member-growers.

- Cooperative buying clubs, in which a group of households gets together to buy foodstuffs in bulk and divide the orders among the members.

- Retail co-ops like Ace Hardware, which was formed in 1924. The company is still owned “solely and exclusively by the local Ace retail entrepreneurs.”

- Community-owned businesses , such as the Nebraska Cooperative Development Center, which has helped communities in small rural towns start cooperative grocery stores.

- Housing cooperatives are formed when people join to own or control housing and/or related community facilities. These co-ops are different from condo associations, in which each unit is privately owned and there is a common area owned jointly.

- Youth co-ops are businesses incorporated and run by young people to give them experience with one type of real-life work model. They can be set up in a school or community center or another organization that supports youth.

- Worker cooperatives are formed and owned by employee groups that generate profits for the company and its workers.

As demonstrated by the descriptions of several types of cooperative businesses above, organizing a group with a common business purpose in this way can pay off. Positives and negatives can include:

Lower costs by buying in bulk

Common protection from loss (mutual insurance companies)

More price power for sellers when joining together (like Sunkist)

Equal say in the business for members

Shared values. Many co-ops (like REI) value more than just making a profit

Tax advantages for co-ops organized as non-profit businesses

Less opportunity for outside investors because they can’t gain control

Lack of interest by members over time

A co-op can be as simple or complex as you want. You can decide to start a co-op like a food buying club just by getting together with other families to order and distribute food. As you grow beyond this small group, you should form a cooperative business in your state.

Business Type. You’ll need to decide on a business type (corporation, partnership, or LLC) and register your business with a state .

Some states have regulations specifically for cooperatives ( New Mexico, for example.) In some states, you must be formed under co-op status to use the word “cooperative” in your name.

You’ll need to do all the other tasks involved in forming a corporation , partnership, or LLC, including electing a board of directors to oversee the operations.

If you want to be non-profit (exempt from income tax), you first form the business, then apply for tax-exempt status. See IRS Publication 557, “Tax-Exempt Status for Your Organization,” for details.

The overall philosophy of cooperatives is that they are intended to operate at cost, so there’s no “profit,” and the patrons (those doing business with the co-op) receive net earnings on an equitable basis.

The IRS allows several different federal income tax options for cooperative businesses. One variation is exempt from tax and another is subject to tax.

The federal tax agency considers cooperatives exempt from federal income taxes if they meet certain qualifications. To qualify for and maintain exemption (Internal Revenue Code 501(c)(12)), the cooperative must:

- Be organized and operated as a cooperative

- Conduct business as set by the tax code and IRS regulations

It must receive 85% or more of its income each year from its members and use the income solely to meet the cooperatives’ losses and expenses.

Taxes for cooperative businesses are complicated and getting non-profit status from the IRS is not for amateurs. Get help from a tax attorney if you want to form a cooperative business.

A Subchapter T cooperative is subject to tax. This co-op type may conduct any kind of business. Members or patrons (those doing business with the co-op) can be individuals or organizations. The co-op returns margins (net earnings) each year to users as patronage refunds, based on the amount of business each user does with the co-op. The tax is paid by the cooperative on a temporary basis; it receives a deduction when the money is passed on to the patrons.

The National Agricultural Law Center has a state-by-state list of Business Organization Forms and Filing Instructions that could be helpful. Also, the National Cooperative Business Association has a spreadsheet (Excel download) showing the cooperative business regulations in each state.

Small Business Administration. " Choose a Business Structure ." Accessed March 24, 2020.

Cornell Legal Information Institute. " Cooperative ." Accessed March 24, 2020.

Cooperative Directory Service. " Coop Directory Service ." Accessed March 24, 2020.

U.S. Department of Agriculture. " Income Tax Treatment of Cooperatives ." Page 2. Accessed March 24, 2020.

IRS. " General Survey of IRS 501(c)(12 Cooperatives and Examination of Current Issues ." Page 177. Accessed March 24, 2020.

Business Cooperatives

A business cooperative, also known as a "co-op," is an organization owned and operated by a group of individuals who come together to achieve common economic goals.

These goals may include purchasing supplies or services, marketing their products, or providing employment opportunities. Here is a breakdown of co-ops to decide if this is a good option for you and your business.

Benefits of Starting a Co-op

- Shared Ownership and Decision-Making: Co-ops are owned and governed by their members, which means that each member has an equal say in the decision-making process. This democratic structure ensures that all members have a voice in shaping the direction and policies of the co-op.

- Economic Benefits: Co-ops aim to provide economic benefits to their members, such as lower costs for inputs or access to markets that might be difficult to reach individually. By pooling resources and leveraging collective bargaining power, co-op members can often achieve economies of scale and negotiate better deals.

- Risk Sharing: In a co-op, the risks and rewards are shared among the members. This can help reduce individual financial risk and create a supportive network where members help each other overcome challenges.

- Long-Term Sustainability: Co-ops tend to have a long-term focus, prioritizing the needs and goals of the members and the community over short-term profits. This can lead to more sustainable business practices and a greater sense of social responsibility.

Steps to Start a Co-op

- Identify the Need: Determine if there is a demand for a co-op in your industry or community. Research and gather a group of interested individuals who share the same goals.

- Feasibility Study: Conduct a feasibility study to assess the viability of the co-op. This study should analyze the market, financial projections, legal requirements, and potential challenges.

- Develop a Business Plan: Create a detailed business plan outlining the co-op's goals, structure, operations, marketing strategies, and financial projections. This plan will serve as a roadmap for the co-op's development.

- Legal Structure: Choose a legal structure that suits your needs, such as a cooperative corporation, a limited liability company (LLC), or a cooperative association. Consult with an attorney specializing in cooperative law to ensure compliance with local regulations.

- Membership and Governance: Determine the membership criteria and admission process for the co-op. Establish governance procedures, including how decisions will be made, voting rights, and board member elections.

- Draft Cooperative Documents: Prepare the necessary legal documents, such as articles of incorporation, bylaws, membership agreements, and operating agreements. These documents outline the rights, responsibilities, and obligations of the co-op and its members.

- Funding and Financing: Identify potential financing sources for your co-op. This could include member investments, loans from financial institutions, grants, or crowdfunding. Prepare a financial plan that outlines the capital requirements and how the co-op intends to secure funding.

- Register and Comply with Regulations: Register your co-op with the appropriate government agencies and comply with legal and regulatory requirements. This may involve obtaining business licenses, tax identification numbers, and adhering to labor laws.

- Operationalize the Co-op: Once all legal and administrative requirements are fulfilled, begin operating the co-op according to the business plan and cooperative documents. Develop marketing strategies, recruit members, and start providing products or services.

Fiscal Responsibilities

Co-op members typically contribute financially through initial investments, purchasing shares, or paying membership fees. Members may also be required to contribute capital based on their usage or patronage of the co-op's services. Additionally, members may share in any profits or surpluses generated by the co-op, which can be allocated based on the cooperative's bylaws or predetermined formula.

Financing Sources for Co-ops

- Member Investments: Co-op members can provide initial capital through equity investments or by purchasing shares in the cooperative.

- Loans and Credit: Co-ops can obtain financing from traditional lenders, such as banks or credit unions, by presenting a solid business plan and demonstrating their creditworthiness.

- Grants and Funding Programs: Explore grants, subsidies, or funding programs specifically designed for co-ops. These may be available through government agencies, foundations, or other organizations supporting cooperative development.

- Crowdfunding: Raise capital through crowdfunding platforms that allow individuals to contribute money in exchange for rewards or equity in the co-op.

It's important to note that the specific steps, documents, and requirements may vary depending on your state and the type of co-op you intend to start. Consulting with legal, financial, and cooperative development professionals is highly recommended to ensure compliance with local laws and best practices for a co-op to be successful.

The information provided on www.onepercentforamerica.org is intended for general informational purposes only. It should not be considered as professional advice or a substitute for seeking professional guidance.

Apply for 1% Loan — Learn More

Checklist for Starting a Business

Types of Business Structures in the U.S.

Workers' Rights in the U.S.

Invest in all of us.

Your financial support will help make citizenship more affordable for millions of future Americans.

Invest Today

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Nonprofit Recording Co-op Business Plan

Start your own nonprofit recording co-op business plan

Gamehenge Tapers Co-op

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

Gamehenge Tapers Co-op is a not-for-profit organization that was created to serve the Portland tapers community. The tapers community is a hobby based community that trades live recordings for personal use, never for commercial gain. The Co-op will provide this community with the equipment needed to further the taping of shows which in effect supports the trading community as well (people who trade these live shows for personal consumption only). The Co-op sells the recording equipment at wholesale prices + a low overhead percentage. By offering the members heavily discounted rates, it encourages them to become more active tapers. Because the organization is a not-for-profit co-op, members are willing to volunteer their time to help the organization allowing it to become successful. The organization exists to support the trading community.

Membership dues and a small charge for overhead will allow the organization to cover costs associated with doing business and allow it to slowly grow. Gamehenge Tapers Co-op will be increasing their membership roster by at least 20% per year.

1.1 Objectives

The objectives for the first three years of operation include:

- To create a co-op whose #1 goal is to serve its members.

- To increase the membership base by 20% each year.

- To provide the Portland traders community with cost + overhead deals on CD-R media, microphones, CD-RWs and DAT recorders.

- To develop a sustainable co-op.

1.2 Mission

Gamehenge Tapers Co-op’ s mission is to serve the Portland tapers community. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall in to place. Our services will exceed the expectations of our customers.

Organization Summary organization overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Gamehenge Tapers Co-op is a co-operative organization designed to serve the Portland tapers community. The tapers community is a hobby based group that records and trades live concerts. All of the bands that allow live recordings are “live” or “jam” bands who incorporate improvisation into their live performances so each performance is unique. The group members trade these live performances for personal consumption, enjoying the unique attributes of each individual show. Commercial use of these shows is strictly prohibited.

The organization sells a wide range of equipment for tapers. The equipment is purchased through normal wholesale distribution channels and sold directly to organizational members. Membership is required for entry to the co-op. A $40 entry fee and proof of traders status (a list of your show list is usually sufficient) is all that is needed to become a member. Products must be purchased through the web site and then picked up from the office at certain times throughout the week. Questions regarding products can be answered via email or phone (typically voicemail with a return phone call).

2.1 Legal Entity

Gamehenge Tapers Co-op is a 501C not-for-profit co-operative organization.

2.2 Start-up Summary

Gamehenge Tapers Co-op’s start up costs include:

- Desk, chair and file cabinet.

- Computer with printer, CD-RW, and internet connection.

- Legal fees for formation of not-for-profit status including filing fees.

- Website development.

Gamehenge Tapers Co-op offers the tapers community the following products:

- CD-RW (Compact Disc ReWriteable) drives for computers, external units with USB, SCSI or Firewire connections.

- High quality stereo microphones for audience taping.

- DAT(digital audio tape) portable recorders.

- CD-R (Compact Disc Recordable) media.

Market Analysis Summary how to do a market analysis for your business plan.">

Gamehenge Tapers Co-op is a not for profit organization designed to serve the individual members of the co-op. These members come from the Portland tapers community, a group of people who attend specific live performances and tape them for their personal consumption as well as for personal trading purposes. This is a very active community and intimate community.

Gamehenge Tapers Co-op will grow its membership through word of mouth promotions at the events. Because it is an intimate community where most people know each other, it will be relatively easy to build up membership. In addition to word of mouth advertising, Gamehenge Tapers Co-op will also have a web site that provides prospective members about the organization and its goals.

4.1 Market Segmentation

Gamehenge Tapers Co-op will be addressing the tapers community in the Portland area. The taping community is made up of individuals that legally tape live concerts. There are a handful of bands that allow taping of their live performances. Generally, record labels discourage or ban taping of live performances because they believe that it infringes on profits from record sales. On the contrary however, it tends to promote the band as there is an entire community that trades these shows, attends the concerts, and buys the records after they hear live performances of the band.

From a legal standpoint, the live performances are copyrighted, but the band nonetheless allows the taping. The vast majority of bands to do not allow taping, it is only a few select bands that allow tapings. These bands are representative by the fact that they are very good live performers, they have a loyal following of people that tour with them and consequently these bands tend to play entirely different set lists each night recognizing the fact that there are people seeing several to many different shows in a row.

The bands that allow recording of live concerts are the remnants of the Grateful Dead (Phil Lesh & Friends, The Other Ones) remnants of Phish (Trey Anastatio and the Giant Country Horns), String Cheese Incident, moe., Blues Traveler, Dave Matthews Band, Medeski Martin & Wood, Tony Furtado, Bela Fleck and the Flecktones, Widespread Panic, Galactic, Government Mule, Greyboy Allstars, Karl Denson and the Tiny Universe, etc.

These bands have a loyal following, a very close knit community. This element lends itself to word of mouth promotion.