Disney Investment Thesis

Disney Investment Thesis: Whether the economy is thriving or in crisis, one thing stays the same: Disney has a permanent place on Forbes’ list of the World’s Most Valuable brands . It’s the only leisure company to hold a spot in the top 10, joining names like McDonald’s ( MCD ), Louis Vuitton, Coca-Cola ( KO ), and Facebook ( FB ) .

With that said, it’s true Disney had a difficult 2020. The COVID-19 pandemic decimated large parts of the business. First, Disney share price went from approximately $140 per share to just $85 per share when the market crashed in March 2020. Then, theme parks and movie theaters closed for a period. When some were able to reopen, it was at limited capacity.

According to CNBC, Disney was essentially “ hemorrhaging money since the outbreak ,” and the company was forced to lay off 28,000 employees in early October. That news, combined with several other developments, allowed share prices to fully recover by November 2020.

Since then, Disney stock has been trending upwards, and that has new investors curious. If Disney can generate this much growth before parks, resorts, and movie theaters are back to business-as-usual, what does the future hold? In other words, is Disney stock a buy?

Analysts say yes – and the Disney investment thesis is compelling. Here’s what you need to know.

Disney Market Share Has Accelerated

The Walt Disney Company has businesses in multiple industries, from theme parks and resorts to at-home streaming services. Calculating market share requires a closer look at the organization’s major divisions.

The most remarkable story comes from Disney+, which launched in mid-November of 2019. Whether because of the pandemic or in spite of it, Disney+ grew its subscriber base shockingly fast. Today, it is four years ahead of schedule in terms of member enrollments.

At the end of 2020, Disney+ had six percent of the streaming market. At first glance, that isn’t impressive when compared to Netflix’s 28 percent. However, Netflix’s market share came down three percent year-over-year. That suggests Disney+ is making inroads.

At its current rate, Disney+ is likely to surpass Netflix in terms of subscribers within a few years. When Netflix announced its 2020 year-end numbers, it was at 203.67 million paid members. Disney+ is projecting between 230 and 260 million subscribers by 2024.

A look at Disney’s share of the movie box office market paints another impressive picture – assuming 2020 is left out of the equation. In 2019, Disney releases made up 33.1 percent of box office earnings in North America. That dropped to 11.5 percent in 2020, but the drop is expected to be temporary.

Disney theme parks also took a big hit in 2020, but the industry as a whole is expected to recover and grow through 2026. That’s good news for Disney and its investors, considering Disney controls nearly half of the total market.

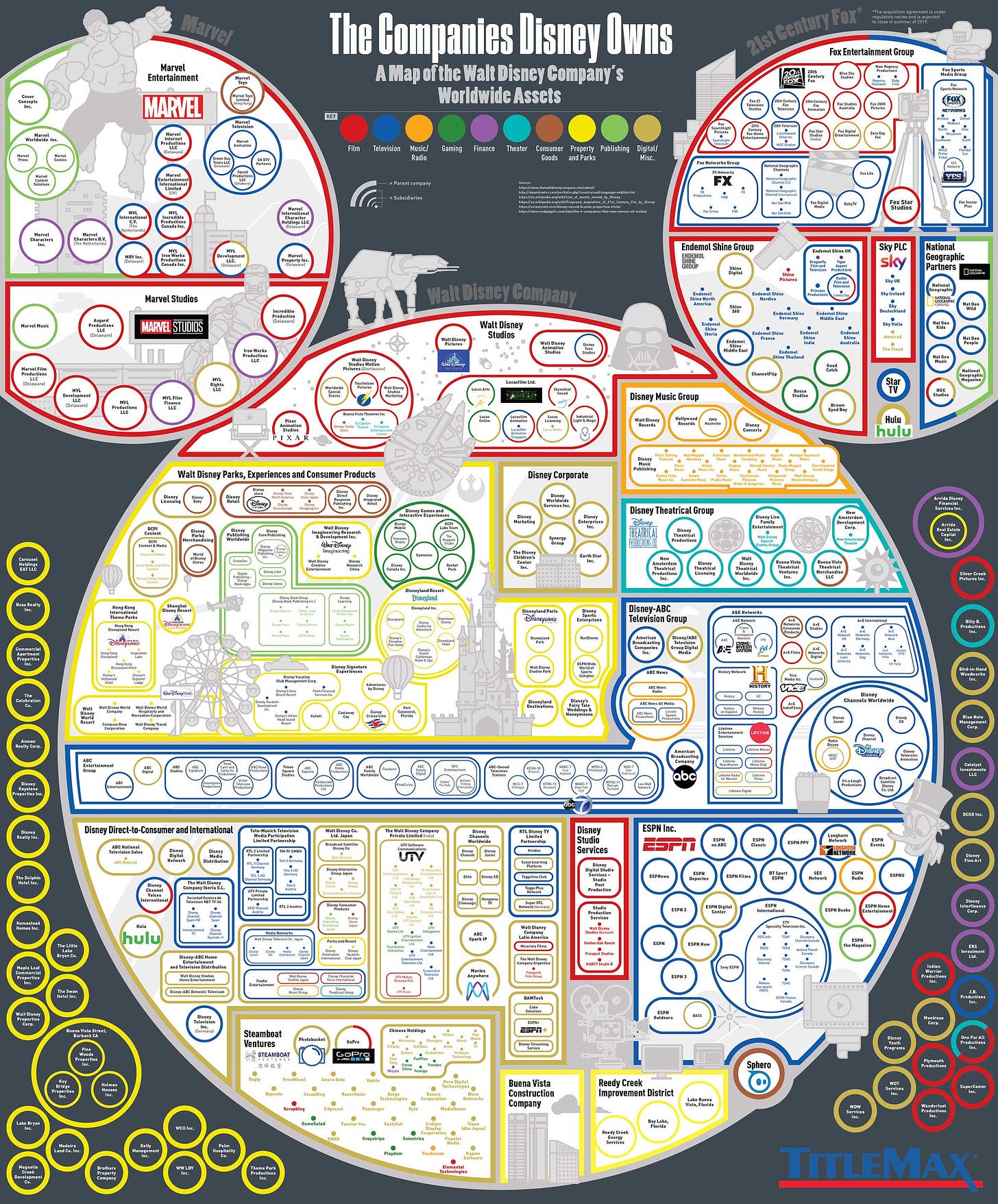

These positions represent just a fraction of Disney’s total business. It owns a long list of media and entertainment companies that include ESPN, National Geographic and the ABC broadcast television network.

In addition, it has an entire unit devoted to content licensing and sales. By many measures, Disney is a winner in nearly every market where it has a presence.

Does Disney Stock Have a Moat?

Any review of the Disney investment thesis must include discussion of the company’s moat. However, the question is less “does Disney stock have a moat?” and more “can any company boast a moat as wide as Disney’s?”

The company’s brand is its first and most valuable asset – the Disney brand creates a moat on its own. However, the Walt Disney Company has other unique features that create an unbeatable economic moat.

Specifically, the size and scope of the company’s combined businesses are more valuable than the individual business units. Many are interconnected and reliant on each other – but they also support each other through economic ups and downs.

Disney films, theme parks, licensing, and streaming services rely on an underlying set of entertainment assets – movie franchises, individual films, and characters that have captured the world’s imagination. It would take generations for another company to develop the same level of passion sparked by the likes of Star Wars, Cinderella, and the entire Marvel Universe – assuming it is possible at all.

Is Disney Growing Revenues?

Aside from the anomaly that was 2020, Disney revenues have grown steadily in recent years. A 10-year history shows the following results:

- Fiscal 2020 – $65.4 billion

- Fiscal 2019 – $69.6 billion

- Fiscal 2018 – $59.4 billion

- Fiscal 2017 – $55.1 billion

- Fiscal 2016 – $55.6 billion

- Fiscal 2015 – $52.5 billion

- Fiscal 2014 – $48.8 billion

- Fiscal 2013 – $45 billion

- Fiscal 2012 – $42.3 billion

- Fiscal 2011 – $40.9 billion

It’s interesting to note that even in 2020 – a period during which the company was “hemorrhaging money” – the year-over-year decline in revenue was just 6.06 percent.

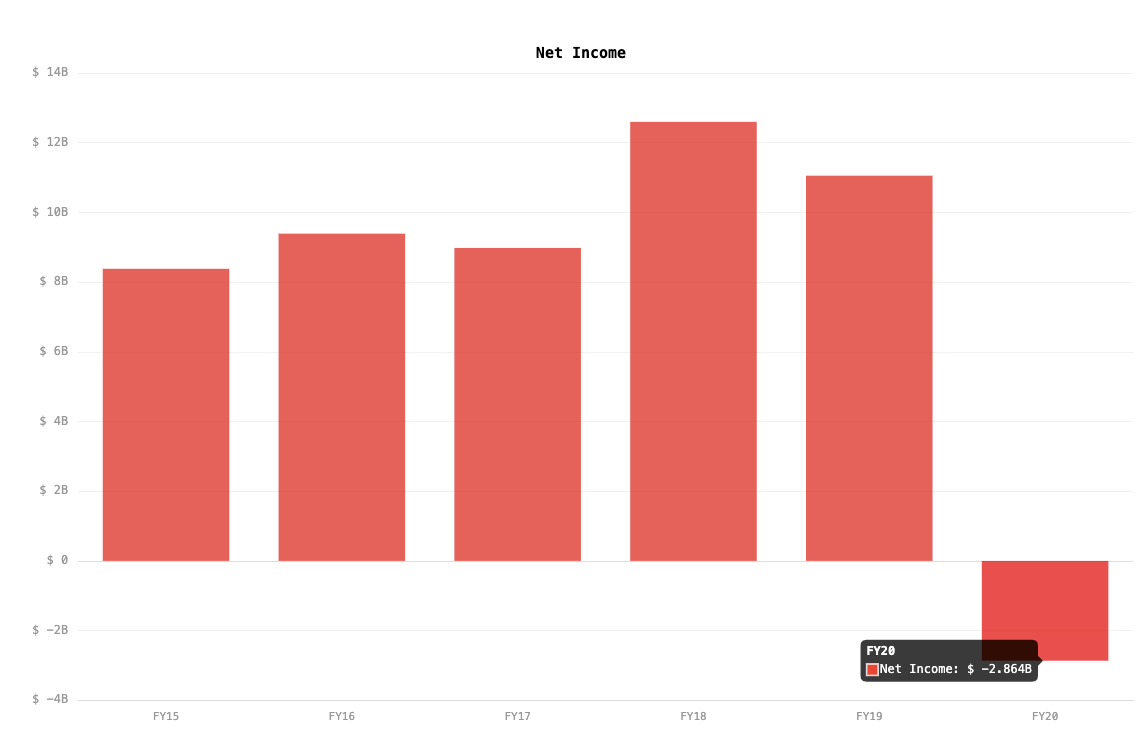

What Rate Are Disney Earnings Growing?

The picture painted by Disney’s earnings per share isn’t quite as positive as its revenues. Disney had a couple of down years, and they weren’t all COVID-related. The past decade of earnings per share results look like this:

- 2020 Annual Earnings per Share – $-1.58

- 2019 Annual Earnings per Share – $6.64

- 2018 Annual Earnings per Share – $8.36

- 2017 Annual Earnings per Share – $5.69

- 2016 Annual Earnings per Share – $5.73

- 2015 Annual Earnings per Share – $4.90

- 2014 Annual Earnings per Share – $4.26

- 2013 Annual Earnings per Share – $3.38

- 2012 Annual Earnings per Share – $3.13

- 2011 Annual Earnings per Share – $2.52

Given its long history of gains, most investors are comfortable that even though earnings per share occasionally dip, on the whole, the figures are trending upwards and will recover within the next 12 – 24 months.

Robert Iger’s Final Act Might Be His Best

Disney’s leadership team is often recognized among the best in the business. Executive Chairman and Chairman of the Board Robert Iger served as CEO for 15 years – through February 2020 – before handing the CEO title over to Bob Chapek, a 30-year veteran of the company.

While Iger was in the CEO seat, he acquired Pixar, Marvel, Lucasfilm, and 21st Century Fox. In addition, he expanded the business into new markets. For example, he opened Disney’s Shanghai park and resort.

Iger’s most important legacy may be the launch of Disney+. Most expect the streaming service to drive a substantial portion of Disney’s long-term growth.

Chapek was barely in his new role a month before the pandemic took over and the economy tanked. Perhaps he doesn’t have a collection of acquisitions and record-breaking films to boast about quite yet, but his ability to steer the company through one of the most trying times in its history is telling.

There is little doubt that Disney will come out intact on the other side, and Chapek can take some of the credit for that.

Headwinds Facing Disney

Disney’s stock has recovered since the March 2020 market crash, and it has neared all-time highs. Much of that is based on the company’s success in adapting to the unusual environment presented by the pandemic. For example, the company found a way to release and capitalize on big-budget films like the live-action Mulan though movie theaters were closed.

Part of the stock’s price trend is based on expectations for the company once the world returns to business-as-usual. The revenues lost during park, resort, and theater closures will pick up – and perhaps swell in response to pent-up demand.

The biggest headwinds facing Disney remain pandemic-related. Until the world achieves herd immunity, there will be some hesitation around traveling and spending time in crowds. In addition, the timeline for fully extinguishing COVID-19 is decidedly uncertain. That creates a difficult environment within which to run a leading entertainment and leisure company.

Disney Investment Thesis Conclusion

The bottom line is that Disney stock is a smart buy , particularly over the long term. The company holds a leadership position in multiple industries, and it is rapidly taking over new ones. The most notable advantage that Disney and its shareholders have is that other media, entertainment, and leisure companies simply can’t compete.

While they may pull a bit of market share away from Disney now and then, Disney always comes out on top due to the strength of its brand and its internal ecosystem.

#1 Stock For The Next 7 Days

When Financhill publishes its #1 stock, listen up. After all, the #1 stock is the cream of the crop, even when markets crash.

Financhill just revealed its top stock for investors right now... so there's no better time to claim your slice of the pie.

The author has no position in any of the stocks mentioned. Financhill has a disclosure policy . This post may contain affiliate links or links from our sponsors.

Where is DIS Headed Next?

Sideline Genius

Disney Investment Thesis

Should you invest in the house of mouse.

Disney (DIS) is no stranger to us.

Disney’s Business and Company Description

The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide.

The company's Media Networks segment operates domestic cable networks under the Disney, ESPN, Freeform, FX, and National Geographic brands; and television broadcast network under the ABC brand, as well as eight domestic television stations. This segment is also involved in television production and distribution.

Its Parks, Experiences and Products segment operates theme parks and resorts, such as Walt Disney World Resort in Florida; Disneyland Resort in California; Disneyland Paris; Hong Kong Disneyland Resort; and Shanghai Disney Resort; Disney Cruise Line, Disney Vacation Club, National Geographic Expeditions, and Adventures by Disney and Aulani, a Disney resort and spa in Hawaii, as well as licenses its intellectual property to a third party for the operations of the Tokyo Disney Resort in Japan.

The company's Studio Entertainment segment produces and distributes motion pictures under the Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar, Searchlight Pictures, and Blue Sky Studios banners; develops, produces, and licenses live entertainment events; produces and distributes music; and provides post-production services through Industrial Light & Magic and Skywalker Sound.

Its Direct-To-Consumer & International segment operates international television networks and channels comprising Disney, ESPN, Fox, National Geographic, and Star; direct-to-consumer videos streaming services consisting of Disney+/Disney+Hotstar, ESPN+, and Hulu; and operates branded apps and Websites, such as Disney Movie Club and Disney Digital Network, as well as provides streaming technology support services.

The company was founded in 1923 and is based in Burbank, California.

Here are the companies that Disney owns. Disney’s flywheel is an extremely strong moat. Click here for the HD version of this image

Is their industry big enough for their continued growth?

Let’s start off with Disney’s biggest businesses, their media entertainment and studio network arms.

The entertainment and media market globally is set to hit 2.5 trillion dollars by 2024 . Disney’s revenue for their media networks, studio entertainment and DTC (Think Disney+) was 54 Billion for FY20 .

This part of Disney’s revenue is small compared to the total addressable market. Not to mention that the global growth DTC Paid video subscriptions has been growing 37% CAGR for the past 5 years.

Disney is in a growing segment. It doesn’t even have to be a winner take all situation to be highly profitable.

What about their parks, experiences, and consumer products businesses?

Disney scored a 16.5 Billion dollar for FY20. It is a huge drop from 26.2 Billion from the previous year (FY19) due to the pandemic. Before the pandemic, their parks and experiences business has been grown by 10% since 2015.

So this is still a growing business if we discount the pandemic.

We expect the business to go back to its glory days once the virus is under control.

Moreover, the total park & experiences market opportunity is 73.3 Billion in 2019 which is still a huge pie.

However, Disney’s next growth [hase will not come from their Parks but from their DTC segments.

Is Disney growing financially? How healthy are they financially?

We’ll look at their revenue to see whether they are growing and have a strong balance sheet.

Looking at revenue, they’ve been able to steadily increase year over year with a 17.1% increase from FY18 to FY19.

Even with a black swan event in FY20, Disney has shown the resiliency of their business. As their parks and cruise liners suffered a loss of 1.1 Billion a Q4 2020. There are parks in faster-recovering countries that opened but they were still unable to operate at full capacities.

While the Parks and Cruise lines are not performing well, their DTC business has covered the company pretty well.

Disney+ is going to be the main growth driver from Disney moving forward. (More on this in a while)

Net Income Loss for FY20 but far from danger and bankruptcy

You’ll need to know that Disney made a major loss this year still with Net income of -2.86 Billion . That said, it’s mainly due to the launch of Disney+ and other restructuring costs.

These are special income charges and should not occur frequently.

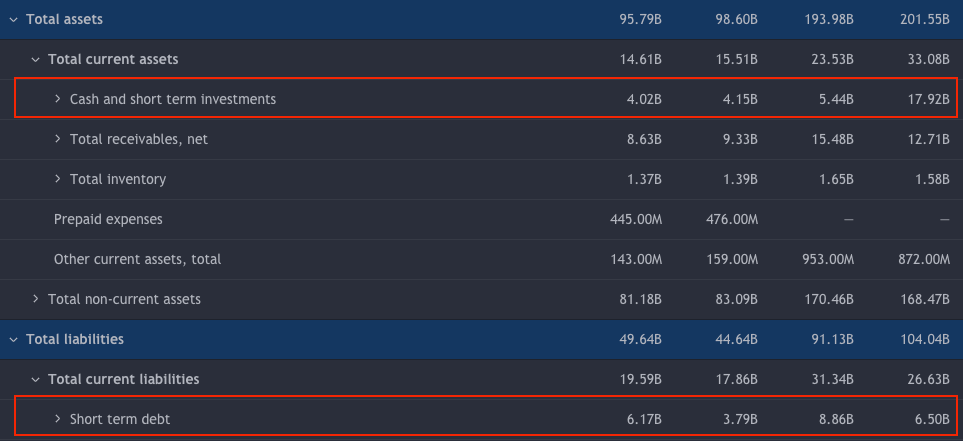

Disney still has a very strong cash position and is financially stable. There is no imminent danger to the company and they can still focus on growth.

They have over 17.9B in cash with only 6.5B in short term debt.

Sounds rich.

How is Disney generating revenue? What’s their sales and marketing strategy?

The Disney Flywheel is something that even Netflix will find difficult to compete (in my opinion).

For many streaming services, the goal is to acquire or create the best content to attract new subscribers. That’s causing huge content spending across many streaming service providers.

Disney has a different strategy from others.

They have their own IP which they will build their movies and shows off. Then they would use these hit characters to introduce new ones organically. They’ve got classic characters from Marvel like Iron Man, Black Widows, Ant-Man etc that continuously spins-off new series and movies.

Think about the potential of the Star Wars or Marvel Universe. There are so many story angles to it.

Disney’s IP is their trump card.

I mean, look, even children are singing Frozen theme songs till this day. Disney characters are ingrained in our childhoods.

That’s not all, Disney would then spin these characters off into merchandise, theme park rides and more.

And we have not even touched on ESPN+ or Hulu.

Disney’s growth strategy eats the cake. Fantastic.

What about the competition?

As of 2nd December, Disney has announced they had 137million global paid subscriptions. Disney+ alone has amassed 86.8 million subscribers and they were only expecting to his 90 Million by 2024.

They have far exceeded expectations here. For context, Netflix took almost 19/20 years to grow to 195+ subscribers.

Disney’s tremendous success with Disney+ is something to watch out for.

Disney’s flywheel in the previous chapter is also a competition moat to me.

How’s the customer’s feedback?

It’s always a good idea to see what customers are saying about a product/service that you’re planning to invest in.

There isn’t many public reviews on the internet yet considering Disney plus is not globally launched yet.

Consumeraffairs had a 4-star rating from 49 reviews. Which is not bad!

I dug deeper into the reviews with lower ratings and realized most of them were about streaming technical issues, slow service support, and not so much about Disney plus content.

While Disney Plus should always strive for good service, i won’t fret over a couple of low star reviews that are not related to Disney Plus content (Which is the main offer here).

There are plenty of good reviews like these:

Is the Leadership team innovative?

The current CEO is Bob Chapek. Reviews on glassdoor seem acceptable to the culture and their new CEO.

Bob Chapek was the chairman of Disney’s Parks, experiences, and products previously, and his role as CEO of Disney will be tested through this world-changing pandemic.

He was recently promoted to CEO in Feb 2020, just as the pandemic started.

That said, it’s worth noting that while he was Chairman of Disney’s Park, Experiences, and products, that business grew from 16.62 Billion to 26.22 Billion in the period of 2015-2019 (pre-pandemic).

Legendary Robert A. Iger, who was the previous CEO of Disney for 15 years, is still executive chairman of the board.

This is comforting to know the person who was responsible for transforming Disney into a media powerhouse is still contributing.

So technically, Robert A. Iger is still the boss of Bob Chapek.

In fact, Robert A.Iger mentioned this will allow him to focus on the creative long-term direction of Disney since Bob Chapek will now oversee Disney operations overall.

But let’s not take anything away from Bob Chapek. He has a proven track record for growing Disney Parks. Think of him like Tim Cook of Apple while Iger was the Steve Jobs of Apple. Both have their strengths.

Another clear evidence of innovation is the DTC businesses like Disney+. It’s easy to say in hindsight that it’s a no-brainer move.

Disney has already been arming this business unit since 2009 with early investment in Hulu. They’ve proven to be thinking ahead of the game.

These strategies were born out of the leadership team at Disney. Yes, they have proven to have the capability to innovate.

Is Disney Stock a Buy now? Here are some valuation metrics

We’ll be using EV/Gross profit metric to evaluate the current value of Disney.

They are currently trading at 18x EV/Gross Profit. Comparing that with Netflix’s 24x this seems like a decent buy if you believe in Disney+ potential.

Keep in mind that the current profits are down due to the parks, experiences, and products business unit losing money this year. I expect that to come back when the pandemic is over.

If you’re a long-term investor, Disney would be a good purchase.

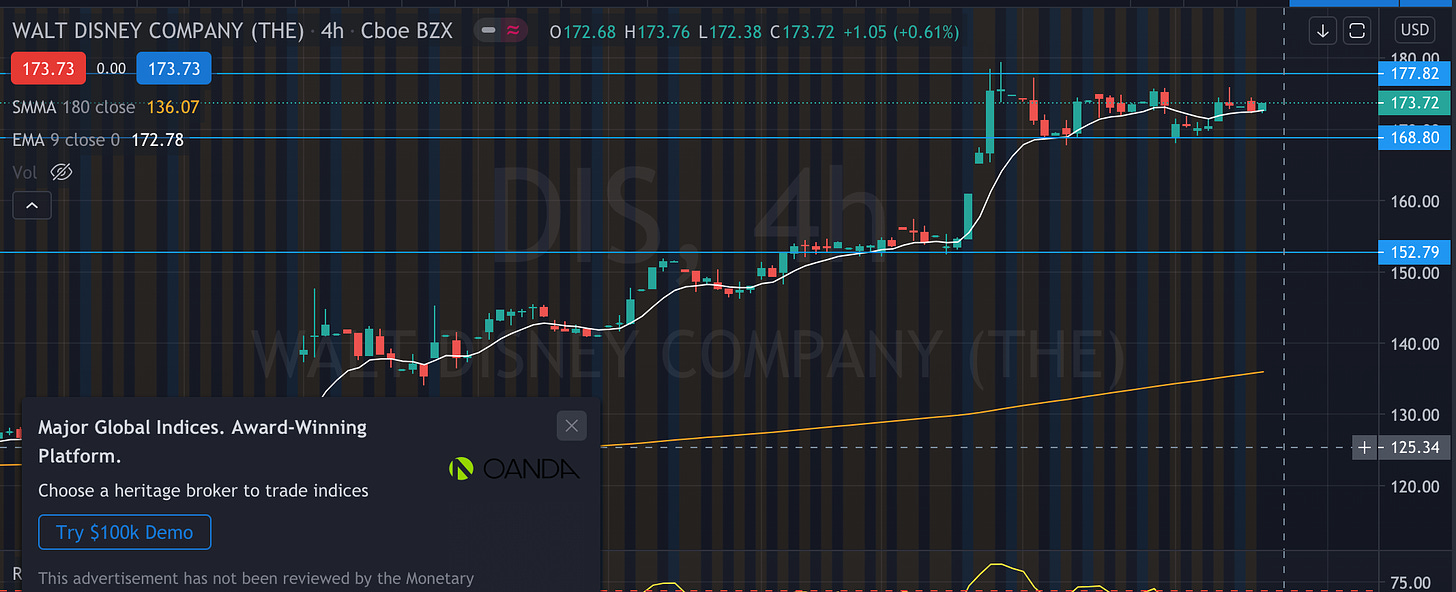

Looking for a technical analysis standpoint, anything below $168 will be a good buy. If it drops below $168, the next support point will be at $152.79.

Observe if the stock breaks out $177. As that is the current breakthrough point for another new high trend line.

Disclaimer: This is written as an opinion piece and is not financial advice.

Ready for more?

Disney stock analysis – Netflix built it, Disney is going to milk it!

- It is like the EV industry – Thank you Tesla – thank you for spending billions and creating a market, now let the big boys make the money!

- Trust me, as a social media provider, content is king!

- Investors should expect returns from Disney between 9% and 14% over the long-term.

Disney is a great business

Disney’s current fundamentals

- 21st Century Fox acquisition – putting things into perspective

Disney vs. Netflix

Disney investment thesis – 3 scenarios

I look at a lot of stocks during a week as part of my investment research process and most of the week was spent on commodity stocks, mostly zinc miners , but I also like to look at great businesses. I wish to have a list of 30 great businesses to follow so that I can be ready to buy when the rare opportunity comes, to buy a great business at a fair price. One that fits a great business description is certainly Disney (NYSE: DIS), as it is an earnings compounder.

Why is Disney a great business? Well, revenues increased 63% over the last 10 years, net income increased 230%, book value increased 86% and cash flows increased 184%, while the number of shares outstanding actually went down by 17%.

Source: Morningstar – DIS key ratios

If Disney does similarly over the next 10 years, you have nothing to worry about your investment in Disney. The key analysis aspect for long term investors is to eliminate short term noise and look at where will Disney be in 10 years and how will its fundamentals evolve. There is a lot to watch as Disney is acquiring parts of 21st Century Fox (FOX) and expanding into direct to consumer (DTC) services, but at the end it is always about the product and the demand for it.

The key factors to look at are:

- The long-term impact of DTC and FOX acquisition

- The margin of safety

- The long term risks

The good thing about Disney is that it is a well-covered and researched stock, so there is nothing really one can add, you only need to systematize the information and look beyond the next few quarters, something few actually do.

Let’s look at what is there now, the current fundamentals and whether those can represent a margin of safety.

The dividend yield isn’t really spectacular at 1.58% but the PE ratio is already interesting as a PE of 15 is better than the market’s average. An earnings yield is of around 6.5% is not really a great return, but we have to think about the future.

Source: Morningstar – DIS quote

The free cash flows are in line with net income, confirming the 6.5% expected yield on the current price. So, let’s talk about what might happen next.

21 st Century Fox acquisition – putting things into perspective

There are lots of unknows related to the FOX acquisition but one has to put the exorbitant $71.3 billion headline acquisition into perspective.

- Disney will issue 343 million shares, so that won’t be a cash cost. The dilution covers for $38 billion. $33 billion to go.

- FOX divested its 39% in Sky for $15 billion and the money goes to Disney. $18 billion to go.

The $18 billion plus the $14 billion debt assumption from FOX’s current debt, is by what we have to increase Disney’s debt. Thus, $31 billion. Given the Sky divestiture, Disney might keep its high credit rating and enjoy lower interest rates, especially now that the FED paused with hikes. Disney’s part of the $3.5 billion FOX had in free cash flows, should be well enough to cover for the increased interest payments without considering the increased leverage it might get form the new platforms. If they reach the $2 billion in synergies, no worries about the debt payments.

Source: The Walt Disney Company

We can only assume what will Disney’s increased international footprint look like in a few years, plus the leverage it is going to have on its content. However, an exercise in valuation is always good.

Netflix has created the market, but the market will always be dominated by content and I think content is on Disney’s side. Combining ESPN, FOX and Disney Plus will allow the company to leverage its content and grow at a faster pace then Netflix, especially as the international footprint and brand recognition is already there. As most of the costs are already sunk because content creation is Disney’s and FOX’s actual business, the company will not have the huge costs Netflix has for content production and purchase.

Source: Netflix Investor

Over the last 12 months, Netflix spent $13 billion for additions to streaming content assets, $10 billion in 2017, $8.6 billion in 2016. Disney has it all already, therefore, we can expect much better margins once HULU, Disney Plus, ESPN and whatever they are going to present on the conference call in April are launched properly.

I would also argue Disney is better than Netflix as Netflix’s content is based on volume, not on quality. I actually tested it for this purpose and not once did I say wow, I cancelled my subscription immediately.

Source: Netflix

I must say Hulu just looks more familiar, plus whatever Disney is doing, will be more familiar to all.

Source: Hulu

Further, Given that Netlix is not cash flow positive, it is a risky story as a contraction is subscriber growth, possible if there are new entrants, and I really don’t see that much potential for stickiness with Netflix, could create funding concerns, limit content investments, all to the benefit of Disney’s big guns.

The cosy, pessimistic scenario

If they just reach Netflix’s revenue, I would dare to add $5 billion in free cash flows over the next 5 years, just from DTC. If we add the $2 in synergies, $2 billion FOX already has and the current $10 billion and some growth, we easily get to $20 billion in free cash flow by 2024. At the current free cash flow yield, we could estimate a market cap of around $300 billion, divided by 1.9 billion shares, it should result in a stock price of $157. Add the 2% dividend you will probably get, you have a return of about 9%. Not bad from a great business.

From a business perspective, Disney’s current market cap is $166 billion, i.e. what you would be paying for it if acquired now. When we add the new issued shares, the market cap will be around $200 billion for cash flows of around $12 billion with the combined entity. This again, leads to a current 6% return. However, I think the growth will lead it to a 9% return over time but the key question is the growth. I am sure it is not going to be linear.

The positive scenario

Let’s say that Disney, that has much more diversification and a stronger brand than Netflix, manages to get to 25 billion in revenue over the next 5 years, adds $10 billion in free cash flows from DTC and $5 billion from other things, we are at $25 billion in free cash flows. Multiply that by 15 and we have a market cap of $375 billion for $197 stock price. This already implies a 12% return, 14% if we add the dividend.

From a business perspective, the positive scenario, that I deem most likely, will still be a single digit cash flow yield.

The exuberant scenario

The exuberant market scenario would be one where Disney becomes a growth stock like Netflix, gets a PE ratio of 25 and reaches a capitalization of $625 billion. Given the current market conditions, the willingness Central banks have to keep monetary policy loose, I would now say it is not a possibility.

Disney’s free cash flow with 14% growth over the next 5 years and subsequent 5% growth.

Source: Author’s estimations

I really think Disney is a great business but it doesn’t yet meet one of my investing criteria, or Buffett’s investing criteria, a very attractive price.

Source: Berkshire Hathaway

It is a business we understand well and probably love some of the brands, it has favourable long-term prospects, the management did well over time and will probably do so in the future, but it is not available at a very attractive price.

There is nothing to despair about that, if you follow 20 great companies like Disney, I would bet that every year, at least one will fall into the ‘very attractive price’ basket. With great businesses, showing good growth potential, with strong brands, I would say that a 10% return is a very attractive price. Is it impossible for Disney to trade at such lows that imply a stock price of $74? Well, it did trade at such low multiples from 2009 to 2011.

Source: Morningstar

So, I’ll keep watching it, I’ll keep looking at other great businesses, so pleas subscribe to my YouTube channel or newsletter to keep up to date with content. Many more great, and not so great businesses will be analysed.

I am not really working on a newsletter anymore, if you want to contact me, check my Research Platform above or send me an email through the contact form.

Email address:

- accounting for investors

- airport stocks

- Aluminum Stocks

- Amsterdam stock exchange

- Argentina Stocks

- Austria Stock Exchange

- Berkshire Hathaway

- Brazil Stocks

- Canada stocks

- Charlie Munger

- China Stocks

- copper mining

- copper stocks

- Cryptocurrencies

- Dividend stocks

- Emerging Markets

- European Stocks

- Financial Education

- Food stocks

- German stocks

- Gold Miners

- Gold Stocks

- growth stocks analyses

- How to Invest

- Index Funds

- Investing Books

- Investing Education

- Investing in Uranium

- Investing Strategy

- Margin of safety

- Mining Stocks

- Mohnish Pabrai

- Nassim Taleb

- Oil & Gas Stocks

- Portfolio Management

- Railroad stocks

- Real Estate

- Russian Stocks

- Stock Analysis

- Stock Market

- stock market crash

- Stock Market News

- Stock Valuation

- Stocks Sector Analysis

- Swiss stocks

- The Intelligent Investor

- Uncategorized

- Uranium Stocks

- value investing

- Warren Buffett

- waste management stocks

- Zinc Mining Stocks

- Research Platform

- STOCK MARKET INVESTING COURSES

Investment thesis for Disney

HOSTS Maddy Guest & Sophie Dicker | 1 March, 2022

On today’s episode, Maddy shares her tips and tricks for finding a good investment. One of our favourite investing quotes is ‘know what you own and know why you own it’. That’s where an investment thesis comes in! And it doesn’t have to be tricky… Today Maddy shows you how, by building up an investment thesis for Disney (NYSE: DIS), whilst Sophie tries her best to pull it apart.

Keep track of Sophie and Maddy between the episodes on Instagram , or on TikTok , and come and be part of the conversation on Facebook with our You’re In Good Company Discussion Group . Got a question or a topic suggestion? Email us here .

In the spirit of reconciliation, Equity Mates Media and the hosts of You’re In Good Company acknowledge the Traditional Custodians of country throughout Australia and their connections to land, sea and community. We pay our respects to their elders past and present and extend that respect to all Aboriginal and Torres Strait Islander people today.

You’re In Good Company is a product of Equity Mates Media.

All information in this podcast is for education and entertainment purposes only. Equity Mates gives listeners access to information and educational content provided by a range of financial services professionals. It is not intended as a substitute for professional finance, legal or tax advice.

The hosts of You’re In Good Company are not financial professionals and are not aware of your personal financial circumstances. Equity Mates Media does not operate under an Australian financial services licence and relies on the exemption available under the Corporations Act 2001 (Cth) in respect of any information or advice given.

Before making any financial decisions you should read the Product Disclosure Statement and, if necessary, consult a licensed financial professional.

Do not take financial advice from a podcast.

For more information head to the disclaimer page on the Equity Mates website where you can find ASIC resources and find a registered financial professional near you.

You’re In Good Company is part of the Acast Creator Network.

Maddy: [00:00:19] Hello and welcome to youre in good company, a podcast that makes investing accessible for everyone. I'm Maddy, and as always, I'm in very good company with my co-host Sophie.

Sophie: [00:00:29] I'm really excited today for two reasons. One, because we're recording together in the same room. Love that. Better energy, good vibes. That number two, because you are giving me an investment thesis today for a stock that we both love, which is Disney.

Maddy: [00:00:45] Yes, I feel like this one is like, really defined our childhood. We've talked a few times on the podcast before randomly. Yeah, how I like Disney Kids. We've had a few arguments over which ones we love, which ones we listed, which films we watched.

Sophie: [00:00:58] The Aristocats is the best.

Maddy: [00:01:00] I mean, yeah. Anyway, what is your favourite? We'll say when we had this discussion, I went to Hannah Montana, but I'm like, Oh yeah, I've been actually reflecting on this. Quite. Here we. Sure, I'm glad. So you haven't? Oh, this is like I've never seen the aristocrats and I can. You have an older sister? So you like watched younger ones, old ones? I don't know. I mean, like, I feel like even though the oldest, I'm not trying to say that Hannah Montana is like the earliest Disney film I watched. Like that was made like 10 Disney Love. Yeah, but I felt like when I think about my Disney films, I think like Toy Story Monsters Inc, even like

Sophie: [00:01:40] all like the classic cartoon. Yeah, yeah. Right? Interesting. Anyway, anyway, I'm excited for this one because you our previous season, I pitched Sonos and I did an investment thesis and I built it up in a certain way, so I'm intrigued to see how you build up your thesis. Yeah, and I am not going to tear it down, but I'm going to, you know, test you nuts.

Maddy: [00:02:02] But before we get into today's episode, let's hear from a YIGC community member.

community member: [00:02:06] Show me the money, honey. Hi, everyone. I'm 25 years old and I work in retail part time while I'm in my last year of university studies and I'm currently earning around $2000 a month. Each month, I tried to invest at least $1000 into shares, particularly when everything has been so low. I was finding myself investing a little bit more. My portfolio has mainly consisted of ETFs and some individual blue chip companies. I started investing last year and my strategy was to invest in some stable shares and ETFs that pay dividends. Although after being influenced by some male figures, I found myself being caught up in FOMO and investing in overhyped speculative stocks. After being burnt with those stocks, I've been consistently sticking to buying and holding ETFs and some blue chip companies. Today, the total value of my portfolio is nineteen thousand one hundred and ninety two dollars, and I've made a profit of nine hundred and fifty dollars. I hope this motivates all of us to take the plunge into investing and that it's okay to stick with what you know and believe in and block out the other noise.

Sophie: [00:03:10] Love hearing how someone else is kind of building up their portfolio and getting, I guess, a bit of the insight to their strategy in their stocks or ETFs. All right, let's jump into your investment thesis.

Maddy: [00:03:19] Yes, so I'm a big believer when it comes to building up a thesis around a stock that you don't have to do too much work. Okay, all right. It's not i-, I'm really of the belief that if you have a good story and if you believe in the story and it makes sense to you, then it can often be a really good investment.

Sophie: [00:03:41] So but surely you have to have a bit of research into this story and

Maddy: [00:03:44] make sure the story is part of the research process, right? Like, that's when you look into it and you know, you might have an idea. Yeah, but I fill out the story a bit more, but I don't think it doesn't have to be complicated. I think it can actually be really simple. Idea is because at the end of the day, especially for a company like Disney, where the consumers.

Sophie: [00:04:03] OK, so your investment thesis is going to be on Disney, and you said that the way that you build up a thesis is kind of creating a story to why you really like this company. So why don't we start at the beginning then? And you can give us some background on Disney and what's been happening?

Maddy: [00:04:16] Yeah, great. So I think for Disney, this is particularly important because it was impacted like quite significantly by the pandemic, both positive and negative. First of all, we know that all of the theme parks were forced to close, and historically the theme parks have contributed like 50 percent of Disney's income. Wow. Huge, huge amount. So the fact that they were all shot and then even when they did reopen, you know, limited capacity people aren't travelling that were significantly impacted.

Sophie: [00:04:45] So this was over like the Covid period, like 2020. A bit of 2021.

Maddy: [00:04:49] Exactly. Yeah, OK. And then you've got the flip side of that, which is in November of 2019. So I guess five months before the pandemic sort of really hit Australia. Disney Plus. Launched and we all know how the streaming services Ren Covid,

Sophie: [00:05:03] yeah, so it's like such a diversified business has a bit of

Maddy: [00:05:06] both. Oh, this business is very diversified. My favourite thing about it. So if we take a step back and think about the stock price, when the pandemic hit theme parks and things with forced to shot, the stock price went from about $140 a share to eighty five when the market crashed,

Sophie: [00:05:24] and that was mainly because of lack of travel restrictions and people not visiting the park.

Maddy: [00:05:29] Correct. And I guess in the broader context like that was in March of 2020. So yes, the whole stock market was crashing, right? So it really has been quite a volatile time because obviously we know that a lot of their business had to shut down. Films couldn't be made, things like that. But then on the flip side, you've got these streaming services. And when they were releasing how fast their subscriptions were growing, you know, their share price went up quite significantly because investors really love to say that, especially in the context of like competing with Netflix and things like that.

Sophie: [00:05:56] OK, so this is where I'm kind of a little bit sceptical. So I'd like to get, I guess, your opinion because obviously during Covid times, a lot of companies did benefit. Like you look at the likes of like, you know, obviously the streaming services, but even like the likes of Zoom, and the growth is kind of unsustainable. Like, for example, Zoom is down 60 percent this year. And for me personally, I feel like we've really seen that with Disney as well, because their top share price was in March 2021, when a lot of other businesses were struggling, that hit around $200. But then, in December of last year, they posted that their subscription numbers were less than what was expected by the market. So, you know, we saw this growth, and that's great for Disney. But what does it mean now? Because subscriber numbers dwindling?

Maddy: [00:06:41] It's a fair call. I guess how I think about this is like, what were we doing in December of last year or in November of last year? Like we came out of lockdown, there was no way like, I don't think I picked up Netflix once like I was. We were out on the town. Oh, where are you? We said we skipping migrate is like, I think we were out of lockdown. It was summertime. And I'm sorry. I know this is in the context of Australia that was baking. But like I think in the post kind of pandemic phase, it'd be silly to think that subscriber numbers for things like Disney and Netflix aren't going to dwindle a little bit.

Sophie: [00:07:15] And I think you have mentioned before that, like with the Netflix thing, that subscriber numbers really do kind of drive the share price sometimes because of its growth. So maybe this was just a period that I don't know why I'm supporting your argument.

Maddy: [00:07:28] I will also add to that that the first quarter results this year were much better and they have seen accelerated subscribers again. So bam.

Sophie: [00:07:36] So we're talking about Disney Plus a little bit, and we've spoken about like that as the story. What are the elements that are building up like your conviction around a company like this?

Maddy: [00:07:45] Yes. I think the biggest reason that I love Disney and you kind of touched around a little bit then is like, how you know, Netflix, for example, is driven so directly by subscriber growth, and Disney experience is a little bit of the same. But and there's also so much more to the Disney story or the Disney company. Oh, God. So the main thing that I want to come back to on this and talk about with you because this honestly blew my mind when I first started really digging into it. Is the Disney franchises right?

Sophie: [00:08:12] OK, so what do you mean by franchise?

Maddy: [00:08:15] Yes. I want to chop through quickly what some of the brands or shows that Disney actually owns, because I think I definitely didn't realise just quite how overarching it was and how incredible it was.

Sophie: [00:08:28] So what you're saying is that Disney is a brand or a company, and it owns other brands and companies underneath it, but they all fall under like the Disney umbrella.

Maddy: [00:08:36] Exactly. Gotcha. So I guess traditional Disney, you've got things like Mickey Mouse, Lion King, Aladdin, Sleeping Beauty, all iconic. All love. Yeah. Then you've also got Pixar and say, This is where I started to click with where we have like different experiences because I kind of feel like you have the Disney experience you Aladdin, The Lion King, Sleeping Beauty, Little Mermaid. I have the Pixar experience. So that's like Toy Story, frozen. I mean, frozen was beyond my time, but Toy Story four, wasn't it? So wasn't so much frozen. Toy Story Finding Nemo Monsters Inc cause like The Incredibles, OK, or Disney. Then you've also got Marvel, where there's like a whole lot of shows under that Star Wars fox like The Simpsons, X-Men Family. Oh, wow, yeah, they aren't everything Disney

Sophie: [00:09:23] owns Fox

Maddy: [00:09:24] Plus a lot of is like broadcasting assets as well

Sophie: [00:09:28] random.

Maddy: [00:09:29] Then you've also got other iconic franchises things like Winnie the Pooh, The Muppets of Pirates of the Caribbean and other major entities as well, including Lucasfilm, National Geographic, ABC History, Lifetime Vice. Like, it's quite unbelievable just how much actually comes under the Disney umbrella.

Sophie: [00:09:46] I find that really interesting personally, because I didn't really know that about Disney. And one of the things that I was going to bring up because when you said you were pitching Disney stock, like I was having conversations with people about like, you know, why you wouldn't invest in Disney because we're trying to pull apart. Both arguments and one of them was a friend of mine at work had said that, you know, isn't Disney being a bit boycotted? Because when you think of the classic Disney brands of the movies that I used to really love, there's a lot of painting of the pictures of there's a damsel in distress and oh, true. Yeah, it is really true when you think about a lot of the films, and he was saying that there's going to be a next generation of children that might come through that won't be watching these movies because they don't want that picture painted of, you know, you've going to be this helpless woman that has to be saved by a prince or a man or whatever else. And I was like, Wow, I hadn't really thought about it, but I'm now contradicting myself a little bit because you've just explained that there's so many more areas that Disney is involved with.

Maddy: [00:10:42] Yeah, true. And I think like what I'm thinking when you say that because I think it's a very valid point is like the probably the real question is is is Disney going to actually be able to shift in the movies that they make? Going forward, they're going to be able to be more encompassing and more inclusive.

Sophie: [00:10:59] Yeah, I do actually agree with you there to some sense, and I feel like Disney is transformative in that way, because if you think about some of the more recent movies like Moana, make one of those people. I'm addicted to Moana. I don't know why I could watch it 10 times.

Maddy: [00:11:12] Again, I have to say, Oh my God,

Sophie: [00:11:14] you haven't watched Moana. I'm so sorry. Oh, okay. It's just like a really like on a Sunday watch miner makes you good. Makes you happy. But that kind of frames like a female heroine, you know who saves like the island. So I do feel like they do. They're very reactive to that kind of stuff.

Maddy: [00:11:31] One of my friends, actually, I want to give a shout out, has a great podcast called Conceiving It All. And she actually had this conversation about Disney princesses and in the context of disabled people and how, when like, how important representation is in this context, because we grow up watching these films and these shows and we become so engrossed in the storylines. And if you're someone who is not in any way, shape or form represented in that, like, that's a real issue. Hmm.

Sophie: [00:12:00] Well, it's interesting, then, I guess, to watch what Disney do in this space and how they keep evolving. We are taking a quick ad break for our sponsors, and we'll be right back to keep building up Maddie's Disney thesis. One thing I'm really curious about is that Disney is in a bit of a transformative spot at the moment in terms of its leadership, because you mentioned on our summer series, the Bob Iger book

Maddy: [00:12:24] such a good run ride of a lifetime New York bestseller, which I said

Sophie: [00:12:28] that I was going to write and I haven't yet, but I promise I will. But my question is, is that obviously we're moving over that to a new CEO because Bob is now retiring as CEO. So what do you think of the new leadership coming into the company?

Maddy: [00:12:41] Yes, it's an interesting one because the previous you oversee for 15 years, which is like an incredibly long time slate, a company which I mean economy is like potential red flags. When he laid the first thing that I saw that really put my mind to rest in this context is that the new CEO, whose name is also Bob, which is hilarious as Bob Bain at the company for 27 years. So it's not like he's a new guy coming in who has no idea what's going on. He knows how Disney works. He recently sort of spoke to the media and outlined what his three strategic pillars for 2022 was.

Sophie: [00:13:17] I love someone with gold.

Maddy: [00:13:19] Got me very excited. The first one very relevant for us today is all about the storytelling experience and really embracing like the Disney magic, which I just love it. The next one is all about innovation, which I'm going to touch on a little bit next. And then the third one is a relentless focus on audience when he says We must evolve with our audience and not against them. Yeah. Which I guess is what we were just kind of talking about prior to the ad break with like what people want to say in Disney films now and how that's completely shifting from what it was five 10 years ago.

Sophie: [00:13:53] So you're happy with the leadership at the moment because you think it's someone that's like really focussed on the audience and that are willing to innovate?

Maddy: [00:14:00] Yeah, new bob is a big tick for me.

Sophie: [00:14:02] You hear, Bob, what about Old Bob

Maddy: [00:14:05] also a big tick?

Sophie: [00:14:08] So turning the page from the past

Maddy: [00:14:10] to the future,

Sophie: [00:14:12] where is Disney headed? Can you build up more of this story of why you like it for a future investment? Yeah, for sure.

Maddy: [00:14:19] So I think the first one that comes to mind is box office, so we kind of coming out of lockdowns. Hopefully we are really putting Covid behind us for now, and we are able to stop making movies again, get back to cinemas. And I think there's a real potential upside. Yeah, box office revenue.

Sophie: [00:14:37] I actually think that's really a thing as well, because going to the movies is so nice

Maddy: [00:14:41] and I love it.

Sophie: [00:14:42] Yeah, I feel like it's such a nice thing to do.

Maddy: [00:14:44] I always forget how much I love it, and every time I go, I should do this more.

Sophie: [00:14:48] Yeah, I hope that like goes back, you know, go on a date to the movies.

Maddy: [00:14:51] And on the flip side, every time I go, I'm like, Wow, this gets more and more expensive, which I guess is maybe a good thing for Disney. Yeah, true. The other thing that's happening is they in parks and resorts reopening, we can get on planes again. It's all very exciting. And I think as people get more confident with travel, the theme parks are going to get busier and busier.

Sophie: [00:15:12] Have you been to Disneyland before?

Maddy: [00:15:15] I haven't. I always wanted to go so badly as a kid. I've never actually. I never even went to like the Queensland ones, the like waterpark.

Sophie: [00:15:22] Yeah, have you? I was actually so lucky as a kid like shout out to mom and dad because I know you guys listen. My dad actually

Maddy: [00:15:31] had Tony

Sophie: [00:15:33] and they surprised us. We were, I think, like they took us on like a little family trip when I don't know how old I was, but they surprised us at the very end and I cannot tell you that feeling it is the coolest viewing Baz Bryce to go to Disneyland as a kid like my heart. I know, and I think when you talk about theme parks and like, that's one of the things that's never going to die because the Disney magic is legitimately a thing.

Maddy: [00:15:56] The new CEO was actually the previous head of the theme park segment, which is exciting, and I know that there's been a lot of focus on how they can kind of elevate the experience of theme parks recently. So Disney has introduced sorry, this is a bit actually, it's not really off topic, but it's just a really cool thing that I was writing. They've introduced this thing called a janee plus service. Yeah. And it's like this thing where you go on and you pay $15 a day and it completely like plans at your Disney experience, which in turn is leading to much more revenue for them as well. But it's also elevating the experience of everyone who visits the parks,

Sophie: [00:16:28] and it's interesting to say that they're obviously trying to work out how they can use innovation or even like technology or automation to grow revenue within a, I guess, which segment of the business which is really traditional.

Maddy: [00:16:40] So funny, you bring that up. Speaking of innovation, in the last couple of weeks, Disney has appointed an executive to a new role, and they are responsible for leading its next generation storytelling, a.k.a. the Metaverse strategy.

Sophie: [00:16:55] Oh, I have read about Disney going into the Metaverse. Yes, it

Maddy: [00:16:59] there's been a few things happening that actually patented the technology for a theme park metaverse.

Sophie: [00:17:05] Before we jump into what's happening in the metaverse, can you quickly give me like what you think your definition is of the metaverse?

Maddy: [00:17:13] To be honest, no. Yeah, it's not like I kind of get it, but I don't really. And the hard thing is is it doesn't exist yet. Yeah, it's a virtual world.

Sophie: [00:17:23] Yeah, I think it's the easiest way to understand it for the moment is like virtual reality, I guess.

Maddy: [00:17:28] Yes, a few things have been happening in this space in the context of Disney, which is pretty cool to say that such a lack like your kind of same for traditional company is really embracing this new thing. Hmm. Their patented the technology for a theme park metaverse, which is pretty cool. And I mean, like I was saying before, like, what a great opportunity to make the theme park experience more accessible for people like all over the world.

Sophie: [00:17:52] Hmm. I think on the one hand here, I completely agree with what you're saying. But on the other hand, it makes me wonder. Playing devil's advocate here, you know, like you said, the metaverse is, you know, very much in its infancy, infancy, stages, and people really do like Disney because of that Disney magic, which is created because of like in-person experiences. So I wonder if putting its resources to something that might not even eventuate into, I guess, like a profit making area for them?

Maddy: [00:18:19] It's true, but I like I get what you're saying, but I kind of disagree.

Sophie: [00:18:24] Yeah, I think like it is.

Maddy: [00:18:26] Yes, the theme parks are magical, and that's one way to experience Disney. But I think, you know, we experience it in the cinema as we experience it at home, watching the movies, the stories. And I think if you can make virtual reality and we can experience a theme park in our own home, like even better.

Sophie: [00:18:41] Yeah, I'm just a sceptic of the metaverse at the moment.

Maddy: [00:18:45] No, I appreciate that, and I kind of agree. But I think what I find that's impressive. Even if you take like the metaverse specifically out of it is that such an old traditional company that's been around for so long is actually able to be agile enough to embrace this kind of stuff.

Sophie: [00:19:02] You make a very good point, and I can't argue with you much longer.

Maddy: [00:19:06] So before we finish, I guess the final chapter of my pitch, if you will, is I want to describe to you how I say the moat for Disney because.

Sophie: [00:19:16] And can you give us a quick recap of what a moat is?

Maddy: [00:19:19] It's basically

Sophie: [00:19:21] sorry. I'm asking you all the really hard questions. It's like a moat around a castle, because as a princess stuck in the coffin,

Maddy: [00:19:29] I guess you think of a moat as like, what's its competitive advantage? Like, what is going to stop another company from just replicating what Disney does and being better at it? So we like

Sophie: [00:19:38] to invest in things with a good moat. So what is Disney's moat?

Maddy: [00:19:42] Well, recently I read something that described Disney's business as a waterfall. So you've got great movies which drive box up big box office and streaming subscribers, which then drives content for TV networks and eventually rides at theme parks and sales of consumer products like everything flows into everything, and it's kind of a system that just self advertises itself. It's quite incredible.

Sophie: [00:20:04] So really, the business is making more business for itself just by going through its everyday kind of practises.

Maddy: [00:20:10] I think for me, it really all comes back to the franchises, like when I was writing them and listing them off before the stories that they have under the Disney umbrella are almost just impossible to compete with.

Sophie: [00:20:22] So that raises a good question then in my mind, who if if we're talking about them having a competitive advantage? Who are Disney's competitors? I mean,

Maddy: [00:20:32] I actually kind of struggled to think of this, to be honest, but I guess maybe it's like you break it up into the segments like we talk about how they're such a diversified business. I guess, you know, Netflix are a competitor to Disney Plus. There's like Sony or WarnerMedia competitors for their franchise business, but there's not really anyone else that I can think of that can fully encompass what Disney offers.

Sophie: [00:20:55] OK, so you've really carried this story for us? You know, it's got lots of different components. I am feeling a bit sold on Disney.

Maddy: [00:21:02] Thank you, but not financial advice. Why?

Sophie: [00:21:07] I guess my question is why now? And you know, when you do look at a share price and I think it's sitting at around like the $150 mark like, is that the peak it's going to go to and is that too expensive? Like, how do you see this going in the future and why you investing in it right now?

Maddy: [00:21:23] I mean, you raise a very good point. And I think often in the past when I have looked at companies individual stocks to invest in. To be honest, I'm not really someone that like gets into the financials. Like, I don't look at that stuff. And I guess over the last couple of years that I have been investing, I've gotten away with that because the markets have been going up. Yeah. So like when people say companies are overvalued, it kind of hasn't really mattered because everything has gone just continued to go up regardless.

Sophie: [00:21:50] So is it more important to you now to like even look at if the company is profitable?

Maddy: [00:21:55] Definitely. I think I I'm kind of taking a step back at the moment and maybe thinking that I should consider the financial aspect of businesses more because something that is overvalued. Actually, now that we are in more of a bear market that has a lot more weighting to it than what it ever has. Obviously, in the time that I've been investing,

Sophie: [00:22:15] I guess, considering all of that in mind, why do you think now is still a good time to be investing in Disney?

Maddy: [00:22:20] So I think if we go back to the key points that we've discussed today, we've got a CEO who has a lot of theme park experience who's really focussing on this on the backdrop of a world that is opening back up again and travel is coming through. So we've got a lot of upside in theme park revenue. Yeah. Number two is we were just saying how we want to get back to cinemas and that is the perfect time to be driving box office revenue. Yeah. Number three, you've got Disney Plus, who is looking to overtake Netflix in the next few years, which is unbelievable growth. Do you have a Disney Plus membership?

Sophie: [00:22:51] No, but Sam does bigger, and I watched Cruella de Vil on it.

Maddy: [00:22:56] You've got Disney Plus, which is kicking goals and has really good prospects for the next few years. And then you've got this house of franchises that is really hard to compete with with stories that I mean, we've kind of joked about it a few times that a quite magical. And finally, we have a new CEO at the helm of this company who has a really clear and core vision for where he wants to take the company into this new world that we're entering at the moment. I really like

Sophie: [00:23:23] how you built up the faces today. I think it is really important to have that story behind it. But on the same token, you've got to criticise the lack the good points, because otherwise you're going to have like all this happiness about the stock and not understand why it would go down.

Maddy: [00:23:36] Definitely. So out of interest. Have I sold you? Are you thinking about investing in Disney?

Sophie: [00:23:41] Well, this is a this is a really hard one, as is like, I love Disney and then you're like, I'm doing Disney and you've got to be against it. And I'm like, So yes, you've sold me nuts, and maybe we should do a little exercise. And like, you know, the end of the year, check in on Disney and so on us because it's on us. It's true it's gone down recently, but that's fine. Long term conviction, exactly. And see whose basis is holding strong

Maddy: [00:24:06] on that note would love to hear if you guys have any thoughts about the thesis and if we have missed any like weaknesses or even strengths, happy for my thesis to get even

Sophie: [00:24:14] better. Join our Facebook community at YIGC Investing Podcast Discussion Group. Because we're going to start a conversation about it in there. I actually love getting people's opinions about this stuff.

Maddy: [00:24:25] Jump onto Instagram @yigcpodcast or across on Tik-tok. We're trying very hard. Also @yigcpodcast

Sophie: [00:24:33] You will hear from us next week. Catch you then bye. [1368.5]

- Company Analysis

- You're In Good Company

- Investing Thesis

Companies Mentioned

- Walt Disney (NYSE: DIS)

Meet your hosts

Maddy Guest

Sophie Dicker

Get the latest

Receive regular updates from our podcast teams, straight to your inbox.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

The walt disney company (dis) is attracting investor attention: here is what you should know.

Walt Disney (DIS) has recently been on Zacks.com's list of the most searched stocks. Therefore, you might want to consider some of the key factors that could influence the stock's performance in the near future.

Shares of this entertainment company have returned -3.8% over the past month versus the Zacks S&P 500 composite's -2.7% change. The Zacks Media Conglomerates industry, to which Disney belongs, has lost 4.8% over this period. Now the key question is: Where could the stock be headed in the near term?

While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Revisions to Earnings Estimates

Rather than focusing on anything else, we at Zacks prioritize evaluating the change in a company's earnings projection. This is because we believe the fair value for its stock is determined by the present value of its future stream of earnings.

Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock's fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward. Because of this, empirical studies indicate a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

For the current quarter, Disney is expected to post earnings of $1.09 per share, indicating a change of +17.2% from the year-ago quarter. The Zacks Consensus Estimate has changed +0.6% over the last 30 days.

For the current fiscal year, the consensus earnings estimate of $4.67 points to a change of +24.2% from the prior year. Over the last 30 days, this estimate has remained unchanged.

For the next fiscal year, the consensus earnings estimate of $5.57 indicates a change of +19.3% from what Disney is expected to report a year ago. Over the past month, the estimate has changed -0.1%.

With an impressive externally audited track record, our proprietary stock rating tool -- the Zacks Rank -- is a more conclusive indicator of a stock's near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #2 (Buy) for Disney.

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Revenue Growth Forecast

While earnings growth is arguably the most superior indicator of a company's financial health, nothing happens as such if a business isn't able to grow its revenues. After all, it's nearly impossible for a company to increase its earnings for an extended period without increasing its revenues. So, it's important to know a company's potential revenue growth.

For Disney, the consensus sales estimate for the current quarter of $22.11 billion indicates a year-over-year change of +1.3%. For the current and next fiscal years, $91.57 billion and $96.32 billion estimates indicate +3% and +5.2% changes, respectively.

Last Reported Results and Surprise History

Disney reported revenues of $23.55 billion in the last reported quarter, representing a year-over-year change of +0.2%. EPS of $1.22 for the same period compares with $0.99 a year ago.

Compared to the Zacks Consensus Estimate of $23.41 billion, the reported revenues represent a surprise of +0.58%. The EPS surprise was +25.77%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates just once over this period.

Without considering a stock's valuation, no investment decision can be efficient. In predicting a stock's future price performance, it's crucial to determine whether its current price correctly reflects the intrinsic value of the underlying business and the company's growth prospects.

Comparing the current value of a company's valuation multiples, such as its price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), to its own historical values helps ascertain whether its stock is fairly valued, overvalued, or undervalued, whereas comparing the company relative to its peers on these parameters gives a good sense of how reasonable its stock price is.

As part of the Zacks Style Scores system, the Zacks Value Style Score (which evaluates both traditional and unconventional valuation metrics) organizes stocks into five groups ranging from A to F (A is better than B; B is better than C; and so on), making it helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Disney is graded C on this front, indicating that it is trading at par with its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Disney. However, its Zacks Rank #2 does suggest that it may outperform the broader market in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Recommended Stories

Paramount, the final season: it’s scions versus shareholders.

Will Shari Redstone close a sweetheart deal with Skydance’s David Ellison, or be forced to accept a fairer one? A standoff with Charter over fees adds a plot twist.

Kroger considers Disney+ perk for grocery delivery members

The move comes as the market attempts to compete with e-commerce leaders such as Amazon.

American Express Stock (NYSE:AXP): Strong Earnings Strengthen the Bull Case

American Express (NYSE:AXP) is one of the few stocks that offers growth at a reasonable price (GARP). For instance, the company’s 19.1x P/E ratio isn’t overstretched, and financial growth is strong for the credit and debit card giant. While the company has been a GARP play for quite some time, its recent earnings report offers additional optimism. Therefore, I am bullish on this stock. Rising Revenue and Profit Margins American Express has consistently increased its revenue and profit margins. T

American Express (AXP) Boasts Earnings & Price Momentum: Should You Buy?

Finding strong, market-beating stocks with a positive earnings outlook becomes easier with the Focus List, a top feature of the Zacks Premium portfolio service.

- DISNEY INVESTMENT THESIS

- DISNEY TECHNICAL ANALYSIS

DISNEY (DIS) INVESTMENT THESIS

The wonderful world of Disney transcends Magic, inspiring the imagination of children and bringing families together. From the early days of Mickey Mouse the company has grown into a global media and entertainment conglomerate. INVESTMENT THESIS An Investment Thesis has to be looked at within the context of three areas 1. Best in class 2. Secular growth trend 3. Macroeconomic environment The Investment Thesis is founded on three pillars 1. THEME PARKS AND CRUISE Disney is the best theme park operator, not only domestically but internationally as well, with franchises across the US, Europe and Japan. More important than the theme parks is the effect of exponential growth in a self sustaining business. Each family that attends a Disney park or cruise consists of two or three children. As those families experience the bond Disney creates and share the memories, they will grow up into parents and want their children to share those same experiences. A strong economic environment with record employment levels and rising wages increase the disposable incomes of families. 2. MEDIA AND ENTERTAINMENT Disney creates blockbuster movies generating billions in revenue with franchises including Star Wars, Marvel, Pixar Animation. ESPN is the largest sports network. Disney recently acquired assets from the Fox network to expand it’s footprint. 3. ONLINE STREAMING The subscription based business model makes online streaming services an exceptional growth opportunity within a strong secular trend. Disney is expected to introduce Disney+ in 2019. An annual production budget exceeding $12B, strong franchises and a vast library provide a solid foundation to attract tens of millions of subscribers. There are threats and weakness. An economic downturn will affect families disposable income and impact theme park attendance. Since 2010, theme park prices have risen from $80 to above $125. Average ticket prices would likely have to decrease, or discount/incentive strategies used, to stimulate attendance. Regulatory requirements involved in the fox acquisition could limit planned opportunities. Disney is a conglomerate whose size makes it slow to respond or adapt to changes and secular trends can change or evolve rapidly. Netflix created the Online Streaming trend and has first mover advantage with a six year lead and an installed base of over 125m subscribers. What does that mean at MONEYWISEHQ? Disney is a place that creates magic and it’s that certain magic that is going to be around for years, creating the exponential growth which provides the foundation for a strong long term investment holding. Disney is best used as part of a long term investing strategy, it’s not necessarily a trading stock, but there are opportunities to add to positions at the right price. It’s important to follow the earnings reports to validate the Investment Thesis, not only for Disney’s benefit, but also the impact of progress on competitors such as Netflix. Disney is a stock which could be considered as an education saving plan investment to help pay for your children’s future. Disney is a fun company and it’s a great way to get kids interested and involved in investing. Imagine taking them to Disneyland and explaining that they own a piece of the Theme Park and Mickey Mouse is going to help pay for them to go to University when they grow up.

created with

Why Disney is doubling down on theme parks with a $60-billion plan

- Show more sharing options

- Copy Link URL Copied!

Over the decades since Walt Disney opened his first theme park in 1955, the company’s tourism business has ballooned to an enterprise worth tens of billions in yearly sales, with sprawling locations in Anaheim, Orlando, Paris, Shanghai, Hong Kong and Tokyo.

Today, the Burbank entertainment giant is doubling down once again. Disney plans to invest $60 billion over 10 years into its so-called experiences division, which includes the theme parks, resorts and cruise line, as well as merchandise.

In Anaheim, the city council recently approved an expansion plan at Disneyland Resort, which could lead to at least $1.9 billion of development and involve new attractions alongside hotel, retail and restaurant space.

Why the massive investment? At a time when Disney faces revenue challenges due to cord cutting, streaming wars and a slower film box office, its theme parks are a bright — and reliable — spot for its business. Moreover, they play a major part in the company’s strategy — using well-loved movies to inspire rides and vice versa (think “Pirates of the Caribbean”), feeding an ongoing virtuous cycle.

“When you consider other elements of Disney’s business, those theme parks, they’ve shown themselves to be proven winners,” said Carissa Baker, assistant professor of theme park and attraction management at the University of Central Florida’s Rosen College of Hospitality Management. “There’s no doubt that they have stayed very competitive in the film space and the TV space, but they’ve always led the theme park sector.”

Travel & Experiences

Will Disneyland get an Avatar land? It’s likely. Here’s what else may be in store

With the approval of DisneylandForward, new attractions and adventures will be coming to Disneyland. Here’s what’s been teased by Disney officials so far.

April 17, 2024

During the most recent fiscal year, the company’s experiences division — which is heavily anchored by the parks — brought in about 70% of Disney’s operating income, according to a filing with the U.S. Securities and Exchange Commission. By contrast, Disney’s sports sector, including ESPN, contributed 19% of operating income. The entertainment division, consisting of the company’s TV channels, streaming services and movie studios, brought up the rear at 11%.

Those numbers represent a stark contrast from even 10 years ago, when the company was heavily reliant on its TV networks, which brought in 56% of Disney’s operating income (that segment included ESPN at the time). The parks and resorts division drew just 20%.

The tide began to turn in 2019, as the global theme park industry saw record-breaking attendance, just in time for the pandemic to hit the next year.

With the parks closed, Disney reported an operating loss of $81 million in 2020 . Disneyland and Disney’s California Adventure, in particular, were shut for 15 months, due to tight restrictions in the Golden State. Since then, pent-up demand from visitors has propelled theme park revenue in a way that hasn’t been replicated in movie theaters.

“The industry was really growing quickly before COVID-19, and that obviously put a crimp on everything,” said Martin Lewison, associate professor of business management at Farmingdale State College in New York. “But it appears as long as the economy remains healthy, the industry is back on track for that growth.”

Company Town

Disney’s Bob Iger triumphs over Nelson Peltz in bitter shareholder vote. But big challenges remain

Disney shareholders reject billionaire investor Nelson Peltz, who wanted changes, for a board seat. The hard-fought battle exposed Disney’s challenges.

April 3, 2024

Theme parks are typically one of the fastest parts of the travel and hospitality industry to recover after economic downturns, said Dennis Speigel, founder and chief executive of consulting firm International Theme Park Services. Part of that is because it’s hard to duplicate the theme park experience at home.

“Disney sets the bar for our entire global theme park industry,” Speigel said. “The guests, the visitors, they love the way Disney immerses you in their storytelling.”

The Disneyland Resort expansion plan, known as DisneylandForward, will help the 490-acre park stay fresh for visitors. The plan calls for changes to the park’s zoning, allowing the company more freedom to mix attractions, theme parks, shopping, dining and parking. While the plan doesn’t specify exactly which attractions will be added to the resort, company officials have floated ideas including immersive Frozen, Tron and Avatar experiences.

Over the years, Disneyland has cycled out many rides and exhibits to make way for new ones — for example, of the original 33 attractions that debuted with the park , only about a dozen still exist. (One that didn’t make it? The Monsanto Hall of Chemistry).

Though Disneyland and Disney’s California Adventure have recently seen additions such as Star Wars: Galaxy’s Edge , Avengers Campus and the renovated Pixar Place Hotel , giving guests new reasons to come back again and again are the key to increased growth. This summer, the Magic Kingdom will open Tiana’s Bayou Adventure , replacing the controversial “Song of the South”-inspired Splash Mountain attraction.

“In the theme parks business, you tend to make more money the more you invest,” said Lewison of Farmingdale State College. “People love riding Haunted Mansion 50 times, but the truth is that even that gets old. So new rides, new lands, new parks — these things draw in attendance, they create pricing power and they add capacity.”

And Disney’s rivals in the theme parks business show no signs of slowing down, meaning Disney can’t just rely on its existing hits. Universal Studios Hollywood recently added Super Nintendo World to its park, SeaWorld is touting new attractions and shows for its 60th anniversary this year, and even immersive art installation company Meow Wolf is expanding throughout the U.S.